Introduction

The third-quarter operations updates the mining companies and Hong Kong-based retail jewelers published highlighted the deep challenges facing the industry in 2024.

The negative numbers were hardly surprising, given the prevailing weak sentiment in the diamond trade.

The Hong Kong jewelers had previous noted the slow gem-set jewelry category, while sales of gold products surged when the metal’s prices rallied and have slumped since gold has peaked.

Most alarming was Luk Fook’s assertion that it was reducing its diamond offering and shifting toward fixed-price jewelry. While such a move by one company does not make a trend, it sets a dangerous precedent. It is another indication of the struggles the diamond trade has endured recently in greater China.

The production updates by the mining companies were equally unsurprising yet informative. The major suppliers have borne the brunt of the slump, while junior and mid-tier miners generated revenue within last year’s range. De Beers and Botswana’s Okavango Diamond Company (ODC) canceled sales during the quarter to enable manufacturers to reduce their inflated polished inventory.

Consequently, De Beers added to the large inventory of rough it was already holding, and there are still a lot of goods in the midstream.

But all is not lost. There are rising expectations for the US holiday season, which began in November — even if many view Thanksgiving as the official starting point. Researchers have given optimistic outlooks for overall retail during the period. And there are encouraging signs for jewelry, with strong sales growth reported in October, including for diamonds, according to jewelry data providers.

Even an incremental improvement in diamond-jewelry sales at retail could jump-start the trading of polished and rough, helping reduce those inventory levels. The focus will be on retail over the next two months. After that, as the trade assesses its potential for 2025, there may be even more pressing questions to consider.

Will positive end-of-year jewelry retail sales pull the diamond trade out of its current predicament? Expectations were rising as the holiday period kicked off in November. US consumers were upbeat in the run-up to the annual shopping frenzy, despite a contentious election that took place on November 5.

Consumer confidence rebounded in October as The Conference Board’s index rose 10% from September, its strongest gain since March 2021. Consumers grew more optimistic about the job market and prospects for the economy, The Conference Board noted.

The National Retail Federation (NRF) projected that the momentum would continue, predicting sales across all retail categories would grow 2.5% to 3.5% in November-December – the period retailers’ reference for their holiday sales. That equates to a total of between $979.5 billion and $989 billion, a record for the two-month season.

“The economy remains fundamentally healthy and continues to maintain its momentum heading into the final months of the year,” NRF CEO Matthew Shay said. “The winter holidays are an important tradition to American families, and their capacity to spend will continue to be supported by a strong job market and wage growth.”

Sales are expected to spike over Thanksgiving weekend, extending from Black Friday through Cyber Monday (November 29 to December 2), which ushers in the peak shopping period. Bain & Company expects sales to surge 5% year on year over the weekend, outpacing its forecast of 3% growth for the whole season. Black Friday occurs slightly later than usual this year, resulting in a shorter period between Thanksgiving and Christmas, and prompting many retailers to run early promotions, the NRF said.

Positive Jewelry Signs

Jewelry is gaining momentum, too. Gross sales among independent jewelers grew 15% during October, driven by a 5% rise in units sold and a 9% increase in the average sale price, the Edge Retail Academy reported.

The diamond category rose 12% during the month, rebounding from a 6% decline in September, although August and July were both positive for the diamond segment, according to the Edge.

Data provider Tenoris gave a similar upbeat account, reporting that jewelry sales by value grew 7.4% year on year in October.

Independents have outperformed the bigger jewelry chains and department stores, although there have also been signs of improvement among the majors.

Signet Jewelers reported that same-store sales fell 3.4% in the second quarter that ended August 3, the fifth consecutive quarter that the decline has improved, management noted. The company expects to meet its guidance comfortably for the full year as certain categories have turned positive in the third quarter — particularly fashion jewelry.

China Still Down

That all bodes well for the diamond trade, which is relying on robust jewelry sales in the US to stimulate the global wholesale market, while compensating for the continued weakness in China.

Chow Tai Fook and Luk Fook, two of the largest retail jewelers in the Asia-Pacific region, reported double-digit declines in the second fiscal quarter that ended September 30. Luk Fook’s diamond sales fell 47% year on year in both Hong Kong-Macau and mainland China, and it said it planned to shift away from the product.

