The following is the submission that Rapaport made to the Responsible Jewellery Council (RJC) in December 2021.

December 17, 2021

1. Disclosure Related to Value Appreciation of Man-Made Diamonds

The following statement should be required on all marketing material, grading reports and invoices for man-made diamonds.

“Man-made diamonds do not appreciate in value like natural diamonds because they can be created in unlimited quantities and are not subject to the same supply limitations as natural diamonds.”

- Numerous suppliers of man-made diamonds emphasize that they are the same as natural diamonds. They do not disclose that man-made diamonds are fundamentally different from natural diamonds in their ability to retain value over time. (1)

- Some RJC retailers make false or misleading statements regarding the ability of man-made diamonds to retain value. (2) Statements that it is “unknown” if man-made diamonds will retain value are false and misleading. In fact, there is sufficient information and data showing that prices for man-made diamonds decline significantly over time. (3)

- Consumers are subject to partial disclosure or outright misinformation which makes them think that man-made diamonds are the same as natural diamonds regarding value retention. Partial disclosure that mislead consumers is an unethical and illegal business practice. (4)

- Full disclosure regarding the inability of man-made diamonds to retain value like natural diamonds should be required on all marketing material and invoices for man-made diamonds by all ethical members of the jewelry trade, including RJC members.

- In the event the RJC is confused about whether or not consumers are misled by the current practice of partial disclosure by RJC members an independent impartial public survey of consumers should be made by RJC.

- The appendices and background comments provided below are an integral part of this public comment.

2. Martin Rapaport Comments Regarding Failure Of Full Disclosure Regarding Value Appreciation

The idea that diamonds are a store of value is a fundamental component of diamond demand. Consumers are being misled by retailers who sell man-made diamonds without full disclosure. The default assumption among consumers is that man-made diamonds will appreciate over time, even though the opposite is true.

The price of man-made diamonds will significantly decrease over time as they have for other man-made gemstones. The cost of creating man-made diamonds will continue to fall as their supply increases using lower cost technologies.

Many if not most consumers will be sorely disappointed when they try to sell their man-made diamonds and learn that their value has decreased from thousands of dollars to hundreds or even tens of dollars.

Essentially man-made diamonds at the current price level are unsustainable. The current level of “frenzy” demand is driven by windfall profits provided to retailers who fail to make honest full disclosure.

The sad fact is that the diamond industry is trading short-term profit for long term reputational integrity. Consumer expectations are not being managed honestly by unethical retailers. When consumers find out about the true long term value deterioration of man-made diamonds the free-rider windfall profits will crash. Natural diamond demand will suffer significant damage as consumers learn the truth about man-made diamonds.

The only solution is for retailers to take proactive measures to ensure that consumers are aware that prices for man-made diamonds will most likely decline significantly in the years ahead.

Abraham Lincoln advised. You can fool all the people some of the time, and some of the people all of the time but you cannot fool all the people all of the time.

It’s time for the RJC to ensure their members tell the truth about man-made diamonds all of the time.

- Disclosure Related to Treatments

- All treatments of man-made diamonds to enhance color, clarity or other characteristics should be subject to the same disclosure requirements as natural diamonds.

- Patriot Act, AML, CTF Compliance

- Man-made diamonds should be subject to the same Patriot Act, AML, CTF compliance requirements as natural diamonds

- Man-made diamonds should be subject to the same Patriot Act, AML, CTF compliance requirements as natural diamonds

- World Diamond Council System of Warranties

- The World Diamond Council (WDC) System of Warranties (SOW) should apply to Man-made diamonds and should appear on all invoices for man-made diamonds as they do to natural diamonds.

3. Appendices and Background Information

- Claims that man-made diamonds are the same as natural diamonds

- “Zales’ lab-created diamonds exhibit the same optical, chemical, and physical properties as natural diamonds – The core differences are the time they took to form and their origin.”

- “Lab grown diamonds are the real deal – they cannot be distinguished from earth-created diamonds even with a professional loupe”.

- James Allen website

- https://www.jamesallen.com/lab-created-diamonds/

- “Our lab grown diamonds display the same physical, chemical, and optical characteristics as natural diamonds, and exhibit the same fire, scintillation, and sparkle. Using a jewelry loupe, man-made diamonds are nearly impossible to differentiate from natural diamonds”.

- Brilliant Earth

- https://www.brilliantearth.com/lab-created-diamonds/

- “Regardless of whether they were formed underground over a billion years ago or created less than a week ago, lab grown diamonds are identical to their naturally occurring counterparts.”

- Ability of man-made diamonds to retain value

- “As with any gemstone, the resale value can vary over time. Since lab diamonds are a more recent introduction to the market, there is more uncertainty on future pricing, when compared to natural diamonds”.

