Blackstone is considering listing the International Gemological Institute (IGI) on the stock exchange in India, seeking a valuation of up to $3.5 billion for the grading laboratory, Reuters reported.

The US investment group aims to raise $300 million from the initial public offering (IPO), according to the report, which cited three unnamed sources.

Blackstone bought IGI for just under $570 million in May last year. China’s Fosun International previously owned 80%, while IGI CEO Roland Lorie’s holding company, Lorie Holding, held 20%. Both parties sold their entire stakes to Blackstone.

The possible IPO less than a year after the investment is an attempt to capitalize on India’s booming stock market, Reuters said, referencing two of the sources.

Some 21 Indian IPOs raised around $678 million in January, compared with $17 million a year earlier, according to the Financial Times, which cited financial analytics company Dealogic.

Blackstone has appointed US investment bank Morgan Stanley and India’s Kotak to lead the IPO, Reuters said. It had initially sought a valuation of about $1.5 billion for IGI, but in the latest talks it is looking for up to $3.5 billion, the report cited two sources as saying.

IGI and Blackstone declined to comment.

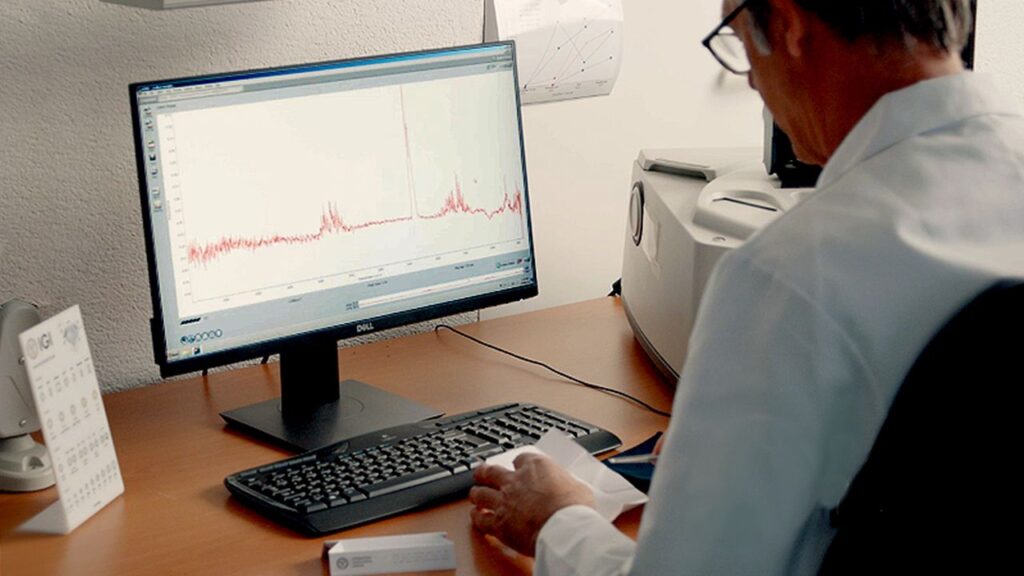

Main image: Graders at an IGI laboratory. (IGI)

Stay up to date by signing up for our diamond and jewelry industry news and analysis.