Thailand has long served as a center for colored gemstones. Its ruby and sapphire deposits and its strategic location — neighboring the gem-rich nations of Myanmar (Burma), Cambodia and Vietnam — have enabled the Thai gem industry to develop multigenerational knowledge and skills in mining, treatment, cutting, polishing and trading.

Political turmoil in Myanmar — starting with the Japanese invasion in 1942, and later a nationalization spree by the government — led to an influx of ruby merchants and miners from Myanmar to Thailand, further enriching the latter country’s gem industry. Among the arrivals was the family of fifth-generation gem merchant Santpal Sinchawla, managing director of Sant Enterprises.

“I was three years old when my parents migrated to Thailand in 1963,” he recalls. “Most businesses [in Myanmar] were owned by Indian and Chinese entrepreneurs, who opted to leave the country. My maternal grandparents owned ruby mines in [Myanmar mining area] Mogok and had dealings with many French firms. Ruby deposits had been discovered in Thailand, and since my mother had good connections in the business, Thailand — and specifically Bangkok — was the logical choice for our family’s new base.”

(Gem and Jewelry Institute of Thailand )

Leader in enhancement

Location and historical circumstances aside, Thailand’s development of heat treatment to transform low-grade sapphires and rubies into high-quality ones was also a contributing factor to its growth as a colored-stone hub. Thai gem merchants extensively traveled abroad to bring back rough gems from countries like Sri Lanka and Australia, and later from deposits across Africa.

The gem markets in the Thai capital of Bangkok and in the country’s Chanthaburi province continue to attract rough-gem merchants from Afghanistan, Pakistan, Burma, Cambodia and African countries.

“The pivotal strength of Thailand’s gemstone industry lies in gem-cutting and enhancement techniques, particularly the refinement of colored stones through processes like heat treatment for rubies and sapphires,” says Sumed Prasongpongchai, director of the Gem and Jewelry Institute of Thailand (GIT). “This expertise has been passed down through generations, contributing to our competitive edge on a global scale.”

Thailand’s gem-cutting industry consists predominantly of medium and small-scale enterprises, with an approximately 10,000-strong workforce, according to GIT data. A look at the country’s global export figures for polished gemstones provides a good idea of how many gems Thailand processes.

In 2022, the country shipped out 5,208 kilograms of polished precious stones, including ruby, sapphire and emerald, and 23,282 kilograms of semiprecious polished goods, according to the Thailand Customs Department. From January to October 2023, those figures rose to 7,972 kilograms and a whopping 69,525 kilograms respectively.

Thailand imports rough stones from countries such as Mozambique, Colombia, Brazil, China, Madagascar, India, Sri Lanka, Kenya and Tanzania. GIT estimates that more than 80% of gemstones traded internationally, particularly rubies and sapphires, have undergone enhancement in Chanthaburi.

“Bangkok handles much of the world’s rubies for treatment, cutting and polishing,” states Philippe Ressigeac, founder and chief operating officer of software company GemCloud, which helps jewelers manage their inventory via its online marketplace. “Small-sized sapphires are also commonly processed in Bangkok, though single, larger stones often go to Sri Lanka. Additionally, medium- to high-quality semiprecious stones are cut and polished in Thailand, with lower-quality ones typically going to India.”

A magnet for businesses

Gay Belmont grew up in Chanthaburi and recalls playing with her friends as a little girl among large jute bags stuffed with rough gemstones. “Most of the larger gem factories — where thousands of cutters shape and polish smaller calibrated gems — and treatment centers are in Chanthaburi,” says Belmont, a partner in supplier KV Gems with her husband Joe. Their company specializes in untreated stones, especially spinel, ruby and sapphire.

“During our early years, my husband and I would travel to Chanthaburi regularly to buy at its weekend gem market. We stopped doing that over 10 years ago, as most of the better-quality stones that we seek come to Bangkok.”

