September should be a busy time for the diamond industry. By now, wholesalers and dealers have returned from their summer vacations, and trading should ramp up as jewelers prepare for the holiday season. Orders from retailers typically spur activity in the polished and rough markets.

However, diamond trading has slowed throughout 2023, and the industry is operating at lower levels than last year. Jewelry sales have declined, jewelers have become more careful in their inventory management, and there has been a change in the mix of goods they’re holding in inventory, resulting in lower orders for diamonds.

These are among several factors that have contributed to the pullback from inventory purchases in 2023. Management at Signet Jewelers emphasized a more efficient approach to its inventory management during the company’s recent second-quarter earnings conference call. The company is using analytics to guide it toward the right assortment at the right place and the right time, explained Joan Hilson, Signet’s chief financial, strategy, and services officer, in the conference call.

Signet had inventory valued at $2.1 billion at the end of the second quarter on July 29, which was 4% below a year earlier. Excluding Blue Nile, which it acquired in August 2022, inventory was down 8% from a year ago and 20% below pre-pandemic levels, the company reported. Signet’s inventory tends to peak in the third quarter, ahead of the holiday season (see graph).

ends January 31.

The company’s inventory turnover is at 1.4 times per year, which is 40% better than its pre-pandemic rate, Hilson reported. The suggested target for the industry is one full cycle per year, Sherry Smith, director of business development at The Edge Retail Academy, told Rapaport News in an interview earlier this year.

Stock turn among independent jewelers has been approximately 0.8% in 2023, she reported in September, citing recent data by The Edge Retail Academy. Inventory among independents is down 6%, which aligns with retailers not buying, she added.

Lower sales

While Signet is aiming for greater efficiency regardless of market conditions, retailers tend to reassess their approach to inventory during a slowdown. Jewelers bought aggressively when the market reopened from Covid-19 and as the strong recovery gained momentum in 2021 and 2022. Retail jewelers therefore had more stock than they needed when the market slowed at the beginning of 2023.

Diamond-jewelry sales have declined in 2023 amid US economic caution and a slower-than-expected rebound from Covid-19 in China. Jewelers require less inventory as sales decline. But by how much have retail sales decreased this year?

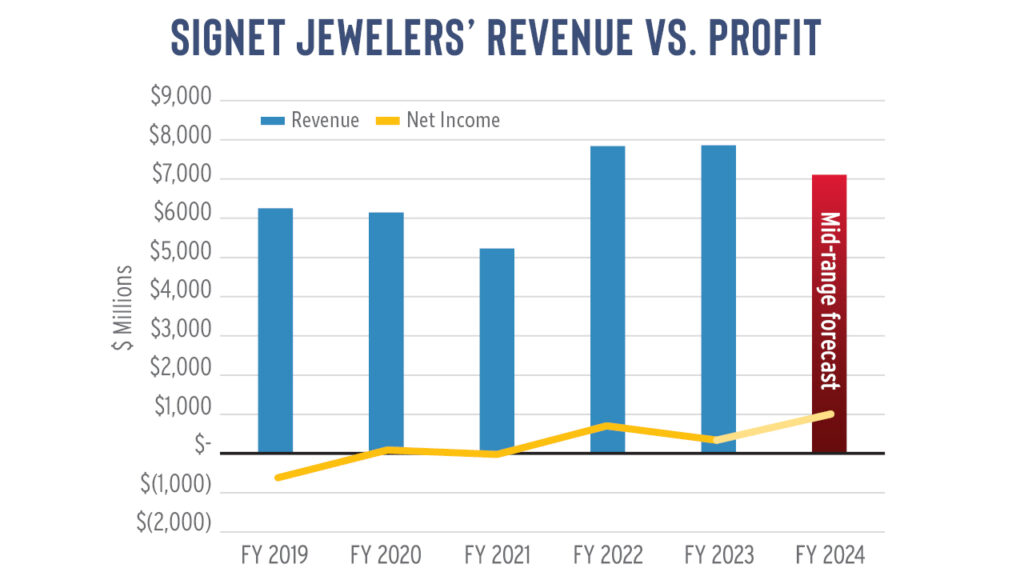

Signet Jewelers reported revenue fell 9% year on year to $3.28 billion during the fiscal half year that ended July 29, 2023 (see graph). Brilliant Earth saw sales edge down 0.4% to $207.9 million during the six months.

