“For the ring finger, for every finger, I put them everywhere… diamonds, diamonds, diamonds, diamonds,” sings a diverse and strikingly beautiful group of models, actors, and fashion influencers to jazzy music and the lyric “love and happiness” in the background on repeat.

Love and happiness are never enough, continues the advertisement, and “neither is one diamond” is its underlying message. “A girl’s best friend?” asks Pamela Anderson, and “diamonds are for everyone” and “for all the right reasons,” comes the answer, before Vogue magazine’s iconic creative director at large Grace Coddington concludes, “Diamonds for all,” and the tagline reveals: “Pandora: lab-grown diamonds.”

For many, Pandora’s aggressive push into the lab-grown space over the past two years is a sign of things to come.

The industry is entering a new phase in which fashion-jewelry collections and brand development will stimulate growth, note several industry consultants and executives.

“You’re seeing a lot more fashion product being introduced, whereas before it was so heavily concentrated on bridal,” observes Sherry Smith, director of business development at Edge Retail Academy, a jewelry industry advisory.

While the bridal segment has been a boon for the lab-grown market in the past three years, driving sales during a period of hyper-adoption by retail jewelers, fashion is about to explode, predicts Amish Shah, founder of lab-grown wholesaler Altr Created Diamonds.

Marty Hurwitz, CEO of MVI Marketing, agrees. “Retailers that are having the most success with lab-grown today are not just sticking to bridal, they’re getting into fine fashion jewelry,” explains Hurwitz, whose company offers consulting services to the trade. “There’s some limited availability of fine fashion jewelry with lab-grown, but that is the opportunity — to offer a collection versus just a bridal story.”

Losing its stigma

The fashion segment is the natural home for the lab-grown product, Shah suggests. And while its spurt in bridal sales took some by surprise, it seems the market is now shifting to its rightful place. That’s largely because consumer awareness and interest continue to rise as most retailers are experimenting with the product, Hurwitz says.

While Smith notes there are still purists that won’t carry lab-grown, Shah claims the product has shaken off the taboo that was associated with it. “The stigma and debate which surrounded the lab-grown product three or five years ago is no longer there,” Shah says. “In fact, it’s becoming trendy, and if you look at the global economy and the state of the US consumer, the economics support the category more than ever.”

diamonds. (Pandora)

Midstream consolidation

Lab-grown diamonds offer consumers a significantly lower price point, with 1-carat pieces selling at an estimated 76% discount to natural diamonds and 2-carat by an average of 83%, according to Edahn Golan, owner of Edahn Golan Diamond Research and Data and a partner in Tenoris, a provider of trend analytics for the jewelry industry.

That has also presented some challenges to the trade, as wholesale prices of 1- to 1.49-carat lab-grown dropped 60% in 2023, while 2- to 2.99-carat stones fell 65%, Golan’s data shows.

Growth slowed in 2023, like other product categories did after record sales in 2021 and 2022, Smith notes.

Still, wholesale prices declined as improved technology increased supply, and the market became overcrowded with diamond companies in the midstream seeking to capitalize on the initial growth. Now, many are being squeezed out. There isn’t room for a dealer market in lab-grown because there isn’t enough margin for everyone to touch the product, explains Hurwitz.

That has led to consolidation and some liquidations. In arguably the most high-profile case, Washington, DC-based WD Diamonds filed chapter 7 bankruptcy in October 2023. Hurwitz expects further consolidation this year. “They’re all trying to figure out how to be vertically integrated, to go further downstream, to recapture the margin that they’ve lost,” he reasons.

India invests

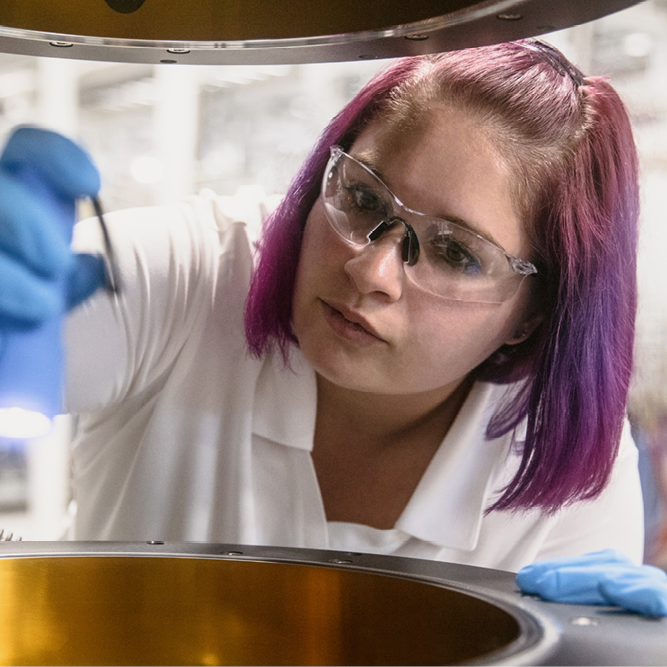

There are approximately 72 growers operating globally today, the majority of which are in India, and upwards of 50,000 chambers producing mainly chemical vapor deposition (CVD) diamonds, Hurwitz reports.

