The diamond industry is bracing for significant change in 2024.

New sanctions on Russia will fast-track the adoption of traceability programs across the supply chain. Should they wish to sell those diamonds into the Group of Seven (G7) countries, companies will have to prove their goods were sourced from non-Russian production.

On December 6, the G7 — comprising Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States — announced its latest sanctions, aimed at “limiting Russia’s ability to fund its illegal war,” the joint statement read.

Diamonds featured prominently in this round of measures, perhaps because the group had delayed a policy decision on how to handle Russia’s diamond supply until then — nearly two years after the war in Ukraine began on February 24, 2022.

Initial sanctions targeted Russia’s oil and gas industry as well as restricting its banking system and the transfer of funds, while touching on diamonds in an ambiguous way.

Still, diamonds contribute to Russia’s government revenue and therefore to the war effort, causing the sector to be entangled in the sanctions discussion.

The Russian Federation owns a 33% stake in mining company Alrosa, the world’s largest producer of rough diamonds by volume. The company generated rough sales of $4 billion from 45.5 million carats in 2021, the last prewar publication of its earnings.

“The goal of this effort remains centered on reducing revenue that Russia earns from diamonds, which fuels Moscow’s war machine against Ukraine,” the European Commission (EC) stressed in a separate statement, which provided additional details about the sanctions.

Sanctions in place

The sanctions will replace existing measures some countries implemented earlier.

The US banned imports of diamonds from Russia in March 2022, but left a loophole allowing for polished stones transformed from Russian rough in third countries. The European Union delayed implementing any restrictions out of concern such measures would place Belgium at a disadvantage in its competition with Dubai — as well as Mumbai and Tel Aviv — for market share as the premier rough-trading center. The United Arab Emirates (UAE), India and Israel have not implemented any restrictions on Russian-origin diamonds, though they export goods to those countries with a ban in place.

An EU-only import ban would not have been efficient, the EC added in its explainer. “It would have meant the death of Antwerp,” said an official who requested anonymity. “What is on the table is the survival of Antwerp.”

Consequently, the EU has been the driving force for a fully coordinated approach and timeline within the G7, the European Commission emphasized.

That effort sees the group phase in various levels of diamond sanctions.

The first stage, which took effect on January 1, banned direct imports of diamonds from Russia. On March 1, the sanctions will be extended to diamonds above 1 carat that were sourced from Russian rough but polished in a third country, addressing the loophole that existed in the original US sanctions. Finally, beginning September 1, the restrictions will include lab-grown diamonds, jewelry, and watches containing diamonds above 0.50 carats.

Traceability component

The big challenge lies in how to verify that a diamond is not of Russian origin. To that end, the group will establish a “robust traceability-based verification and certification mechanism for rough diamonds,” which will be mandatory from September 1, the EC said in its statement. A pilot program for the system will begin on March 1, it added.

The idea is to create a digital twin of the real diamond in its rough state and to issue a certificate of the diamond’s origin, the commission explained. It is unclear whether that certificate will be a physical printout — as customs officials are used to — or only digital, noted another European official.

The identifying information and certificate will be entered into a stand-alone blockchain-based ledger, which will be inter-operational with several existing solutions facilitating the traceability mechanism, an EC spokesperson explained in an email.

In other words, there will be a centralized blockchain that will be fed with information from traceability service providers.

“This allows the diamond to be traced through the production process and can be presented at the time of importation of the finished diamond,” the spokesperson said.

The commission did not clarify by press time the criteria service providers will have to meet to contribute to the G7 system, or what information will be uploaded to the centralized ledger. Companies with diamond-related traceability programs include De Beers’ Tracr, Everledger, iTraceiT, the Gemological Institute of America (GIA), and Sarine Technologies.

Industry concerns

The certification of goods registered on the ledger will be done in Belgium, with some exceptions being considered, an official noted.

As the only producer country among the G7 nations, Canada may be given the option to certify its own production, the official said. It is also understood that rough earmarked for beneficiation — polishing in the country of mined origin — will be exempt from passing through Belgium to be G7-certified.

De Beers is waiting for clarification on several points, most importantly whether its practice of mixing supply from its mines in Botswana, Canada, Namibia, and South Africa — known as aggregation — will be affected.

“We await clarity on how the new import requirements will be implemented in practice and will urge a sensible and practical approach to implementation that recognizes the fundamental importance of aggregation in delivering value for diamond businesses and producer countries, as well as the significance of beneficiation,” a company spokesperson said.

