As the steel elevator doors lift to reveal the inner workings of the legendary Cullinan mine, it’s difficult to believe one is 849 meters below the earth’s surface.

Apart from the predictably gloomy brown tones, the carefully carved tunnels are sufficiently lit and well ventilated, with safety posters lining the passageway to greet workers arriving for another day at the office.

The intricate tunnels, with bulldozers carrying heavy loads of ore navigating their turns, connect two blocks in which mining currently takes place at Cullinan. The unique geological makeup of the mine makes this possible, stresses Jaison Rajan, chief operating officer at Petra Diamonds, which owns the mine.

“Geologically, Cullinan has a vertical and thick shape because it consists of three volcanic eruptions that took place in the same [kimberlite] pipe,” explains Rajan, who was previously general manager of the mine. “That’s why we can afford to have two production blocks at the two extremities producing large volumes.”

In contrast, the Finsch mine, Petra’s other main asset, has a fairly narrow pipe and therefore one production line, he adds.

More carats

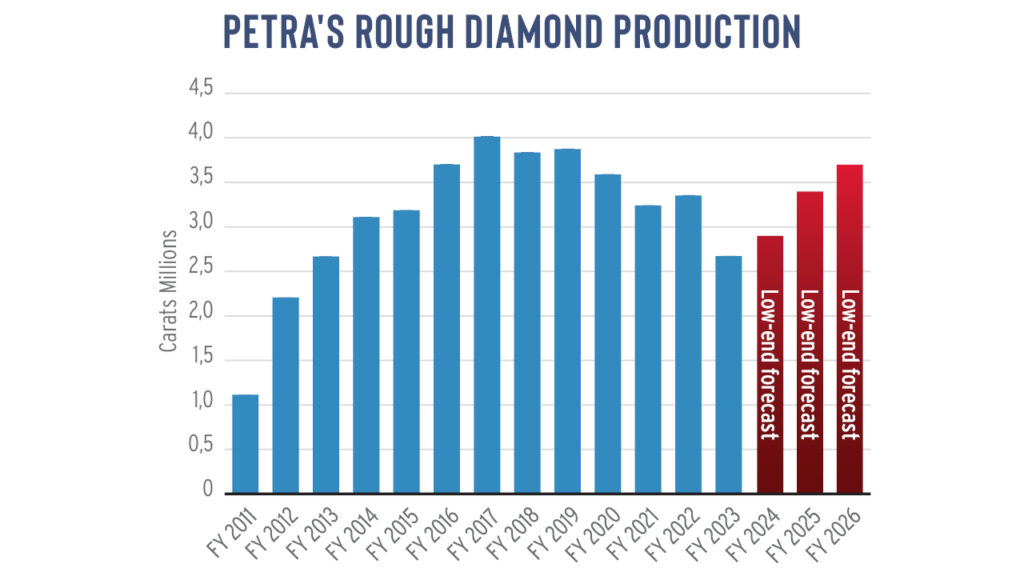

Petra has approved expansion projects at both Cullinan and Finsch, which will boost group production by 1.3 million carats within the next three years, it said in a recent earnings report for the fiscal year that ended June 30, 2023.

