RAPAPORT PRESS RELEASE, February 6, 2024, Las Vegas… Diamond sales were sluggish in January amid limited restocking following the holiday season.

Prices of rounds continued to increase as select categories were in short supply following India’s two-month freeze on rough imports, which ended December 15. This trend will likely continue until inventories become too large.

However, buyers were reluctant to close deals at these prices. US dealers mostly bought for immediate demand and not for inventory. Sales in mainland China remained slow.

© Copyright 2024, Rapaport USA Inc.

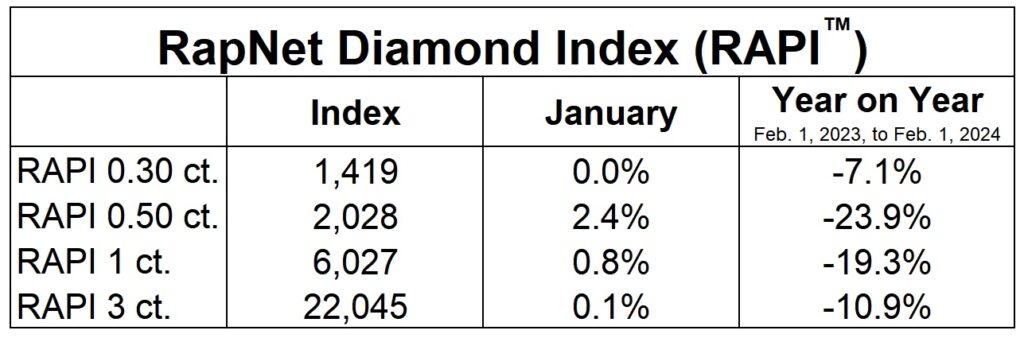

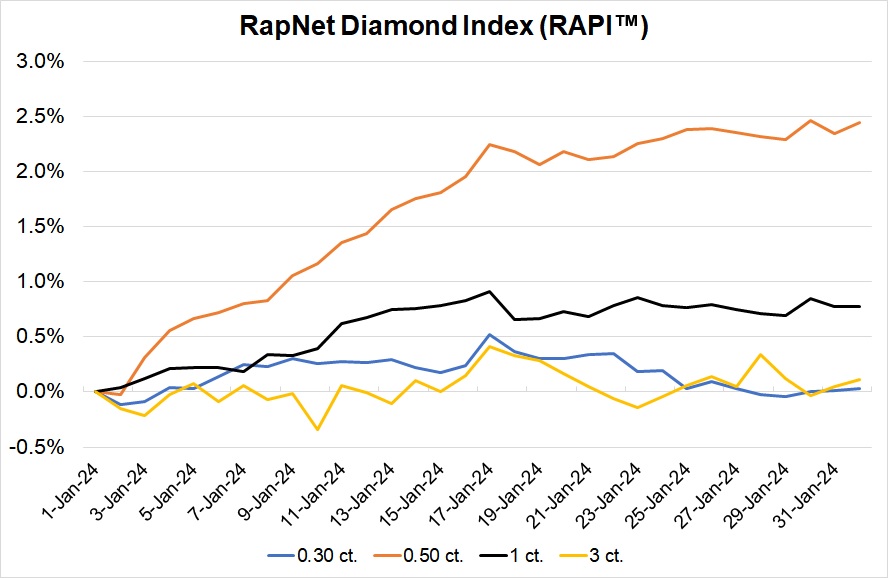

The RapNet Diamond Index (RAPI™) for 1-carat diamonds — reflecting D-to-H, IF-to-VS2 goods — rose 0.8% in January. RAPI for 0.50 carats climbed 2.4%. Most of the increases happened in the first half of the month; prices have been stable since then.

Lower-quality goods saw a greater correction after last year’s price slump: The price of 1-carat, D-to-L, SI1-to-SI2 diamonds rose 2.1% in January. Prices for fancy shapes were steady or declined.

De Beers reduced rough prices by an average of 13% at its January sight. Sightholders welcomed the changes, but the goods remained expensive relative to polished and compared to rough prices at auctions and tenders.

The outlook for the US retail market in 2024 was mixed. Retailers expected steady Valentine’s Day sales. However, the Federal Reserve’s decision to keep interest rates at a 23-year high risks denting consumer confidence.

Chinese demand was weak ahead of the February 10 Lunar New Year. With the economy slow, shoppers preferred investing in gold rather than diamonds.

Dealers remained uncertain about the Group of Seven (G7) sanctions on Russian diamonds. Belgium is trying to use G7 sanctions to control the diamond markets by insisting that all diamonds entering the US go through Belgium. The US imports over 50% of the world’s polished diamonds.

Rapaport is firmly opposed to Belgium’s G7 power grab and has introduced the “Rapaport US Diamond Protocol” at Rapaport.com/sanctions to guide US regulators and legislators regarding effective implementation of sanctions that do not harm US jewelers, diamond dealers and consumers.

Rapaport Media Contacts: [email protected]

US: Sherri Hendricks +1-702-893-9400

International: Avital Engelberg +1-718-521-4976

About the RapNet Diamond Index (RAPI™): The RAPI is the average asking price, in hundred dollars per carat, of the 10% lowest-priced round diamonds in each of the top 25 quality categories (D-H, IF-VS2, GIA-graded, RapSpec-A3 and better) offered for sale on RapNet® (www.rapnet.com). Additional information is available at www.rapaport.com.

About the Rapaport Group: The Rapaport Group is an international network of companies providing added-value services that support the development of ethical, transparent, competitive and efficient diamond and jewelry markets. Established in 1976, the group has more than 20,000 clients in over 120 countries. Group activities include Rapaport Information Services, providing the Rapaport benchmark Price List for diamonds, as well as research, analysis and news; RapNet, the world’s largest diamond trading network; Rapaport Trading and Auction Services, the world’s largest recycler of diamonds, selling over 400,000 carats of diamonds a year; and Rapaport Laboratory Services, providing Rapaport gemological services in India and Israel. Additional information is available at www.rapaport.com.

Stay up to date by signing up for our diamond and jewelry industry news and analysis.