Top Stories

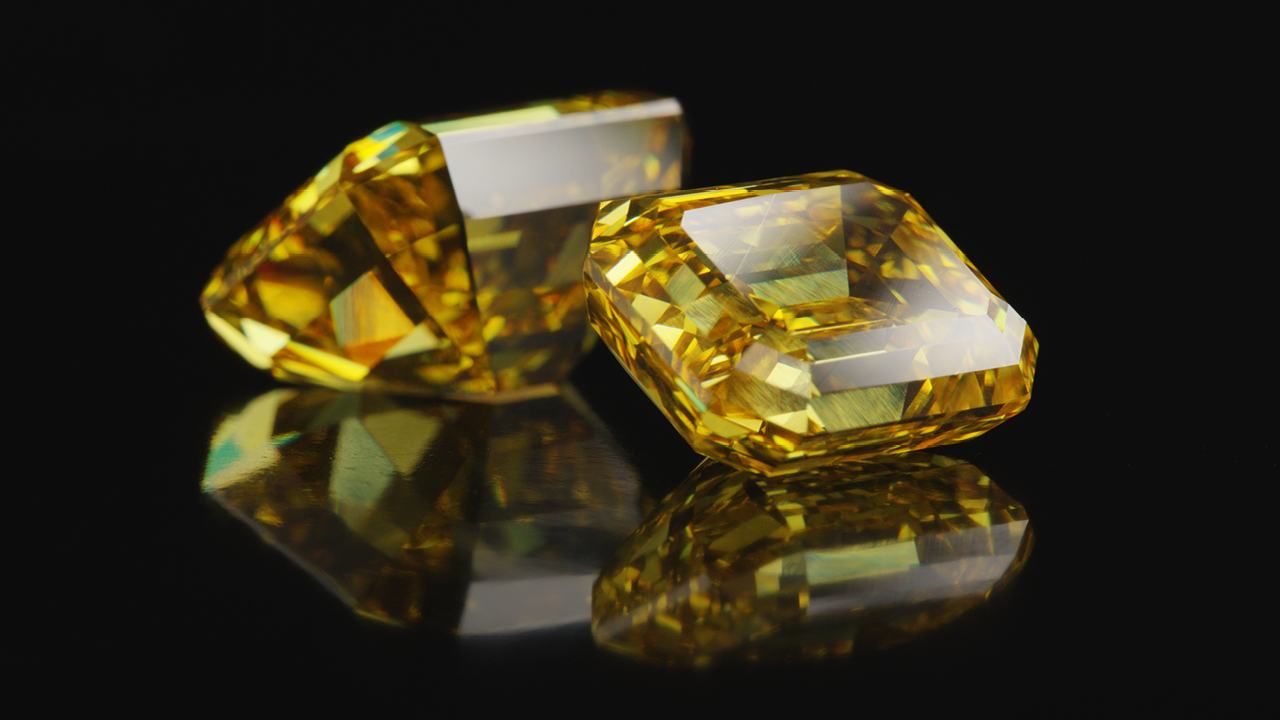

De Beers Slashes Production Outlook

First-half sales and profit drop amid weak diamond market.

A Jewelry Safe Haven: US Market Shows Stability

Sales have stabilized after years of volatility, despite ongoing challenges, creating new opportunities for growth.

Most Popular

Rapaport Magazine Cover Stories

Bling for Men Is No Small Trend

With sales growth outpacing the women’s segment, fine jewelry for the gents is hotter than ever.

