Anglo American has moved away from announcing De Beers’ sales results on a sight-by-sight basis, ending a practice that had existed since January 2016. Instead, the diamond company said it would provide better sales data on a quarterly basis. One of the areas where the company has enhanced its transparency is pricing.

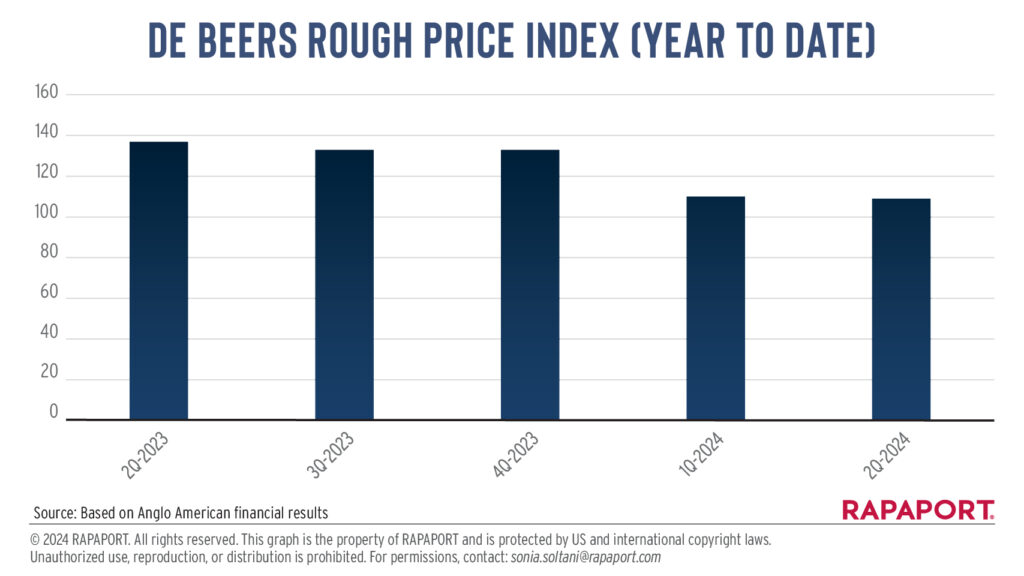

Rather than publishing sales value 10 times a year, De Beers has begun releasing its average selling price and its average rough-price index every quarter. Previously, it only gave these on a half-year basis. Anglo American’s second-quarter production report, which came out on July 18, included this figure for each of the last five quarters (see graph below).

“We are publishing this additional information to provide further insight into our business as we committed to do during the Spotlight presentation at the JCK show,” a De Beers spokesperson told Rapaport News, referring to CEO Al Cook’s June 2 address in Las Vegas.

While the average selling price can vary depending on product mix, the index is the best — albeit imperfect — indicator of De Beers’ actual prices. It measures De Beers’ like-for-like rough prices as an average for the sights taking place during the given period. For the quarterly index, the figure is on a year-to-date basis. This means the index for the third quarter, for example, is the average of prices for the first nine months of that year. All the numbers are relative to December 2006, when the index was set at 100.

To calculate the index, De Beers uses a representative “basket” of goods that the company sold over a period of five sights. Using five sights evens out some of the variation in the types of goods sold at each session, making the index more representative of the company’s range of products.

The numbers reveal on a more granular level what would otherwise require estimates from market sources. (This is how Rapaport News reports De Beers’ price changes at individual sights.)

However, De Beers’ rough prices do not always align with the market: The company will sometimes reduce supply rather than prices in a downturn, and then cut prices when the market shows signs of improving.

This means that the index is, in many ways, a less effective tracker of the rough market than price data from other companies, such as Petra Diamonds, which publishes like-for-like pricing trends after each tender.

For that reason, none of the rough-market insiders that spoke with Rapaport News for this article had paid much attention to the index. One sightholder said it was irrelevant because De Beers’ rough is overpriced compared with the rest of the rough sector.

Still, the numbers shed some light on the miner’s pricing strategy. From the quarterly data, it’s clear the company made limited price adaptations in the second half of 2023, when the market situation was very challenging. The year-to-date index came down just 3% in the third quarter of 2023 compared with the previous two quarters. It remained steady in the fourth quarter as the policy of maintaining price levels continued.

The bigger correction came in the first quarter of 2024, when prices slid 17% compared with the average for 2023. This mostly reflected a sharp price reduction at the January sight. The index did not change much in the second quarter.

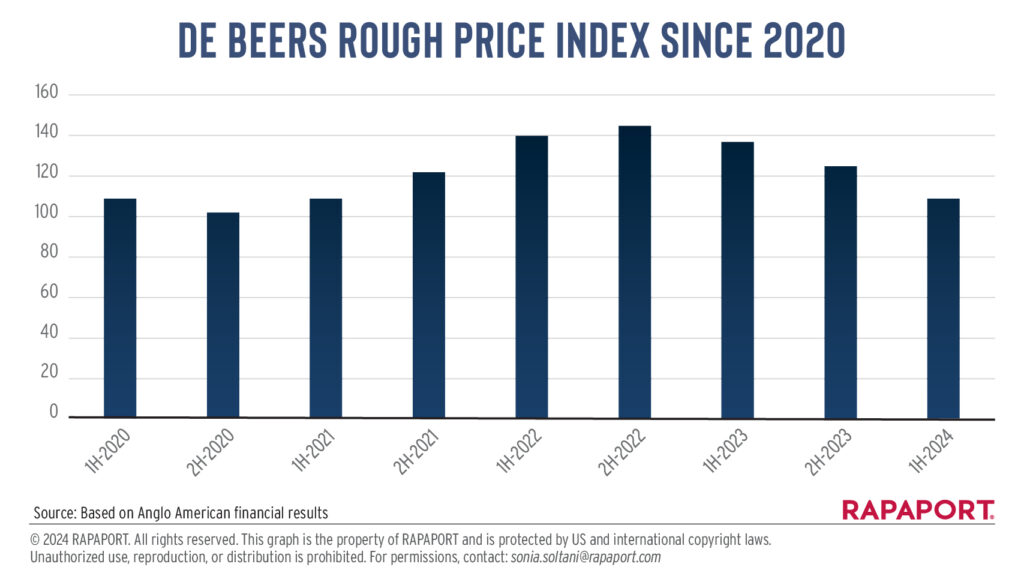

De Beers has also continued to provide price data on a half-year basis. These are discrete figures as an average for the half year, and not year to date. This is why the shape of the price decline in the second half of 2023 is different from for the quarterly index.

The index rose steadily from the second half of 2020 onward, with the diamond market rebounding from the Covid-19 lockdowns, before falling as the recovery unraveled. Prices for the first half of 2024 were the lowest since the first half of 2021, according to Rapaport’s archive of Anglo American’s figures.

The extra information provides some transparency on pricing, for the benefit of the industry and Anglo American investors. It’s also of use to potential buyers of De Beers. But for sightholders, what matters is whether De Beers’ rates align with the polished market. If not, they will struggle to turn a profit.

Main image: Rough diamonds at a sight. (De Beers/Armoury Films/Ben Perry)

Stay up to date by signing up for our diamond and jewelry industry news and analysis.