“The more things change, the more they stay the same,” wrote French writer Jean-Baptiste Alphonse Karr in 1849. The famous proverb is understood to mean no matter how tumultuous a situation is, some underlying patterns remain consistent.

The diamond industry must keep this in mind as it navigates the current market slump. Can the trade learn from the past and bring about a sustainable improvement?

While US economic weakness, rising competition from lab-grown diamonds and the slowdown in China sparked the downturn, market inefficiencies over the past 15 years have also contributed.

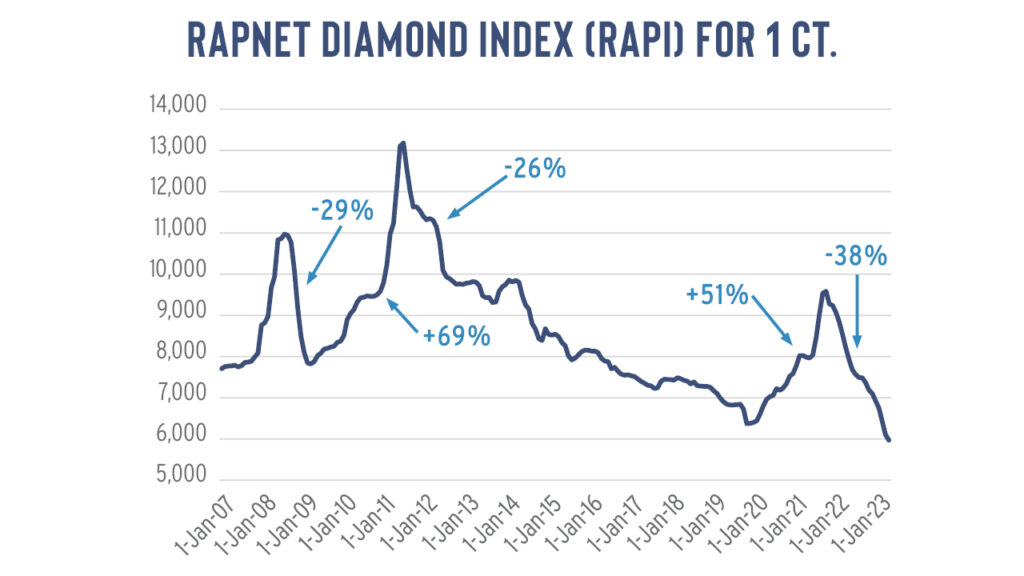

Polished prices have seen their sharpest drop in recent memory. The RapNet Diamond Index (RAPI™) fell 38% from April 2022 to November 1, after sharp increases recorded in the post-pandemic years of 2021 and 2022.

Twice before in the past decade and a half has the RAPI index seen a similar diamond industry pattern (see graph).

Pre-2008, the market was on a strong upward trajectory before the financial crisis. When the markets crashed the 1-carat RAPI fell 29% from its peak in August 2008 to its bottom in April 2009. The retail expansion in China then drove a recovery, fueling prices to rise sharply until mid-2011. The index subsequently slumped 26% between July 2011 and December 2012, with the decline continuing at a more gradual pace until the pandemic hit and the market froze in 2020.

The diamond industry recovered from the Covid-19 crisis, with the 1-carat RAPI rallying 51% between April 2020 and April 2022, before its subsequent downtrend.

Based on those metrics, the current slide is worse than 2008 and the initial slump of 2011. But perhaps it should be viewed as a continuation, or even an acceleration, of the crisis the industry faced pre-Covid-19.

The pre-pandemic crisis

The industry was not in a good place in 2019.

The market fell that year due to an oversupply of diamonds and a shift in the way consumers and dealers purchased them. That resulted in the diamond industry holding a lot of stock that was difficult to sell — and that they carried into the pandemic.

Before Covid-19, the diamond industry operated in a supply-driven buyer’s market. That was due to rough production growing in 2017 and 2018 when the Gahcho Kué, Renard and Liqhobong mines came onstream. Manufacturers raised their polished output during that period even as profit margins tightened, and demand stagnated.

Polished-inventory levels increased, but trading became segmented. Buyers were more selective and focused on better-quality goods while shunning diamonds with fluorescence and those that had a brown, green, or milky (BGM) hue. Manufacturers lowered their polished prices to reduce inventory and raise their liquidity.

Further back

The industry finds itself in a similar position today, cutting prices to stimulate buying and sell off inventory. However, this position came about through different circumstances.

Unlike in 2019, when new mines pushed rough onto the market, high inventory levels in 2023 resulted from aggressive rough buying during the post-Covid-19 recovery. That behavior continued even as the market was slowing in the second half of 2022.

To stop the rut and reduce polished-inventory levels, Indian manufacturers have taken the drastic measure of implementing a voluntary rough-buying freeze for two months between October 15 and December 15. De Beers has allowed sightholders full flexibility to buy what they want — rather than what they’re contracted to purchase — until the end of the year, and other miners and rough sellers have canceled their tenders and auctions to accommodate the drop in demand.

We’ve seen this before. Back in 2008, Indian manufacturers implemented a moratorium on rough purchases that helped stimulate the trade’s recovery from the financial downturn. Not long after, China’s retail expansion stimulated strong buying across the pipeline.

A boom market ensued for the next two years during which the midstream accumulated large inventories to accommodate the newfound Chinese demand. The market improved significantly as prices rose, and dealers turned speculative, thinking the Chinese growth spurt would continue.

But around 2011, the bubble burst as China’s economic growth matured and the government clamped down on corruption – bribery through gifting high-value items. Having built up all that inventory, there was suddenly not enough demand to fill the supply the midstream had accumulated.

Fundamental changes

At the same time, several changes were taking effect that had a profound impact on the way the market operated.