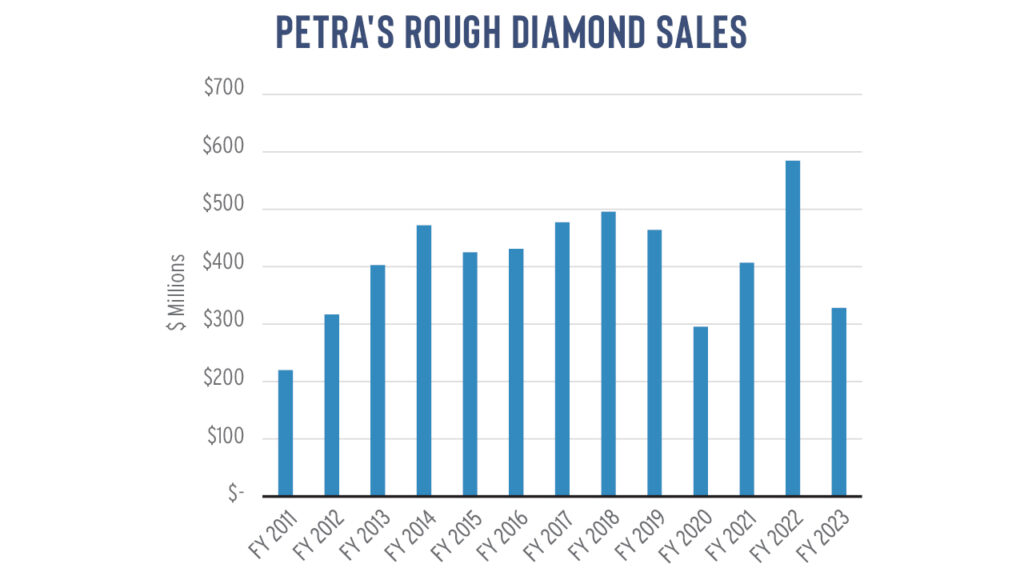

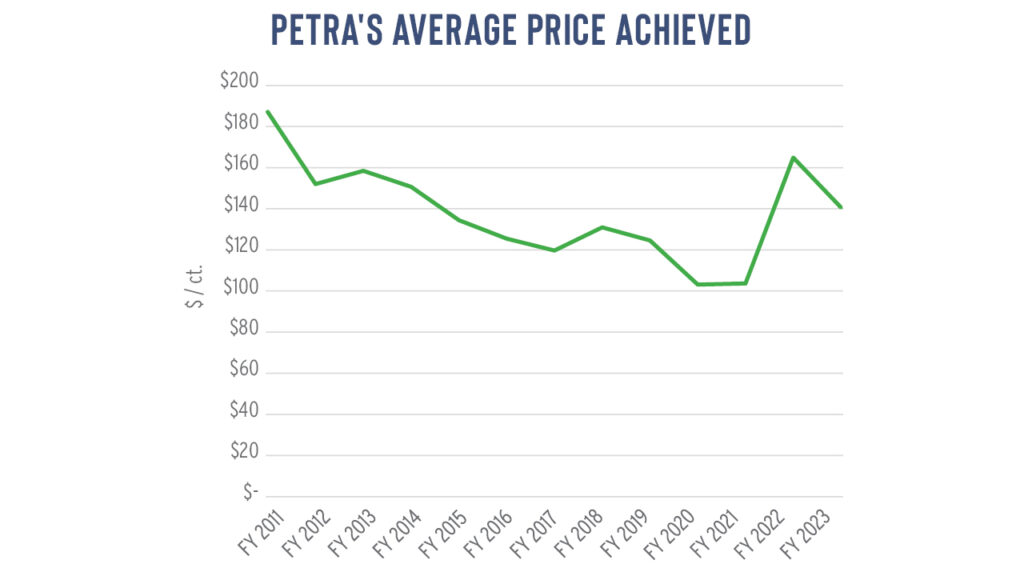

Output fell 20% to 2.67 million carats for the year, while Petra’s revenue dropped 42% to $325.3 million due to lower production and the weak market in calendar 2023. Its average sales price slid 14% to $139 per carat, with a 2% like-for-like price increase offset by a change in the mix of production to lower grades.

That poorer mix was anticipated, considering the company is depleting current mining areas at both Cullinan and Finsch, before operations will shift to the new locations, Rajan says.

The longer one mines an area, the more waste is in the mix of ore. At Cullinan, current mining is focused on two blocks in the “C-Cut” level, while Petra is preparing mining further along the C-Cut and into the “CC1 East sublevel cave,” as well as into C-Cut central cave. There are indications the company will access higher grades in those areas, boosting carat production, Rajan explains.

The company approved the expansion in fiscal 2022 at a capital investment of around $173 million, extending the current mine plan to 2031. It expects production from CC1-E is to begin in the current fiscal year ending June 2024, and will ramp up to full capacity by fiscal 2026.

Staying bullish

And there’s scope for more, adds Rajan. The next phase, which Petra has yet to approve, would shift mining deeper to D-Cut — beyond 1 kilometer underground.

That would extend Cullinan’s mining life past 2040. It would also require a new shaft — the mechanism that transports the ore to the surface — as at such a depth, the current shaft is located too close to the open pit. The deeper you dig, the wider the surface pit naturally becomes, which means the pit would encroach on the current shaft, Rajan explains. A new shaft requires another significant capital investment that would be built into the cost of the D-Cut project, Rajan notes.

For now, mining a remnant block means a higher proportion of waste is in the mix of production. The grade at Cullinan fell to 30.7 carats per hundred tonnes (cpht) of ore processed during fiscal 2023, compared to 36.2 cpht the previous year. The average price achieved for Cullinan’s goods consequently fell 17% to $139 per carat for the year, with the steepest declines occurring in the most recent fourth fiscal quarter.

Petra remains upbeat about its prospects in the medium to long term, despite the declines and having given a cautious outlook for the year ahead. Growth will be driven by the planned ramp-up of new mining areas at Cullinan and Finsch, which will enable the company to capitalize on the “structural supply deficit,” it foresees in the diamond market, Rajan says.

“It’s a perspective that takes a certain view of demand while we’re not seeing new production come onstream,” he says, explaining the projected deficit. “Over time we’ll see a reduction in supply, and given a certain level of demand, prices should be on the increase.”