India has significantly increased its capacity and technical capability in the past two years, he adds. Supply has shifted from China, where manufacturers traditionally use the High Pressure-High Temperature (HPHT) method, to India where CVD is more broadly adopted.

The Indian government has committed to strengthening the country’s position in lab-grown, symbolized by Prime Minister Narendra Modi gifting US First Lady Jill Biden a 7.50-carat synthetic diamond during a visit to Washington, DC, in June last year.

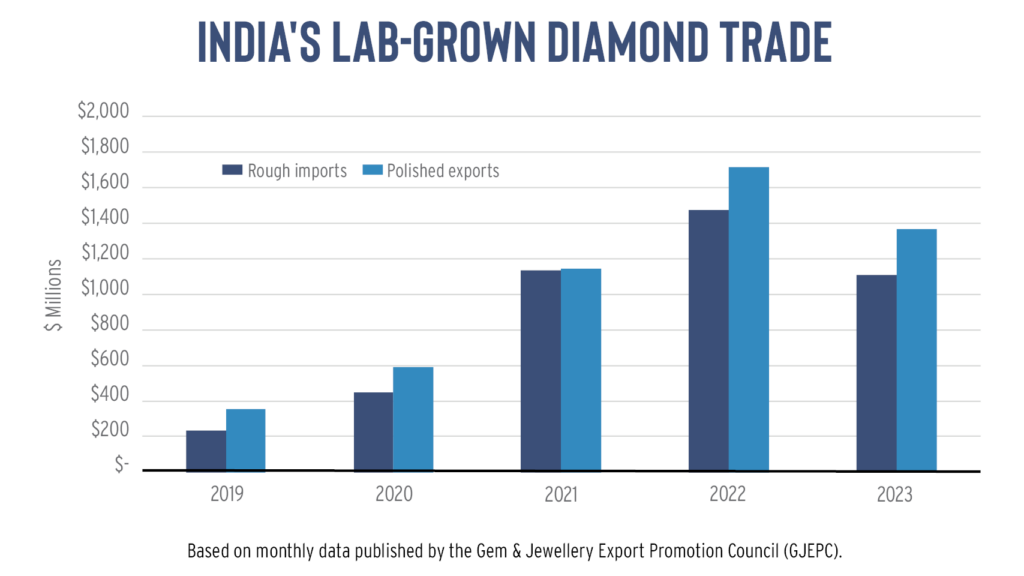

The country’s trade steadily increased from 2019 to 2022 but weakened last year due to the global industry slowdown (see graph). Rough lab-grown imports declined 25% to $238 million, while polished exports fell 20% to $1.37 billion in 2023, according to data from the Gem and Jewellery Export Promotion Council (GJEPC).

India is growing larger stones and of higher quality than before, and its volumes are going up. Today, it is the primary source of 1- to 15-carat CVD goods, Shah claims.

The melee challenge

In general, there has been a shift in focus among growers toward larger stones, which has led to a gap in the supply of smaller goods.

The big challenge surrounds efficiency in cutting and polishing, explains Nick Smart, commercial director of Lightbox Jewelry, the De Beers-owned lab-grown brand. “As you move to smaller stones, the components of the cost to grow relative to your cutting and polishing becomes larger,” he notes.

In other words, it’s more cost effective to produce larger stones, especially when using CVD growth methods. For that reason, the smaller ones are generally left for HPHT growers, typically in China, whose chambers are cheaper to run and produce lower-quality diamonds.

“It’s quite difficult to find melee in terms of really calibrated qualities because people have focused on the larger goods,” Smart says.

The shortage is becoming more apparent as the industry doubles down on fashion jewelry, which relies more on smaller diamonds for its designs than the typical bridal offering. Brands and jewelry retailers are also increasingly hesitant about sourcing HPHT from China, where they claim to run into chain-of-custody issues, especially amid political tensions between China and the US.

Lightbox is looking at possible solutions to supply high-quality, traceable, renewable-energy CVD melee to people who are interested in small stones, reports Smart.

Value in branding

Chain of custody is going to become more important in the lab-grown sector, and there will be differentiation between those whose supply chain is transparent and those whose isn’t, Hurwitz predicts.

That is the case as branding becomes more prevalent, too. The development of the lab-grown product so far has been about gaining acceptance, and understanding what it is and the type of people who might buy it, explains Smart.

“There hasn’t yet been an emergence of multiple strong brands within the space, and that seems to be the logical next step,” he notes. “Very few have said, ‘We are a lab-grown company, and we’re really proud of that as a core part of our identity.’”

Among its virtues are the science and innovation behind the material, the “coolness” that comes with being a tech-type product, and the creative freedom that one can leverage in design, Smart explains. It also has tech applications, such as use in semiconductors, which could raise demand and help stabilize prices, Hurwitz adds.

Lightbox is revamping its brand, with a rollout planned for later this year. The exercise will see Lightbox “transition toward a more style-forward lab-grown diamond brand that champions the creativity and innovation that is inherent in what we do,” Smart confirmed in an email.