Banks tightened their lending and raised their compliance requirements, and consequently reduced their funding of rough purchases. De Beers, meanwhile, shelved its generic marketing as it shifted to a brand-centric strategy. Millennials, who emerged as the core bridal customer, were less drawn by the “Diamond is Forever” concept and brought new considerations to where, how, and why they purchased.

Online shopping gained momentum, and social media and smartphones facilitated a change in consumer habits. Baby boomer jewelers started to retire, and with many unable to inspire succession among the next generation, they closed their shops. Further consolidation took effect through mergers and acquisitions, particularly as Signet Jewelers began acquiring major brands for its portfolio.

All these developments put pressure on the midstream. Meanwhile, manufacturers were contracted to buy rough with De Beers and Alrosa, which together accounted for about two-thirds of global supply. That often resulted in sightholders accumulating goods they didn’t need to gain the ones they did.

Back to today

The midstream never fully adjusted to the changes that had been brewing since 2008, and those developments continued to evolve.

US retail consolidation continues, while China’s expansion has slowed. Besides, jewelers are more conservative in their inventory management, particularly during a downturn. Online trading has empowered retailers to hold less stock and demand faster delivery from their suppliers.

Shopping habits remain in flux, as Gen Z consumers gain spending power, and artificial intelligence is increasingly influencing how companies engage with their customers.

Regulatory and compliance requirements have become even more important and broader in scope. These now include considerations relating to sustainability, which encompasses environmental, social and governance (ESG) concerns. Additional source-verification requirements are being considered by the Group of Seven (G7) nations in response to Russia’s war in Ukraine.

Just as financial compliance raised disclosure standards for the trade in 2008, so too source-verification requirements are increasing considerations that companies need to take into account.

Inefficient rough market

And while these changes put the midstream in flux, manufacturers must still navigate the inefficiencies in the rough market. There, they are obligated to buy diamonds for which they don’t have demand, particularly under the contract system the major miners use to sell rough.

There have been attempts to address those inefficiencies. Lucara Diamond Corp.’s Clara platform aims to link the rough purchase with the desired polished outcome. But it has had limited success as the company lacked the volume from its own production for Clara to gain traction, and it struggled to recruit third-party sellers.

As former CEO Eira Thomas would stress, there has been little disruption or innovation in the way rough is sold — and not much done to address the market’s inefficiencies.

So, when the market recovered from the Covid-19 crash, manufacturers purchased rough as if the growth spurt would continue, just as they did in 2011. They bought to satisfy the broad rise in demand for polished, but not necessarily to meet the specifics of that demand.

And when the market slowed, they were left with a lot of dead stock.

Next moves

Now, as the midstream focuses on selling for the holiday season, and is refraining from buying rough until December, questions arise as to how the market will emerge in the first quarter of 2024.

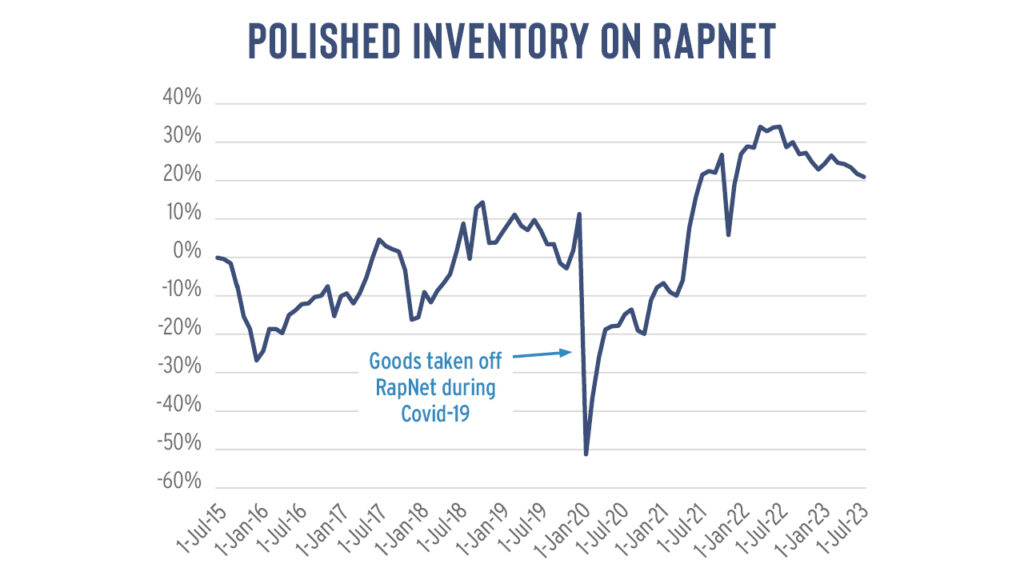

There are already signs of a slight uptick in demand, no doubt driven by the upcoming holiday season. Polished inventory levels have come down in the second half of 2023, but remain historically high, as reflected in the volume of stones listed on RapNet (see graph).

But will De Beers — and despite potential sanctions, Alrosa — push excessive rough production to the market? After all, the major miners have maintained production levels and are currently building up inventory of their own.

Will too much of that inventory be shifted to the midstream, again?

There’s no doubt the diamond market will face the same challenges in 2024 as it did this year. The US economy is projected to continue to face headwinds, Chinese consumers are anticipated to remain cautious, and the threat of lab-grown is not going away — even if it is predicted to shift away from the bridal segment to fashion jewelry.

But as the industry finds its supply-demand balance in the current fourth quarter, it has an opportunity at least to address the inefficiencies that have plagued the market in the past 15 years.

Keeping supply in check will empower the industry to focus on the more important task of stimulating demand and inspiring a sustainable recovery in the long term.

Main image: Shutterstock.

Stay up to date by signing up for our diamond and jewelry industry news and analysis.