“Since the demand for diamond products remains subdued, the group will continue to actively promote non-diamond fixed-price jewelry products,” the company said in its quarterly sales update.

Polished demand from China has been sluggish for a while. The September Jewellery and Gem World Hong Kong show did not inspire confidence as very few buyers from mainland China attended and sales activity was weak.

The Bullwhip Effect

The diamond trade is therefore relying on the US to stimulate trading, even as jewelers there have been buying cautiously. A strong holiday season would motivate jewelers to replace sold inventory, stimulating demand for polished and subsequently rough — helping to reduce the inflated inventory levels in both of those segments.

In a downward-trending market, a small decline in retail jewelry sales leads to a sharper drop in polished demand and an even steeper slump in the rough market, explained industry analyst Pranay Narvekar of Pharos Consulting in an August presentation at the India International Jewellery Show (IIJS).

That knock-on sequence, which Narvekar refers to as the bullwhip effect, also plays out when the market turns positive. Good retail sales stimulate a stronger rise in polished trading and an even better improvement in rough buying.

Inventory Pressure

That is encouraging news for the trade, which has been trying to reduce its polished-diamond inventory for months.

Manufacturers refrained from buying rough for most of the third quarter, focusing on selling existing polished rather than on manufacturing fresh goods.

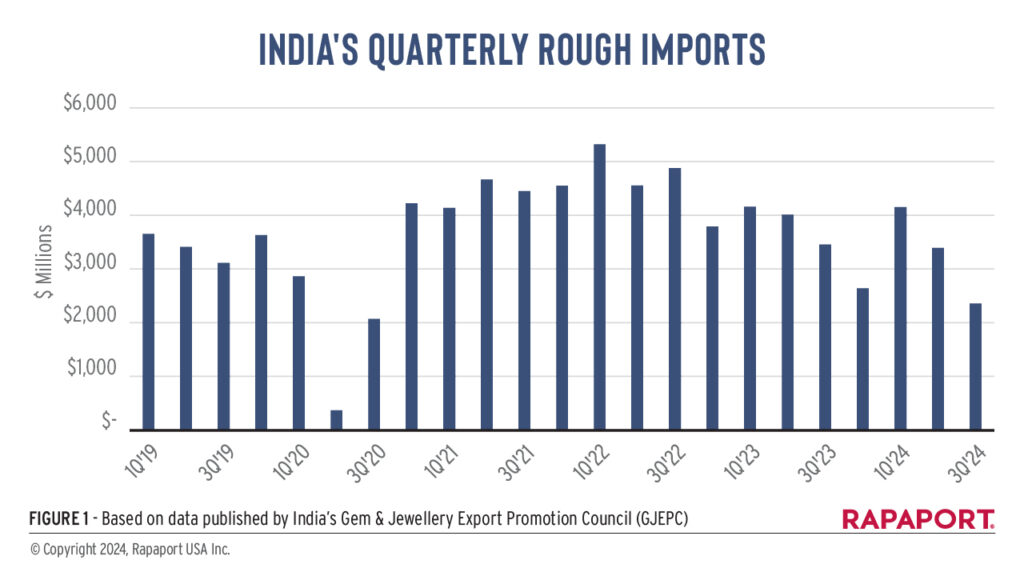

India’s rough imports fell 32% year on year to $2.36 billion in the third quarter, based on monthly data the Gem & Jewellery Export Promotion Council (GJEPC) published. That is the lowest level since the beginning of the pandemic in early 2020, according to Rapaport records (see Figure 1). Polished exports fell 23% to $3.24 billion — a five-year low.

Indian cutters are expected to keep their factories closed for an extended period over the Diwali break, which began on October 31, while there have been reports of significant layoffs in Surat over the festival period.

Limiting supply has brought mixed results. There are scarcities in select categories such as 2- to 3-carat, D to I, VS2 to SI2 diamonds with no strong inclusions and still high availability for less desirable goods, as reported in Rapaport’s monthly report on price trends. The number of diamonds on RapNet rose 0.8% during October, totaling 1.7 million on November 1.

