In mid-2023, as China’s real-estate crisis lingered, property firms started to offer gold bars as an incentive to buy their apartments.

Unlike real estate, gold is perceived to hold its value, the theory went. Then again, companies also presented new cars, cell phones, free decorations and parking lots to woo customers and boost sales.

Their efforts bore little fruit, however, as supply continued to outweigh demand. Housing starts have fallen by more than 60% relative to pre-pandemic levels, according to a February Report by the International Monetary Fund (IMF).

The property slump, along with several other factors, is having a marked effect on consumer confidence and the diamond market, acknowledged participants in the Presidents’ Meeting of the World Federation of Diamond Bourses (WFDB), which took place in Shanghai in early March.

“People put a lot of money in real estate, and some in stocks, so when you see the downturn at such a high level, it has a major impact,” said Abhishek (Andy) Golecha, general manager of KGK Shanghai, the local branch of India-based diamond manufacturer KGK Group.

Along with the property crisis, trade tensions with the United States and the pandemic are having a residual effect on consumer spending, panelists noted in a discussion titled “Natural Diamonds in the Chinese Markets.”

The Covid-19 effect

The economy was already under pressure before the pandemic, but Covid-19 and China’s long lockdowns caused anxiety over households’ limited income, Golecha added.

That cautious sentiment remains as the country ended its lockdowns only in January last year. “The [Chinese New Year] holiday that just past was technically the first [holiday] since Covid-19,” noted Kellan Bo Dong, president of Kimberlite Diamond, a Shanghai-based retail jeweler.

China did not experience a post-Covid-19 bump similar to the one in the US where government-stimulus checks fueled spending. Households in China did not receive that type of financial support during the pandemic, explained Professor Zhang Jun, dean of the School of Economics at Fudan University, who addressed the WFDB executive separately.

“That’s why there’s a really high propensity for families to save,” he said. “They feel they may have to pay more in the future for education, medical, housing, so precautionary saving is still rising, especially after the pandemic.”

Household consumption as a percentage of gross domestic product (GDP) is well below the global average, Zhang stressed.

Depreciating assets

Chinese consumers exert caution when the economy stagnates, and they tend to avoid purchasing assets in a downward-trending market — as was evident in real estate over the past few years.

That is another reason why they have shied away from diamonds, panelists at the Presidents’ Meeting noted.

“The challenge for the diamond industry is that consumers see diamond prices coming down,” explained Lawrence Ma, founding president of the Diamond Federation of Hong Kong, China, and CEO of the Lee Heng Diamond Group, which is engaged in diamond wholesale and jewelry retail. “They don’t want to buy because they see that prices are weakening and don’t want to be seen for a fool.”

In contrast, there has been a boom in demand for gold products, particularly 24-karat gold, and Chinese consumers seem to believe gold jewelry can have good investment value, Ma stressed.

Gold resurgence

While gold jewelry has deep roots in traditional Chinese culture, it has seen a resurgence in popularity among younger consumers in recent years.

“Five to 10 years ago, young people didn’t buy gold jewelry; it was considered an older-generation thing,” said Kent Wong, managing director of Chow Tai Fook, considered the largest jewelry retailer in the region. “But they’ve changed their preferences because of marketing, social media and culture, while gold jewelry also improved its storytelling, making use of Chinese culture to help consumers decide.”

At the same time, in recent years, technology and innovation have improved the functionality of gold and enabled more versatile, more colorful and better designs, increasing the fashion appeal of gold jewelry, Ma added.

Sales boost

Jewelers have capitalized on the renewed popularity of gold, as sales in that category have compensated for weakness in diamonds.

Chow Sang Sang reported same-store sales in mainland China went up 12% in 2023, driven by a 21% rise in gold jewelry and products and 9% growth in watches. Those increases offset a 23% decline in gem-set jewelry, weighed down by diamonds.

“Diamond-jewelry sales, particularly those at higher price bands, were on a downward trend in mainland China,” the company explained.

