Plummeting prices and inflated margins — both phrases have been used to describe the situation in lab-grown in the past year. It’s important, however, to distinguish between wholesale and retail prices and to consider how changes to these impact profits for jewelers and their suppliers.

If, for example, wholesale prices fall 50% and retail prices drop 20%, jewelers’ margins will increase in percentage terms. In absolute dollar terms, however, a retailer must sell more volume to make the same profit.

Many retailers have made a lot of money from synthetics in the last couple of years because of the lag between the wholesale and retail markets, with store owners able to buy the goods cheap and sell them at a much higher price. This encouraged them to promote lab-grown actively to consumers in-store.

Retail prices have fallen since then, as Edahn Golan, owner of Edahn Golan Diamond Research & Data, showed in a LinkedIn post earlier this year. Total US retail revenues from lab-grown diamonds declined year on year for the first time in January 2024, as the drop in prices outweighed an increase in the volume of sales, Golan reported.

Heavy price drops at both retail and wholesale, resulting from a rise in production, dented lab-grown margins in dollars terms during 2023, according to Catherine Angiel, whose New York-based fine-jewelry retail business bears her name.

Angiel has seen strong demand for lab-grown: Some 70% of the business’s engagement-ring sales this year have been synthetic diamonds, she reported.

“Unless you’re a big-box company, it’s much harder for mom-and-pop or independent shops to make their numbers [on lab-grown],” said Angiel.

Lauren Petrovic, designer and founder of jewelry brand Laurenti New York, has also seen an erosion of margins on lab-grown in dollar terms. Unlike Angiel, she sells natural diamonds for engagement rings and wedding bands, but lab-grown for fashion pieces.

Petrovic marks up lab-grown by 20% to 30%, compared with 40% to 45% for natural, but the dollar profit is what matters.

“Because the price is declining so suddenly, you’re going to [have to] work so much harder to sell 15 lab-grown engagement rings versus maybe three or four or five natural diamonds,” she noted.

Michael Givelekian at Royal Jewels of Rye, a jewelry retailer in Rye, New York, also said wholesale prices had fallen faster than retail. He will typically buy a 1-carat lab-grown diamond for around $400 — varying based on the quality — and sell for about $1,000, he told Rapaport News.

“I have a sneaking suspicion that at this point, it’s kind of bottomed out, and it’s going to stay at this kind of price point on the wholesale level,” said Givelekian.

On the retail side, however, consumers’ ability to research lab-grown online, as well as higher production of synthetics, will continue to put pressure on prices, he added.

But declines in profits since early 2023 have made the category less viable for independent jewelers.

“The volume has to be up if I’m going to continue to sell predominantly lab-grown in our store,” Givelekian added. “The same amount of labor, the same amount of time, the same amount of blood, sweat and tears [is being] put into the job, but the profits are not the same. You have to work even harder to generate the same amount of money.”

Many retailers are still overpaying for lab-grown, said Olivia Landau, founder and CEO of New York-based jeweler The Clear Cut, which sells exclusively natural diamonds. “But they don’t care, because they’re making so much on it,” she added.

While wholesale prices are dropping sharply, “on the retail side, it’s obviously going to take a little bit more time, because the consumer needs to be well educated on the value and be able to price-compare,” Landau added.

Wholesale lab-grown prices have more than halved in the past year, agreed a New York-based jeweler who sells natural and synthetics. He estimates he currently buys a 1-carat, D-color, VS1-clarity lab-grown diamond with an International Gemological Institute (IGI) grading report for $160 to $190. The same stone with a report from the Gemological Institute of America (GIA) would cost him $250 to $300.

The long-term prospects for lab-grown mean jewelers should be cautious about the product, he added on condition of anonymity.

“If they cost less, then obviously you’re selling it for less, so your margins are going down, which is why most retailers should not give up so quickly on natural,” the jeweler concluded.

RELATED READING

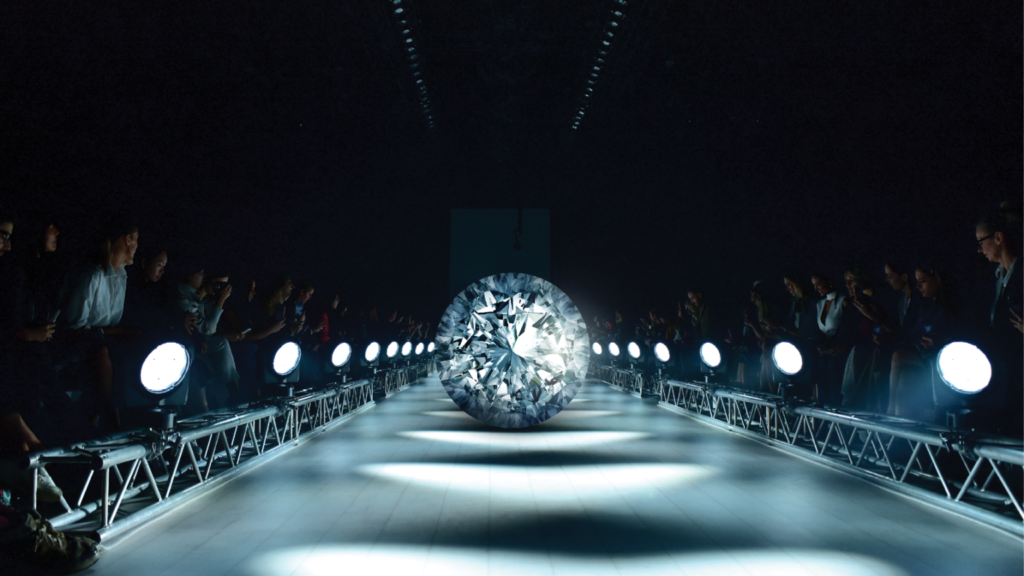

Main image: Lab-grown diamonds produced using the High Pressure-High Temperature (HPHT) method. (Keystar Gems)

Stay up to date by signing up for our diamond and jewelry industry news and analysis.