RAPAPORT… Sarine Technologies has launched a valuation service for rough diamonds, aiming to support the lending sector by making it easier to assess how much collateral is worth.

The Israeli company will analyze rough stones with its existing technology and then value the expected polished outcome using various sources of pricing data, it said Monday. It will refine the estimate via “statistical analyses and weighting,” Sarine explained.

“The data thus derived provide an actual range in dollar terms of the market value and tradeability of the polished diamonds that may be manufactured from the rough stone, indicating its market value,” Sarine noted.

For the project, Sarine has partnered with Mazalit, an Israel-based provider of financial and logistics services to the diamond industry. One of the purposes is to give more clarity about the value of Mazalit customers’ collateral. Sarine will receive payment per diamond scan — as it does with its other services — as well as a “fee commensurate with the actual financing provided,” it said.

“The ability to allow regulated financial entities to provide working capital against rough diamonds as collateral is an important and meaningful development for the diamond industry,” said Sarine CEO David Block. “Though rough diamonds are high-valued assets that embody significant value, financing them till now was difficult due to the highly subjective process employed and the consequential difficulty to accurately assess their value.”

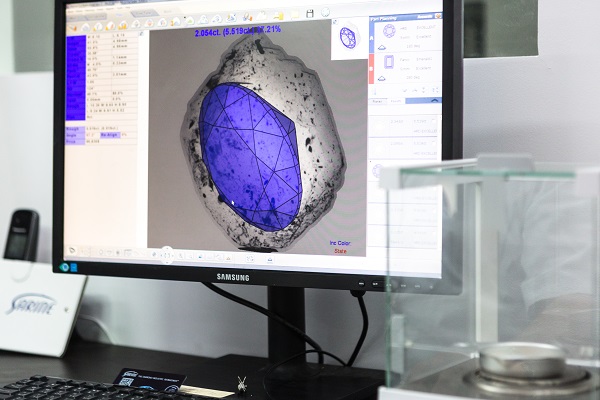

Image: A Sarine scanning machine at the company’s laboratory in Israel. (Sarine Technologies)