Consumers are starting to understand the declining value of lab-grown diamonds, a trend that could boost the natural sector in 2024, Signet CEO Gina Drosos said on an analyst call Wednesday.

Deep discounting by independent jewelry, especially on lab-grown, impacted Signet’s average transaction value in the fiscal fourth quarter that ended February 3, Drosos explained.

The retailer’s sales fell 6% year on year to $2.5 billion during the period, it reported Wednesday. The average transaction value slipped 0.6% in North America and slumped 10% in other regions as the jeweler sold some of its prestige watch locations.

“I think that consumers are becoming more aware that lab-created diamond prices are falling,” Drosos said on the call following the earnings release. “And so while they might be great for fashion jewelry, there’s something very, very rare and individual about a natural diamond. And so we think that that is a potential tailwind for natural diamonds in the year ahead.”

Signet’s lab-grown sales are in the “teens percentage” of total group revenue, she added.

With the US economy still challenging, Drosos noted an opportunity to expand its focus on low-cost fashion jewelry, an area to which it currently has little exposure. Its main banner in that segment is Banter, formerly Piercing Pagoda.

Bringing more lab-grown into the fashion category proved a good strategy for Signet over the holidays, she reported. Gold is also an opportunity for the company, as it has direct partnerships with factories, she continued.

Season of discounts

Last year was a highly promotional environment at independent jewelers in both natural and lab-grown products, the CEO continued.

Independents “didn’t predict the engagement trough as well as we did, and so were over-inventoried all year,” she noted. “They were working through that inventory still in the fourth quarter, and so [there was] a lot of pressure on moving that through. While we have seen continued discounting into the first quarter, I would anticipate that the inventories are recovering somewhat, and so that could be a help.”

Another potential boost this year is the predicted engagement boom after last year’s decline, which Signet put down to a lull in dating during Covid-19.

The owner of Kay Jewelers, Zales, Jared, and online retailers James Allen and Blue Nile expects US “engagement incidents” to decline by low to mid-single digits in its first fiscal quarter — which began February 4 — compared to the same period last year. However, for the full fiscal year, it expects engagements to increase by 5% to 10% versus last year.

“We’re seeing engagements recover as we expected they would,” Drosos said. “We saw the trough happen in [the fourth quarter], and we’re expecting a gradual and incremental improvement in engagement trends over the next three years. So it takes a bit to recover.”

However, Valentine’s Day was a challenging period, with shoppers “late and highly value motivated,” similar to during the holiday season.

Sales in January and early February were “quite soft,” with comparable-store sales down in the mid-teen percentages, Drosos revealed. “Since early February, trends have notably improved, with same-store sales down mid- to high single digits,” she continued.

Still, Signet expects the overall jewelry industry to be “down mid-single digits” this year.

“We’re seeing consumers continue to be value-oriented,” she elaborated. “That’s how they were [in the fourth quarter] and Valentine’s Day.”

RELATED READING

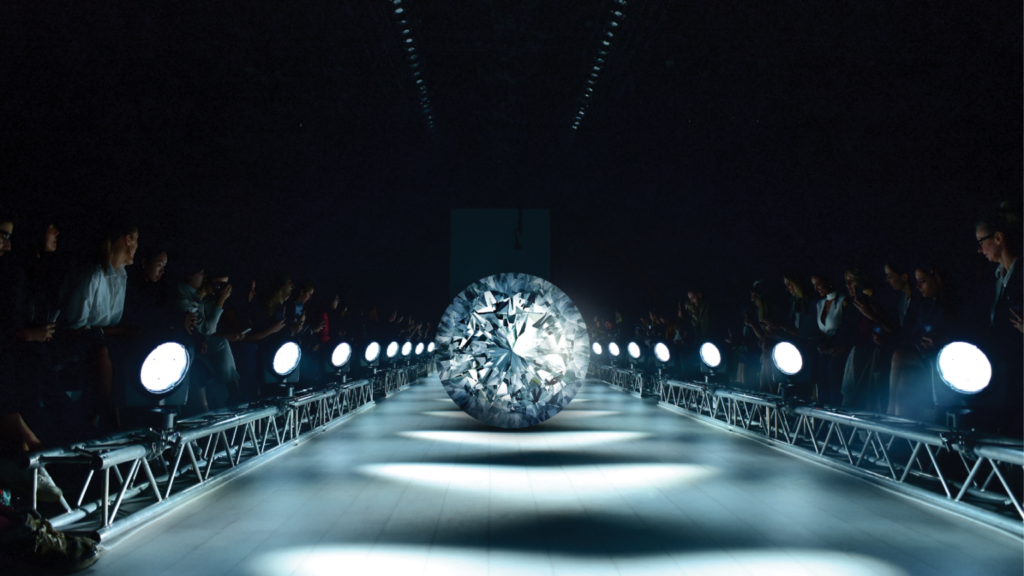

Main image: A Kay Jewelers store. (Shutterstock)

Stay up to date by signing up for our diamond and jewelry industry news and analysis.