Alexey Burlakov moved to Bangkok from Russia in 2011. Five years later, he established Tsarina Jewels, a gem-cutting atelier where his team now fashions rare, top-grade rough stones like emeralds and demantoid garnets into high-value jewelry. The supportive and welcoming nature of the Thai government, along with Bangkok’s affordable and comfortable lifestyle, motivated him to lay down roots in the vibrant metropolis.

Another entrepreneur who’s based his business in the city is Frenchman François Garaude, founder of stone supplier and lapidary Garaude, which cut the record-breaking 55.22-carat Estrela de Fura Mozambican ruby last year.

“I used to visit Bangkok to buy stones, but my customers would complain that the cutting was not up to their standard,” he recounts. “I was used to giving stones for recutting. For example, I would buy stones in Burma that were cut in the native style (maximizing color and carat weight but not proportions) and give them for recutting in Bangkok. This was 30 years ago; you could afford to cut and recut precious gems like spinels. But now, due to the rarity of the material, you can’t afford to waste rough material unnecessarily. As the quality of my purchases increased, I realized I needed to take control of the cutting and polishing to deliver a finished product as per my customers’ expectations.”

Labor challenges

But establishing a gem-cutting facility in Bangkok is no mean feat. One of the top challenges the industry is facing is sourcing skilled labor.

“The only way to learn in gem-cutting is by getting experience,” says Maria Belmont, managing director at KV Gems and daughter of its founders. “At our company, we are constantly hiring, but it takes years for new recruits to gain the requisite skills. Usually we need to train them from scratch, investing significant time and resources. You can find people to enter the gem-cutting industry, but it requires true patience and love to continue cutting gems long-term. Not everyone can make it.”

GemCloud’s Ressigeac believes the gem-cutting industry in Thailand has been facing a downturn for a few years, primarily because the work doesn’t pay very well. This has led the younger generation to seek more profitable and fulfilling employment opportunities elsewhere.

In addition, he continues, “the equipment used in Thailand is largely outdated, lacking the precision necessary for modern, high-quality cutting. As a result, traditional Thai-cut gems are generally considered to be of lower quality by the international market, especially when compared to places like Sri Lanka, where more modern and precision machines are used.”

Nonetheless, he is optimistic about the future. “Despite these challenges, there’s a significant opportunity to revolutionize the gem-cutting industry in Thailand. By training [on] modern machines…[Thai cutters] could achieve higher-quality cuts. This improvement in quality could substantially increase their earnings, potentially reaching $10 to $20 per carat cut, compared to the current lower rates of only $1.50 to $3 per carat.”

Untreated rough, traceable to a mine that has been audited …is only found in a large-scale mining company, and they are all coming to Bangkok.

In the US, he points out, “gem-cutting is considered an art form, with professionals charging over $100 per hour instead of per carat.”

Hand-cutting gemstones is a laborious task that demands patience. The younger generation shows limited interest in labor-intensive handcrafting work, a problem that both the public and private sectors in the Thai gem and jewelry industry are working to address.

Among other things, “gemstone-cutting competitions are periodically organized to inspire gem-cutters to enhance their skills and expertise, and to encourage innovation in new cutting styles and shapes,” says Prasongpongchai. “These competitions contribute to continuous improvement and creativity within the gemstone-cutting community in Thailand.”

A good place for auctions

A key reason Bangkok will likely continue thriving as a gemstone hub is the consistent supply of rough.

Miner Gemfields moved its auctions to the city in 2021, “at a time when Thailand had strict Covid-19 protocols in place, and other mining companies have since followed,” says company CEO Sean Gilbertson. He describes the Bangkok gem district as “very well developed, [offering] all the facilities and services required” for his firm’s gem sales.

“Bangkok is also conveniently located for the majority of our clients, some of whom are based in the city, while others benefit from frequent direct flights,” he adds. “Of the seven locations where Gemfields has conducted auctions, Bangkok is currently the preferred location for both ruby and high-quality emerald auctions.”

Among the other mining companies operating in the city is Fura Gems, which has brought its rough Mozambique rubies, Colombian emeralds and Australian sapphires.