Similar developments were evident in the latest operating updates at Chow Tai Fook and Luk Fook Holdings for the quarter ending December 31. Both companies reported rising gold sales and sluggish gem-set jewelry — with weakness in diamonds — in mainland China.

Tse Sui Luen Jewellery (TSL) expects to record a loss when it reports its annual results in June, it warned. The result is “mainly due to the significant decline in consumer demand for natural diamond jewelry in the mainland market and the diminishing profit margins from the group’s transition to selling 24-karat gold products in a much higher percentage,” it explained in mid-March.

Diamond sales continue to disappoint in 2024, Chow Sang Sang’s management added in its forecast for the year.

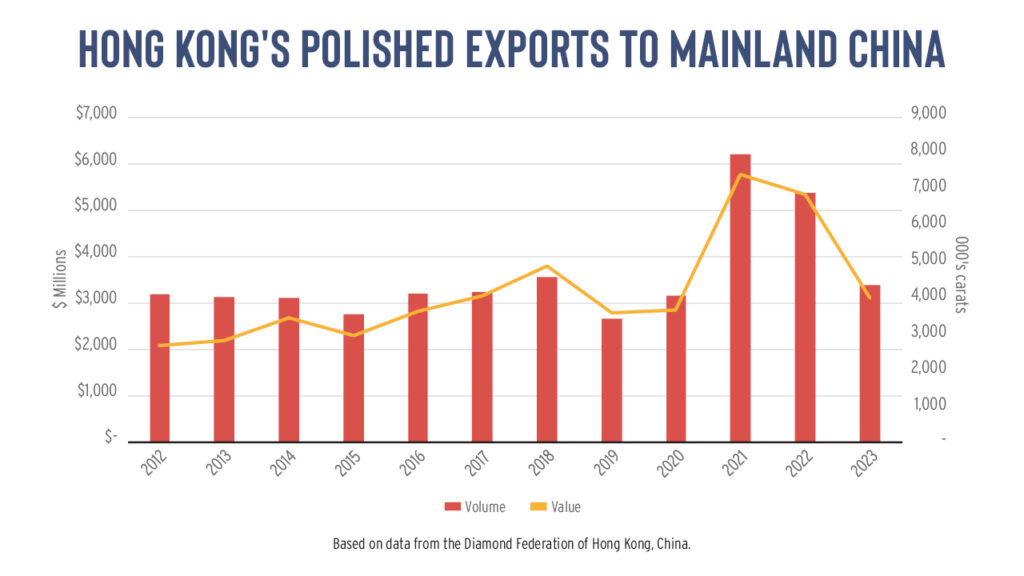

The declines in retail have filtered to the wholesale market. Hong Kong’s exports of polished diamonds to mainland China fell 42% by value and 37% in volume terms in 2023, according to data released by the Diamond Federation of Hong Kong, China (see graph).

Fewer weddings

There is a lot of misinformation about diamonds that is affecting the industry, including the perception of declining prices, which is off-putting for consumers, Bo Dong explained.

The emergence of lab-grown diamonds has also impacted the industry, added Chow Tai Fook’s Wong. “Consumers are confused as to what to buy,” he observed. “They need a clear differentiation between the two products.”

In addition, more of the younger generation is choosing to remain single or delaying getting married, a trend many believe has intensified as a result of the pandemic and the weaker economy.