De Beers’ assortments will still have to be certified in Belgium, but it will be an exception in that these goods will be the only “mixed origin” ones that will be allowed, the official noted.

Yoram Dvash, president of the World Federation of Diamond Bourses (WFDB), urged the G7 to include other centers in the registration process.

It is possible to create “a more efficient and effective mechanism” by allowing other major rough diamond centers such as Dubai, Mumbai, and Tel Aviv, as well as producing countries, to conduct the inspection and registration of goods, Dvash stressed in a statement immediately following the G7 announcement.

RELATED READING

Ready for volume

Among the concerns expressed have been whether Antwerp can handle the large volumes that are expected to accompany the new mechanism. One representative estimated the system would not result in higher volumes than those with which the Antwerp Diamond Office has dealt in the past. That official referenced 2021 as a comparative base, when Belgium imported 68.1 million carats of rough valued at EUR 6.49 billion ($7.1 billion), and exports reached 90.7 million carats worth EUR 7.48 billion ($8.18 billion), according to data the National Bank of Belgium published.

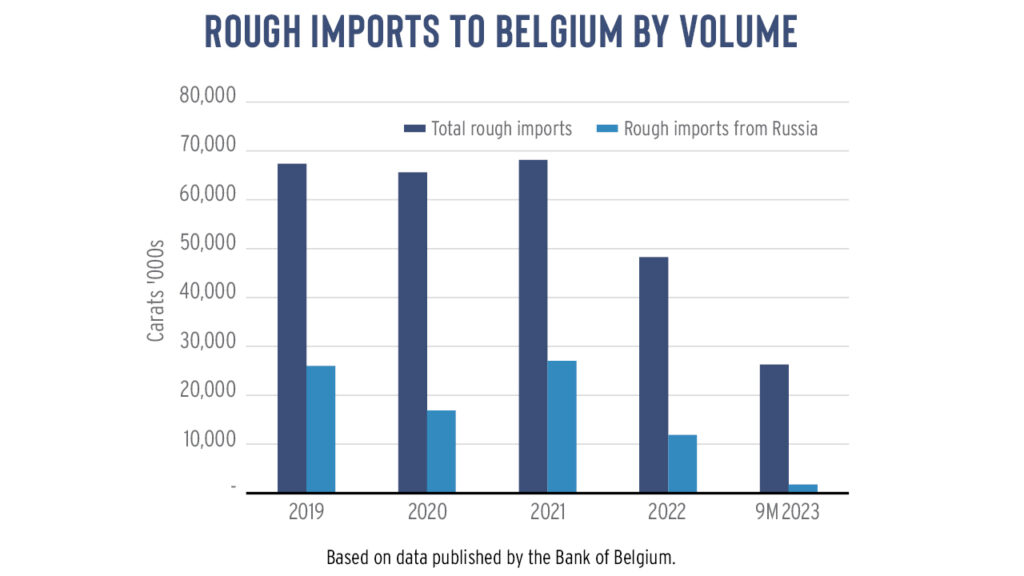

Before the war in Ukraine, Belgium was the largest buyer of Russian rough, importing 27.1 million carats worth EUR 1.57 billion ($1.72 billion) in 2021 — 24% of its total rough imports by value and 40% by volume (see graph). Excluding the Russian goods will mean Antwerp won’t see a significant spike compared to 2021, the official noted. Belgium’s imports of rough from Russia declined 19% in 2022 and have slumped 76% year on year to just EUR 285.1 million ($311.7 million) in the first nine months of 2023, the National Bank of Belgium data showed.

The bigger question is whether the traceability programs can handle such volumes. To date, adoption within the trade has been minimal and largely driven by retail jewelry brands that require thorough source verification.

“We continue to accelerate development of Tracr and engage with the wider industry as we await further details so that Tracr can support the industry’s needs as best as possible,” a De Beers spokesperson said. “However, we also acknowledge that even Tracr, the world’s most advanced diamond traceability platform, does not yet have the breadth of coverage that would be required to meet the G7 objectives in the stated time frames.”

Sarine recently unveiled its Autoscan Plus system, which it claims can scan 1,000 stones per hour for its Diamond Journey traceability program. Autoscan Plus was built for scale and developed as a smaller, cheaper solution, Sarine CEO David Block said.

Extra cost

The Antwerp World Diamond Centre (AWDC), the local trade body that incorporates both government and industry elements and oversees operations of the Diamond Office, is reportedly expanding its capabilities to handle the extra volume.