With an estimated 10% share of the US market, Signet is a bellwether for the rest of the industry. The company expects its full-year sales to reach between $7.1 billion and $7.3 billion, or 7% to 10% below last year, “driven by the impacts of macroeconomic factors on consumer spending and continued shift of consumer discretionary spend,” management explained.

ends January 31.

That should match broader industry expectations, as Rapaport anticipates jewelry sales in the US to decline 5% to 10% compared to last year. Among independents with whom the Edge Retail Academy works, gross sales of diamonds fell 10% year on year in August, with unit sales down 6% during the month, Smith reported.

Economic caution

The decline is largely due to economic caution, which continues to affect consumer sentiment and buying behavior.

US consumer confidence fell in August, reflecting concerns about rising prices, particularly for groceries and gasoline, The Conference Board reported. The group’s index declined 7% from July, with the pullback most notable among households with annual income above $100,000 and those earning less than $50,000. Confidence held steady among consumers who brought in between $50,000 and $100,000, The Conference Board said.

That follows an apparent rebound in June and July when inflation eased following 11 interest rate hikes by the Federal Reserve from March 2022 to July 2023. Inflation was at 3.3% in August — still above the Federal Reserve’s target of 2%.

The slide in sentiment in August reflects consumer anxiety over spending on nonessential goods, particularly if they must pay on credit at an elevated interest rate.

The cost of living and of credit have gone up, which squeezes income, causing the average household to shy away from excessive discretionary spending — or to shift to lower price points.

Signet noted a rebound in less expensive items during the second quarter, particularly fashion jewelry. Its average transaction value for organic banners — on a like-for-like basis — was down, primarily due to product mix and the softening in engagements, affecting its bridal segment, while the volume of transactions fell 13% during the quarter, Signet reported.

The jeweler’s overall average transaction value in North America rose 4.8% year on year to $565, boosted by its acquisition of Blue Nile. The average order price at Brilliant Earth fell 16% to $2,571, while sales volume grew 21% to 42,849 orders during the second quarter.

Lab-grown in the mix

Lab-grown diamonds are gaining traction among consumers, as they “offer great value for customers, especially in the kind of macroeconomic environment that we find ourselves in,” Signet CEO Gina Drosos said.

Sales of synthetics represent a mid-teen percentage of Signet’s diamond mix and carry a higher margin and transaction value than natural diamonds on average, she reported.

“Consumers who often come in with a budget in mind are trading up to higher size or higher-quality lab-created diamonds, which gives them an even more beautiful look,” she explained. Lab-grown accounted for 50% of loose diamonds and about 6.5% of set diamond jewelry sold by specialty jewelers in the US during July, according to Edahn Golan, cofounder of Tenoris, a trend analytics company.

While Brilliant Earth’s total inventory has remained flat since the beginning of the year, its loose-diamond stockpiles have decreased 3% to $11.5 million as of June 30, signaling a slight shift to other product lines. Its inventory of fine jewelry rose 2% to $28.3 million.

China’s gold rush

Meanwhile, diamond-jewelry sales in China, particularly those in the higher price ranges, were on a downward trend, reported Hong Kong-based jeweler Chow Sang Sang. Group revenue rose 31% year on year to HKD 12.67 billion ($1.61 billion) in the first six months of the year, after Covid-19 restrictions in mainland China were lifted in January.

Growth was driven by strong demand for gold ornaments and jewelry for which sales increased 26% in China and by 78% in Hong Kong and Macau. Chow Sang Sang also saw growth in its watch segment, while sales of gem-set jewelry dropped 18% in China and climbed 34% in Hong Kong and Macau. China accounted for 68% of the group’s retail revenue, with gold products making up 78% of the total in China and 70% in Hong Kong-Macau.

