RAPAPORT PRESS RELEASE, November 5, 2024, Las Vegas… Diamond prices declined in October but stabilized in the month’s second half. US buyers purchased for the holiday season ahead of India’s Diwali shutdown. However, manufacturers were under pressure to sell at deep discounts.

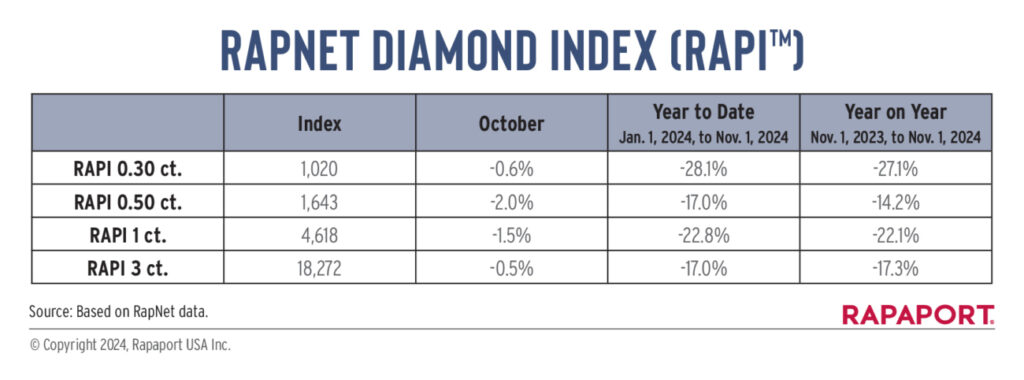

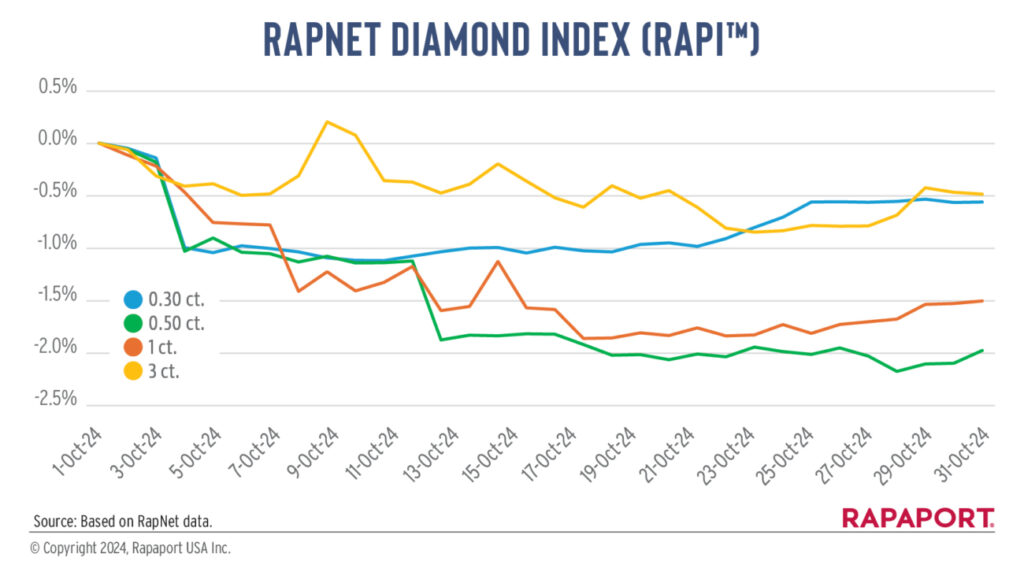

The RapNet Diamond Index (RAPI™) for 1-carat diamonds — reflecting round, D to H, IF to VS2 diamonds — fell 1.5% in October. The index dropped 0.6% for 0.30-carat stones, 2% for 0.50 carats, and 0.5% for 3 carats. The declines were gentler than in September. Prices of pears and ovals were more stable than rounds.

The Indian inventory crisis became less intense as manufacturers reduced rough imports and production while keeping polished exports steady ahead of the US holidays.

Supply was patchy. Inventory of SIs rose as manufacturers produced them in response to demand. Round, 2- to 3-carat, D to I, VS2 to SI2 diamonds with no strong inclusions were hard to find. Manufacturers held large quantities of less-desirable items, while oversizes and perfect goods were in demand. The number of diamonds on RapNet rose 0.8% during the month, totaling 1.7 million on November 1.

Trading in the US, Belgium and Israel was slow due to the Jewish festivals. India shut down for Diwali in late October, with manufacturers closing for an expected three to four weeks and sales offices for 7 to 10 days. The industry hopes this will improve the inventory situation.

A seasonal rise in sales boosted sentiment. US retail was steady ahead of Christmas, with wholesalers preparing for last-minute calls. Domestic Indian demand was robust leading up to Diwali and the wedding season.

Rough demand was weak at the De Beers sight that began November 4. The company indicated it might lower its 2024 production plan, which currently stands at 23 million to 26 million carats. It also announced it would disclose the origins of all 1.25-carat and larger rough on its Tracr platform.

Meanwhile, Duma Boko’s election as Botswana president — defeating Mokgweetsi Masisi — created uncertainty about the government’s ongoing negotiations with De Beers over a new sales agreement.

Media Contacts: [email protected]

US: Sherri Hendricks +1-702-893-9400

International: Avital Engelberg +1-718-521-4976

About the RapNet Diamond Index (RAPI™): The RAPI is the average asking price, in hundred dollars per carat, of the 10% lowest-priced round diamonds in each of the top 25 quality categories (D-H, IF-VS2, GIA-graded, RapSpec-A3 and better) offered for sale on RapNet® (www.rapnet.com).

About the Rapaport Group: The Rapaport Group is an international network of companies providing added-value services that support the development of ethical, transparent, competitive and efficient diamond and jewelry markets. Established in 1976, the group has more than 20,000 clients in over 120 countries. Group activities include Rapaport Information Services, providing the benchmark Rapaport Price List for diamonds, as well as research, analysis and news; RapNet, the world’s largest diamond trading network, with daily listings of over $8 billion; and Rapaport Trading and Auction Services, the world’s largest recycler of diamonds. Additional information is available at www.rapaport.com.

Stay up to date by signing up for our diamond and jewelry industry news and analysis.