- Brilliant Earth

- https://www.brilliantearth.com/lab-created-diamonds/

- “A natural diamond has traditionally maintained its value. However, since lab-created diamonds are relatively new, it is unknown if they will retain their value”.

- Zales Jewelers

- https://www.zales.com/lab-created-diamonds

- “A natural diamond has historically maintained its value. However, since lab-created diamonds are relatively new, it is unknown if they will retain their long-term value”.

- “As with any gemstone, the resale value can vary over time. Since lab diamonds are a more recent introduction to the market, there is more uncertainty on future pricing, when compared to natural diamonds”.

- Man-Made diamond prices decline significantly over time

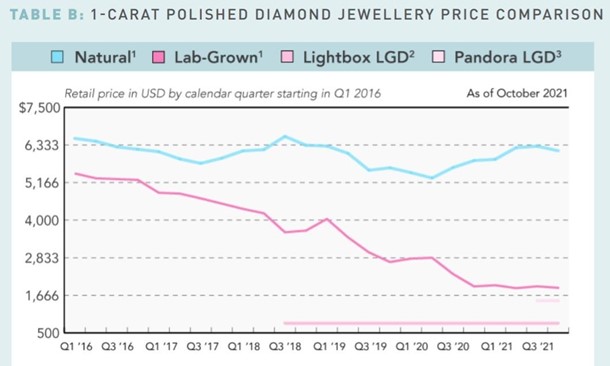

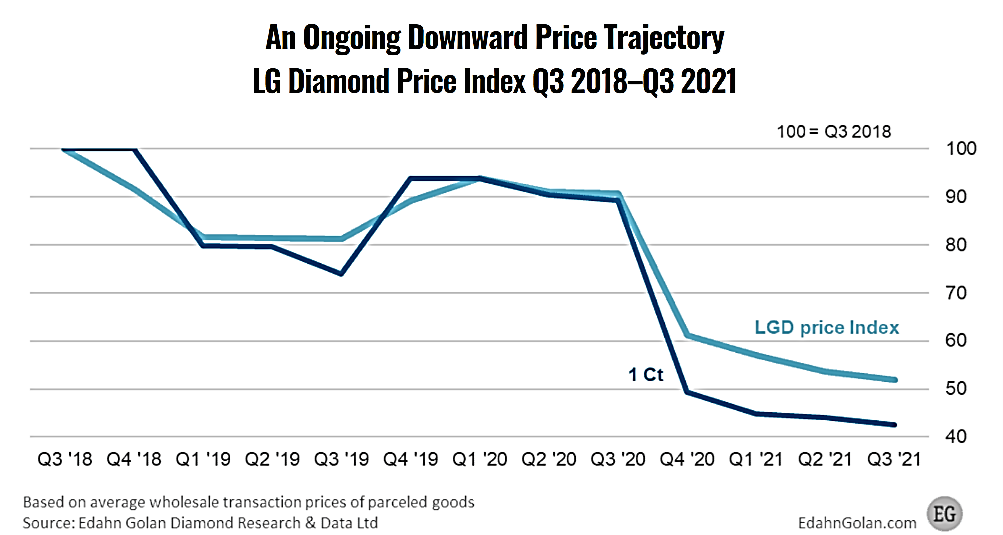

- According to diamond market researcher Paul Ziminsky, there has been a significant steady drop in the price of Lab diamonds over the past 5 years compared to natural diamonds.

- According to Market Researcher Edahn Golan: “The average retail price of round, one-carat, E/SI1 diamonds was $8,900 per carat in September, according to a Tenoris analysis. This compared with $3,557 for LG – a 60% difference. Just as competition pushed down LG prices in the wholesale market, this will follow in the retail market. A gross of 60% is something consumers won’t be willing to accept for long. This decline won’t happen overnight or soon, but it is inevitable. While a price anomaly happens every so often, it is never a long-term economic trend”.

- Edahn Golan published an article called The LGD Price Anomaly: Demand Rises, Prices Decline October 19, 2021

- https://www.edahngolan.com/the-lgd-price-anomaly-demand-rises-prices-decline/

- “Natural diamond supply is limited, due to the billions of years it takes for nature to create a diamond. Yet with man-made diamonds, there is no cap on the supply, which drives the price lower and lower as supply goes up. The price of lab-grown diamonds is falling at an alarming rate and shows no signs of stopping or reversing”.

- Michael Fried

- Partial Disclosure is unethical and illegal

- Gem Treatment Disclosure and U.S Law

- FTC guidelines regarding Laser Treatments

- In the early 1990’s the diamond industry claimed that the laser treatment of diamonds should not require disclosure because it was part of the manufacturing process. In a letter to the FTC Rapaport claimed that disclosure should be required, because upon resale, the value of lasered diamonds are lower than the value of a non-lasered diamonds of the same quality. Ultimately the FTC ruled in 2000 and the trade agreed that disclosure of laser treatment requires full disclosure due to the impact of the laser on resale value.