Consolidating production

With a resource of over 200 million carats, based on the current mine plan, the company is positioning itself by investing in its two flagship mines, and particularly in Cullinan.

Petra owns four operations – Cullinan, Finsch, and Koffiefontein in South Africa, and the Williamson mine in Tanzania — having acquired each from De Beers between 2007 and 2011. Cullinan accounted for 56% of group production and revenue in fiscal 2023 and has been a windfall for the company. Finsch makes up 20% of output and 29% of rough sales, while Williamson accounted for the remainder.

Koffiefontein and Williamson have posed greater challenges for the company than the two larger operations. Williamson experienced a failure of its tailings dam — or tailings storage facility (TSF) — in November 2022, resulting in significant environmental damage and forcing the miner to place the deposit on care and maintenance. Rehabilitation was only recently completed, enabling operations to resume in July. Petra has also had royalty disputes with the government of Tanzania, which owns 25% of the mine.

To mitigate these risks, Petra has agreed to sell 50% of its stake in Williamson to mining contractor Taifa for $15 million, leaving it with 37.5%. Petra will retain responsibility of the operation and sales.

Meanwhile, the miner has been seeking a buyer for Koffiefontein for some time and in November put the operation on care and maintenance after failing to find a suitor. It is now in the complicated phase of closing the mine and ensuring the move has a minimal impact on the community.

The four pillars

The company has allocated ZAR 300 million ($15.6 million) for Koffiefontein’s rehabilitation, reports Avhurengwi Nengovhela, head of sustainable mining practices at Petra. Among other projects, the company will allocate the funds to earth-moving work to reduce the mine’s environmental footprint, while restoring as much biodiversity functionality as possible. It also involves engaging with the community to develop alternative economic opportunities in the area, working with local small businesses and doing what it can to provide economic continuity to employees it laid off.

All that is governed by Petra’s sustainability framework, which Nengovhela and Rajan both stress motivates everything the company does.

“Petra is unique in that sustainability is central to all that we do,” says Nengovhela, who previously worked as a consultant on sustainability strategies for the minerals sector. “We consider the impact on our sustainability goals in all our decisions.”

Guided by the slogan to create “abundance from rarity,” the framework has four pillars, through which it considers the value of its people, largely referring to safety and skills development; respecting the planet; driving partnerships with stakeholders; and delivering production.

Sometimes, such a deep focus might affect the business in the short run, but the longer-term value of the strategy makes the company more competitive, Nengovhela stresses.

Amid all of its expansion plans and reliance on production, the sustainability framework enables Petra to tell a better story to investors, regulators, and the communities in which the company operates, he adds.

“Our social license to operate is directly linked to how we’re perceived in the community,” Nengovhela explains. “The more we tell our story, the more attractive we become versus the competition.”

Anticipating something special

Figuring out why another 3,000-carat diamond has not been recovered at Cullinan is a frequent conversation at Petra Diamonds, says chief operating officer Jaison Rajan.

The famed 3,106-carat Cullinan Diamond was discovered in 1905 and still ranks as the largest gem-quality rough diamond ever found.

Rajan has his theories as to why the feat hasn’t been repeated. That stone was found in the open pit six meters below the surface, he notes. The deeper you go, the more pressure diamonds withstand and the lower the likelihood of finding such big stones. In addition, he continues, the Cullinan was spotted with the naked eye, meaning it didn’t go through a crushing process.

Petra recovered fewer large special stones at Cullinan in fiscal 2023, primarily due to the depletion of mining in the current block cave, which has resulted in lower-grade recoveries.

Besides, Cullinan has more recently become known for its high-value blue diamonds. It boasts The De Beers Blue, The Oppenheimer Blue, The Blue Moon of Josephine, and The Letlapa Tala Collection — an ensemble of five blue rough stones that sold in November 2020 to De Beers and manufacturer Diacore for $40.4 million.

More recently, on October 5, The Infinite Blue, an 11.28-carat, fancy-vivid-blue diamond ring, sold at Sotheby’s for $25.3 million — below presale estimates.

Beginning July 1, Petra changed its definition of special stones to those selling for more than $15 million, instead of the $5 million benchmark it previously set. And it doesn’t consider such a windfall when planning or issuing its annual guidance.

That said, Rajan notes that the processes for recovery at Cullinan are constantly set toward 3,000 carats on the chance that lightning might strike again. “Our engineers insist,” he adds. “There was one instance of a 3,000 carater, so we have to anticipate another.”

Main image: The Cullinan mine. (Petra Diamonds)

Stay up to date by signing up for our diamond and jewelry industry news and analysis.