Jewelry

May 22, 2024

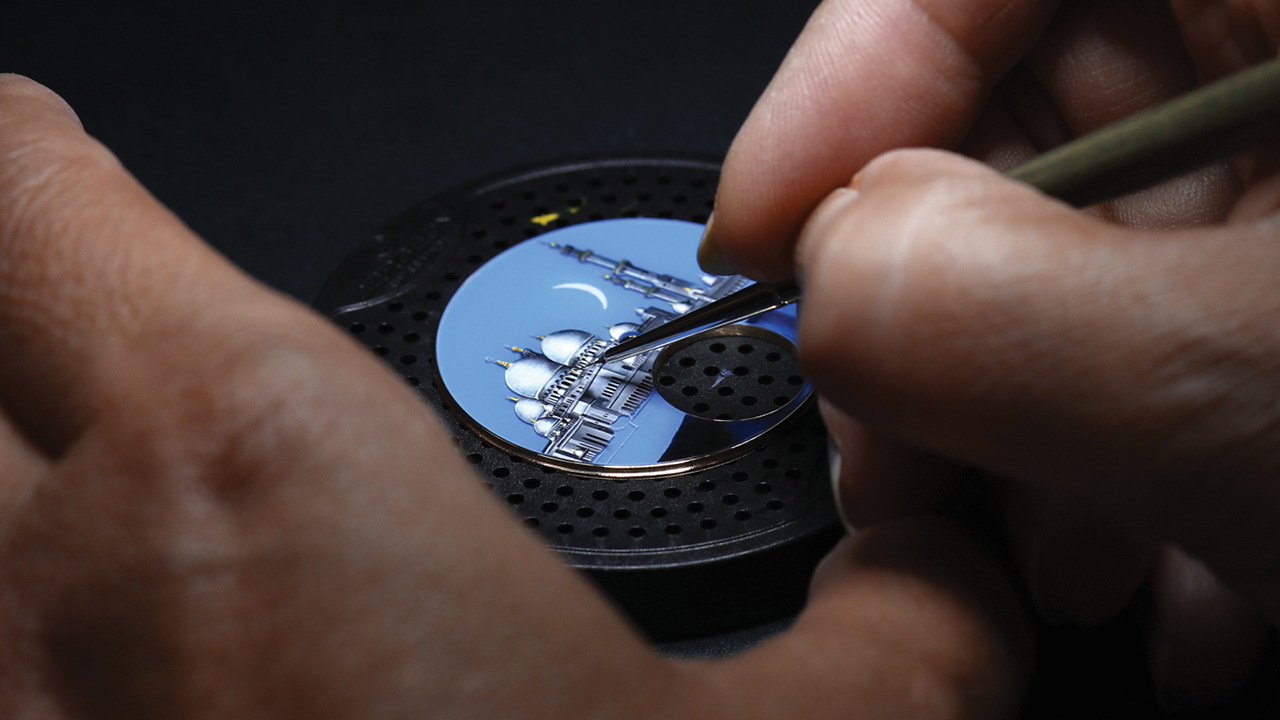

Colored-Gem Engagement Rings Put the ‘Pop’ in Popping the Question

Couples are choosing brightly hued stones as a creative way to express their love.

Colored Gemstones

May 22, 2024

The Edgy Allure of Mixed Metals

As gold prices rise, jewelers are finding striking new ways to combine it with silver, platinum and other options.

Jewelry

May 22, 2024

Rapaport

Market Data

Diamonds

Metals

Currencies

Equities

Market Comment - Jul. 25, 2024

Round prices declining; fancies down less sharply.

Manufacturers switching to cheaper, smaller goods.

De Beers lowers 2024 production plan to 23M-26M cts. from 31.9M cts. in 2023; demand slow and rough prices stable at July sight.

India removes 2% equalization levy on rough, with “safe harbor” rule simplifying tax for overseas miners.

US retailers buying selectively and focusing on memo. Sluggish inventory replacement by brands and large jewelers.

LVMH 1H watch and jewelry sales -5% YOY to $5.6B.

Swatch Group 1H watch and jewelry sales -14% YOY to $3.7B.

Birks FY sales +14% to $135M.

Luk Fook fiscal 1Q diamond jewelry same-store sales -52% YOY.

AWDC names Karen Rentmeesters permanent CEO.