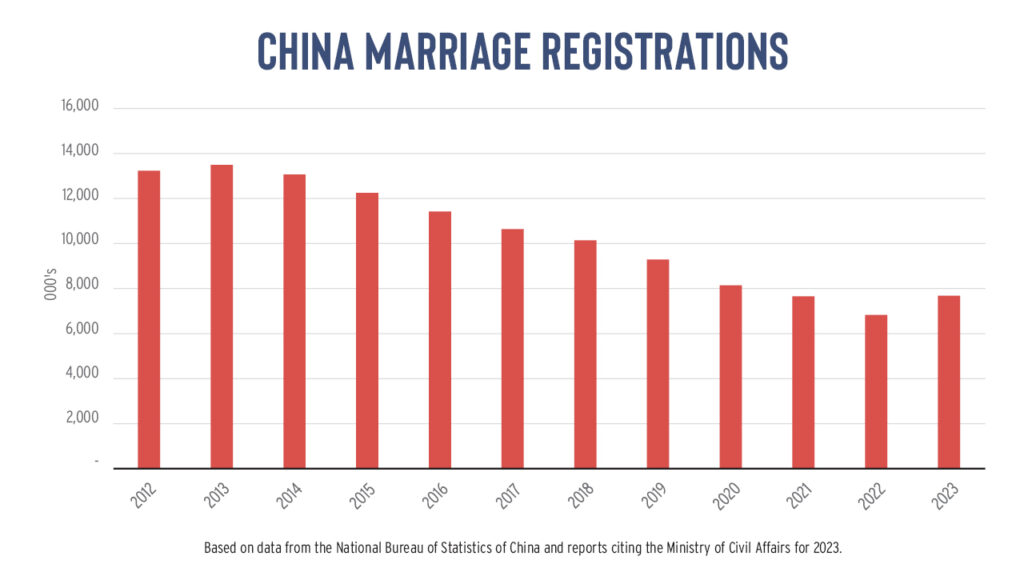

Marriage registrations declined for nine consecutive years, reaching a record low of 6.83 million in 2022, according to data from the National Bureau of Statistics of China. The trend broke last year when some 7.68 million couples registered marriage in China in 2023, according to press reports citing data from the Ministry of Civil Affairs.

Still, that is well below the peak of 2013 when around 13.5 million marriages were registered (see graph). Fewer nuptials have spurred a “rapidly declining fertility rate,” which has led to an aging population, Zhang noted.

Maturing market

Despite the decline in marriage rates through to 2022, those who tied the knot were more inclined to acquire diamond jewelry, according to De Beers’ 2023 Diamond Insight Report.

The proportion of brides receiving diamond jewelry for their wedding or engagement increased to 47% in 2022, the report stated. That’s slightly up from the year before and significantly higher than 2020 when the rate was at 33%.

The higher acquisition rate together with the increased price per piece — up 10% versus 2020 — resulted in bridal market growth in China of 6% in 2022 compared to two years prior, De Beers estimated.

Consumer spending habits have changed rapidly since the onset of Covid-19, stressed Sissi Xu, managing director for greater China of the Natural Diamond Council (NDC), an industry marketing body.

“Consumers in China are increasingly discerning, looking for quality and value,” Xu said in the panel discussion. “This reflects a maturing market in which the consumer is becoming savvier and more value oriented.”

Staying confident

Changes in consumer behavior, particularly relating to diamond purchases, are deeply entwined with the culture, the economy, and the technology evolution, she stressed.

Among the trends causing those changes, Xu noted that sustainability and ethical sourcing were becoming increasingly important to Chinese consumers, as was the rise of the digital native.

“Young consumers shop online not only because of convenience, but also because of the huge range of options and wealth of information about products,” she explained.

Personalization and the quest for a unique experience are also in demand among consumers, while there is a strong emphasis on cultural influences and interpretations.

“In the Chinese wedding, the diamond is taking on a new role,” she noted. “The tradition of the diamond engagement ring remains strong, but we see the very obvious shift to modern and unconventional design.”

Amid a rapidly evolving Chinese diamond market, the key is to stay agile and respond to those consumer needs, and to commit to ethical practice, Xu stressed.

Similarly, Wong urged the trade to stay confident in natural diamonds and to make sure to have a strong message of commitment to them.

Just as the gold industry tapped its storytelling to stimulate a boom in sales, there is a lot the diamond trade must do to improve the desirability of diamond jewelry, Ma added.

“The diamond trade must strive to improve the desirability of diamond jewelry. There are things we can’t change, such as the purchasing power of our audience, which depends on the economy,” Ma concluded. “But we can always try to improve the appeal of natural diamonds to consumers.”

Main image: David Polak and Elisé Jurkovic

Stay up to date by signing up for our diamond and jewelry industry news and analysis.