“Between these two companies, that’s already 12 auctions,” says Garaude. “And it will increase, because you also have the African rough-gem dealers trading in the open market.”

While Sri Lanka’s gem-faceting community is highly skilled, and the cost of labor for calibrated goods may be lower there than in Bangkok, there is more diversity of supply in Thailand, according to industry sources. Traceability is paramount, especially when merchants and manufacturers are dealing with institutional buyers.

“Untreated rough, traceable to a mine that has been audited, fulfilling all international standards, is only found in a large-scale mining company, and they are all coming to Bangkok, which makes it very convenient for us to source,” Garaude explains. “Plus, Bangkok has good international schools for my children. I appreciate the life quality; I live in a gated community with good security and ample space. I come to work by boat. It’s a pleasant life, and I love Thai food.”

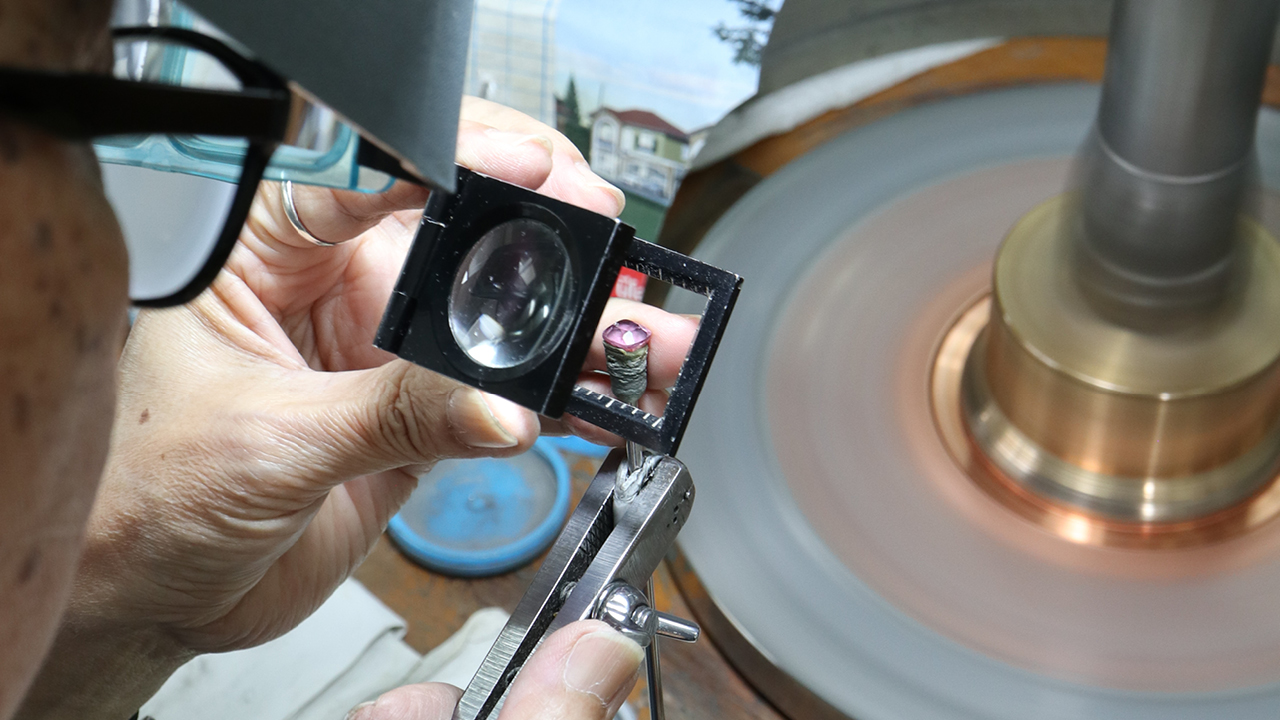

Main image: Gemstone cutting processes in Bangkok. (Gem and Jewelry Institute of Thailand )

This article is from the January-February 2024 issue of Rapaport Magazine. View other articles here.

Stay up to date by signing up for our diamond and jewelry industry news and analysis.