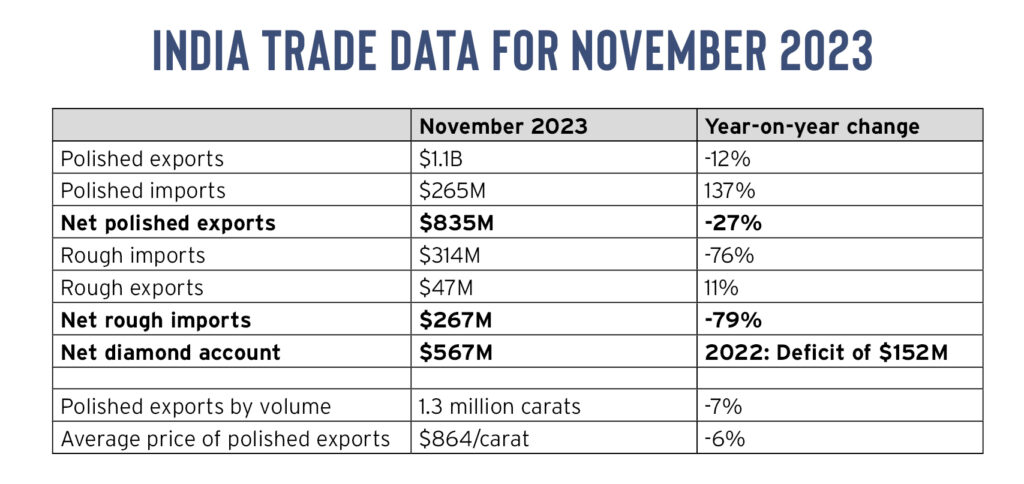

India’s rough-diamond imports slid 76% year on year to $314 million in November as the country observed a voluntary shipment pause. Imports plummeted 72% by volume to 3.3 million carats, according to data the Gem & Jewellery Export Promotion Council (GJEPC) released last week.

Leading Indian industry bodies recommended a two-month freeze on rough imports, beginning October 15, to reduce an oversupply of goods and ease a decline in prices. The moratorium ended on December 15.

Polished exports fell 12% to $1.1 billion, the category’s best year on year performance since February, as demand picked up ahead of the US holiday season.

About the data: India, the world’s largest diamond-cutting center, is a net importer of rough and a net exporter of polished. As such, net polished exports — representing polished exports minus polished imports — will usually be a positive number. Net rough imports — calculated as rough imports minus rough exports — will also generally be in surplus. The net diamond account is total rough and polished exports minus total imports. It is India’s diamond trade balance, and shows the added value the nation creates by manufacturing rough into polished.

Main image: Diamond cutters in Surat, India. (Shutterstock)

Stay up to date by signing up for our diamond and jewelry industry news and analysis.