Miners’ Predicament

As manufacturers curbed their rough buying, the risk of holding inventory shifted to the mining sector — particularly the high-volume major producers. Junior companies with one mining asset have been able to maintain their revenue stream, though sometimes at slightly lower levels, because they work with far lower volumes, which they sell at tenders.

It was left to De Beers and Botswana’s Okavango Diamond Company (ODC) to exert supply discipline. Given their high volumes, doing so created scarcity in select areas and stimulated demand at the tenders.

De Beers relaxed its buying rules in the third quarter and canceled its October sight to help ease manufacturers’ inventory burden. ODC called off its auctions in November and December.

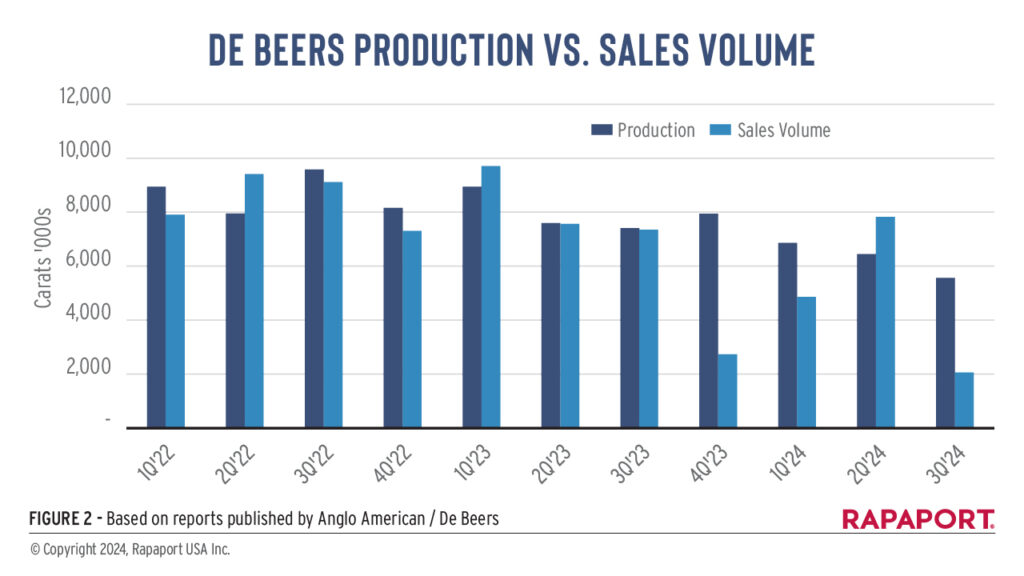

That has resulted in a build-up of rough inventory at De Beers. The company’s production fell 25% to 5.6 million carats in the third quarter, while its sales volume slumped 72% to 2.07 million carats. The company began the year with a lot of diamonds in its vaults, and that would have increased as production exceeded sales by 4.1 million carats in the first nine months of the year (see Figure2).

The company will be under pressure to sell those goods in 2025. While limiting supply enabled De Beers to leave its price book unchanged during the third-quarter market slump, it is anticipated to make adjustments in the coming November and December sights to stimulate rough buying again.

Sustainable Growth

Those decisions could prove negligible if retailers have a bumper season this November-December. Even an incremental improvement could give the rough market a significant boost, according to Narvekar’s bullwhip explanation.

That may stimulate exuberant buying of rough and polished in the first quarter. This excitement to buy has characterized previous recoveries, notably during the post-pandemic boom of 2021-22. The aggressive trading during that period led to an oversupply when the market slowed – a surplus which is still evident today.

It will require discipline across the supply chain during a prospective upturn to prevent history from repeating itself.

The first question to consider in 2025 will be whether an improvement in retail can be sustained beyond the holiday season. If so, the industry must assess the real volume of diamonds required in the market. That should temper any prospective buying hysteria and ensure that the market does not return to its current oversupply predicament.

The real test of the industry’s long-term planning and strategic thinking comes during a market upturn, not in a crisis. In the past that has been severely lacking. For now, though, there is at least some hope.

Stay up to date by signing up for our diamond and jewelry industry news and analysis.