Still, many in the trade are skeptical whether the industry is ready to implement a digital traceability solution at such a scale. “The government fell for false promises regarding how to work and implement the system,” said one dealer. “Even if it is possible, it will be expensive.”

Early critics of the system have expressed concern about the additional cost of certification and of potential double shipping to Belgium.

“Having only one point for registration and inspection will impose additional costs of time and money to the diamond trade,” the WFDB said. It will lengthen the cycle of trading and getting goods to market, added another dealer.

Vipul Shah, chairman of India’s Gem & Jewellery Export Promotion Council (GJEPC), expects the move will impact the cost of raw materials for local manufacturers. “We are coordinating with the World Diamond Council [WDC] to mitigate such disruption and cost impact,” he said in an email.

Members of the trade cautioned that the cost of certification may even make Russian goods more attractive, while the market bifurcates to a two-tier system.

De Beers said it wants to understand how risks such as the creation of a potential supply bottle neck and additional costs will be managed if the G7 intends to limit the points of admission of rough diamonds into G7 nations. “We advocate for a solution that facilitates the trade of our diamonds into G7 countries, rather than restricting them,” the De Beers spokesperson stressed.

The EC responded that the cost for certification is expected to be negligible, “especially considering the price of diamonds,” according to its spokesperson. “The fee will be cost-bearing, not designed to generate profits.”

As for the double shipping, officials expect the goods will simply pass through Belgium as the main gateway — instead of other centers — before being sent for manufacturing. The extra shipping cost will likely apply for rough designated for tender sale in other rough-diamond locations such as Dubai and Tel Aviv.

RELATED READING

Artisanal and cottage industry

While the registration of rough will be overseen by the AWDC at the Diamond Office, it is a government-led mechanism, Rapaport understands. That means that it would be required at the point of export, which is significant when dealing with the artisanal mining sector.

So, if the artisanal miner sells his goods to a buyer in the location of mining, it will be up to the buyer to send the goods to Belgium for registration, an official explained.

Trade bodies, along with De Beers, echoed the WDC’s mantra that “no one should be left behind,” expressing concern that artisanal miners will be at a disadvantage under the new system.

“If such a solution is intended to be fully technological, this would be to the detriment of African producers, artisanal miners and the wider industry, with significant risk of unintended consequences,” the De Beers spokesperson added.

Artisanal and small-scale miners, who typically don’t have access to technology, should be able to send their rough into any cutting center to be registered and certified, trade members wrote in a draft letter being prepared for presentation to the G7, which Rapaport saw.

Similarly, the Indian industry is urging the G7 to take into consideration the interests of small and medium enterprises for whom the adoption of technology to track their polished diamonds might be out of reach at this stage. These marginal diamond units support millions of livelihoods, the GJEPC’s Shah stressed.

EU officials expect the program may even help formalize the artisanal mining sector and motivate investment in that segment — such as among G7 government bodies with an interest to make the traceability mechanism work.

Time to engage

But the system will require extensive engagement with the trade in the next few months to make it work. The industry has many questions and concerns, as communications from the WFDB, GJEPC, De Beers and others revealed. Some queries, such as what to do with existing inventory in the market, require urgent attention.

“I call upon the G7 countries to engage with the industry organizations in order to reach a more equitable and balanced mechanism,” Dvash stressed.

The G7 pledged to continue consultations among its members and with other partners, including producing countries as well as manufacturing countries, “for comprehensive controls for diamonds produced and processed in third countries on measures for traceability.”

It would be surprising if such discussions led to a complete overhaul of the planned system, as the industry might desire. As one trader admitted, the G7 is intent on its implementation, while the US and the EU will use the banks to enforce the sanctions — blocking payments within the pipeline in cases of noncompliance.

The governments charged with developing and implementing the system appear confident they’ve reached the optimal solution.

“This strengthened approach will provide certainty to our citizens and consumers that they are not purchasing Russian diamonds,” the EC spokesperson stressed. “It will also deliver stronger transparency to producers, including in countries with artisanal production. This will positively impact both earnings from diamonds and producers’ story and brand throughout the supply chain.”

It will take a lot of convincing for the trade to adopt such sentiment fully before the traceability pilot program goes into effect on March 1. It seems, at this stage, they’ll have little choice.

Main image: David Polak and Elisé Jurkovic

Stay up to date by signing up for our diamond and jewelry industry news and analysis.