Similarly, Chow Tai Fook’s sales of gold products and jewelry in mainland China rose 10% in the quarter ending June 30, 2023, while gem-set jewelry fell 4.1%.

Lower expectations

It is in this context that the diamond trade is operating during the important preseason third quarter. Dealers and manufacturers have tempered their expectations as retail jewelers have restrained their diamond purchases.

Midstream inventory remains high, with 1.7 million stones listed on RapNet in September. That’s just 3.1% below levels recorded at the beginning of the year, even as manufacturers have significantly reduced their rough buying. De Beers sold just $370 million worth in August, and its rough sales declined 28% year on year during the first eight months of the year, according to Rapaport calculations.

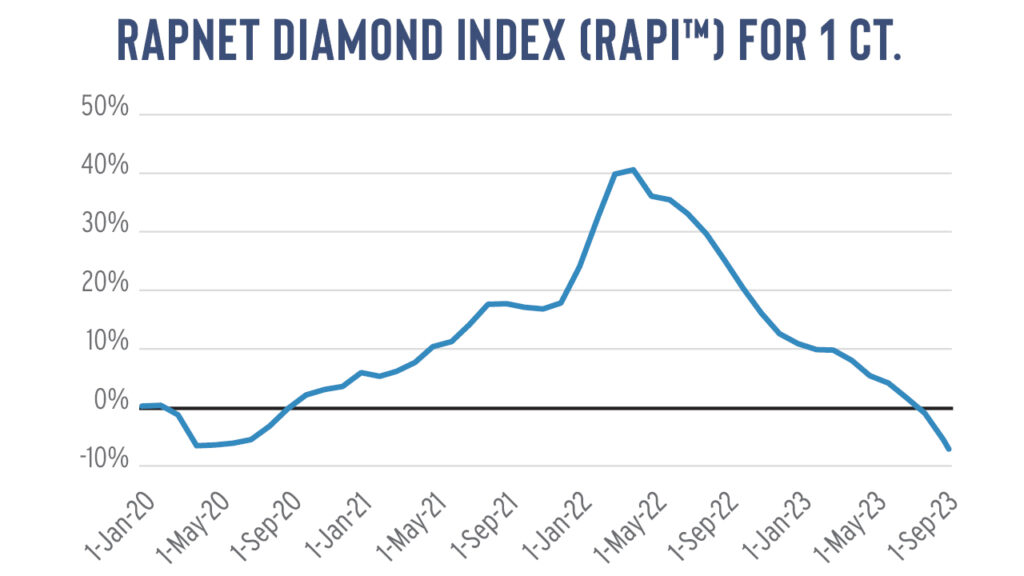

Consequently, polished diamond prices slipped in August, with the RapNet Diamond Index (RAPI™) for 1-carat diamonds down 4.7% for the month and by 15% between January and September 1. The index was 5.8% below its pre-pandemic level recorded on January 1, 2020, and fell a further 1.7% in the first 10 days of September (see graph).

of the top 25 quality round diamonds (D-H, IF-VS2, GIA-graded, RapSpec-A3 and better) offered

for sale on RapNet®.

The consistent decline in polished prices has added to the retail caution. Jewelers are hesitant to buy in a downward-trending market out of concern their inventory will lose further value, or because they expect to buy at better prices later.

It’s a vicious cycle that is difficult for the trade to exit. Jewelers aren’t selling as much as before, so they’re buying less, causing polished prices to slide. And they’re not buying, because they expect further price drops.

At some point, though, they’ll need inventory, even if they focus their purchases on goods that are selling. It may take the holiday season to ignite such an improvement. And supercharged marketing by the brands and the Natural Diamond Council (NDC) to inspire better-than-predicted sales during the fourth quarter.

For now, the many factors that are impacting trading in this important September period are keeping expectations for the holiday season low. At least in the interim, retailers have adopted a more prudent approach to managing their inventory.

This article first appeared in the September edition of the Rapaport Research Report. Subscribe here.

Main image designed by David Polak.

Stay up to date by signing up for our diamond and jewelry industry news and analysis.