Transcending price

In contrast, when it launched in 2018, Lightbox focused largely on the $800 linear pricing model. Since then, technology and manufacturing capacity has vastly improved, raising the quality and cost competitiveness of the products that can be offered, while customer expectations have also changed, the Lightbox team added.

The $800 price guide no longer reflects the direction of the market, and Lightbox has been testing price points to align with its new brand strategy.

“The wholesale prices of lab-grown diamonds are falling sharply, leading to financial challenges at some leading lab-grown diamond producers,” De Beers parent company Anglo American noted in its 2023 annual results late February. “These price declines are expected to lead to further substantial reductions in retail prices, with De Beers’ Lightbox brand testing significantly lower prices for its products.”

Prices at retail have declined at a slower pace than wholesale, down around 35% for 1- to 3-carat stones,

Golan reports.

However, the drop in wholesale prices shouldn’t compel retailers to reduce theirs, since consumers buy fine-jewelry styles and a brand rather than loose lab-grown polished, stresses Hurwitz. The value is in the creation, not the component, Shah adds.

Democratizing diamonds

For that reason, Shah believes the time is right for lab-grown diamond brand development that can transcend the value reduction experienced in the market.

He identifies four tiers in which consumers operate and define the branding opportunity. Those include luxury names such as Prada, Gucci and LVMH’s Fred, which have all released lab-grown collections. The second group are the big-box retailers such as Pandora and Swarovski, Shah continues, and then there is the generic product, which targets the price-conscious consumer.

Finally, there are the boutique brands catering to the middle market, such as Levi’s or Armani in the clothing industry, but for which he believes there is a gap to fill in the burgeoning lab-grown fashion-jewelry market. Shah says he is in the process of rolling out J’evar by Altr Created Diamonds to capture that market.

Pandora, meanwhile, is leveraging its position to “democratize diamonds,” raising the stakes for the rest

of the industry.

“We want more people to experience the power and beauty of lab-grown diamonds for every day, in classic diamond settings and some that are unexpected,” creative director Francesco Terzo said in August last year at the launch of the three new collections Pamela Anderson, Grace Coddington and friends were promoting.

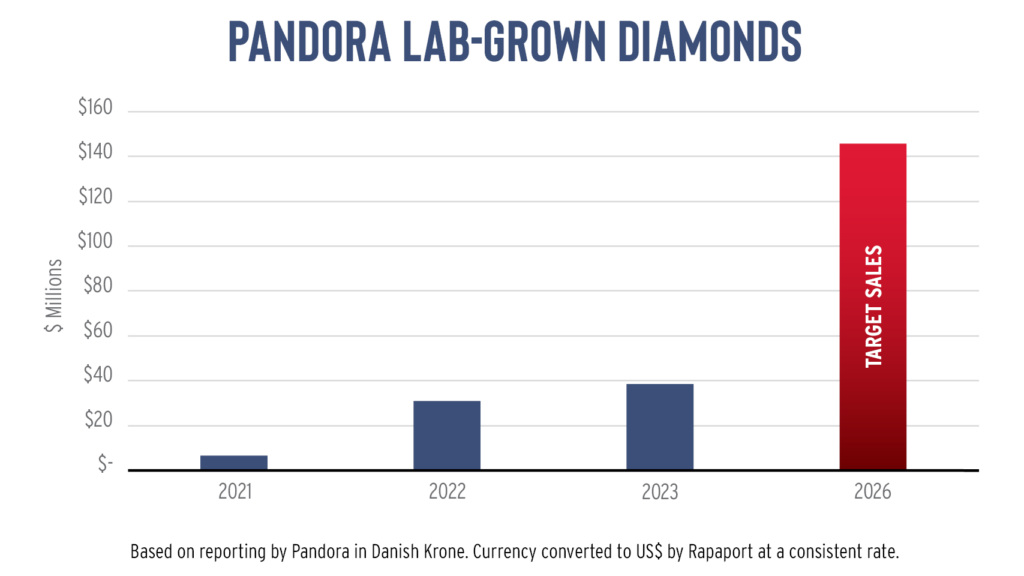

While the segment accounts for just 1% of Pandora’s total revenue, it has been on a steady growth trajectory since its introduction in 2021 (see graph). Pandora’s sales of lab-created diamonds rose 24% to DKK 265 million ($39 million) in 2023. Management has set a target to reach revenue of DKK 1 billion ($146 million) by 2026.

The company is spending millions to advertise this product in every major city in which it operates, Hurwitz says. And that will no doubt raise consumer awareness even more for the broader segment, while it undergoes significant change in 2024.

“Pandora is the world’s largest advertiser of diamond jewelry, and everyone should be emulating the way they do it,” he emphasizes. “Unlike the rest of the jewelry industry that just sort of waits for people to come in the door, they’re investing millions to tell their story their way.”

In doing so, Pandora’s approach to lab-grown could serve as a model for the industry at the start of 2024 — encouraging it to create value in the eyes of the consumer much the way the natural product does, Shah stresses. After all, he adds, “there’s no going back now,” on lab-grown. “We’re going to have to create value in both segments.”

Main image: David Polak and Elisé Jurkovic.

Stay up to date by signing up for our diamond and jewelry industry news and analysis.