RAPAPORT PRESS RELEASE, September 5, 2023, Las Vegas… The diamond market weakened in August as economic challenges persisted and synthetics expanded their market share. The likelihood that G7 governments would soon impose stricter source-disclosure rules to sideline Russian goods also created uncertainty.

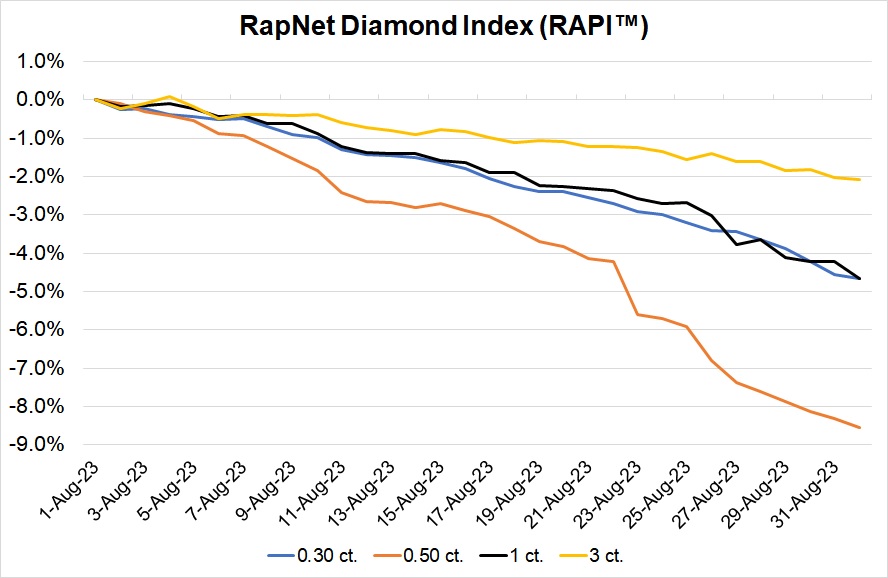

The RapNet Diamond Index (RAPI™) for 1-carat diamonds fell 4.7% in August. The 0.30-carat RAPI also dropped 4.7%. Both of these were the worst performances since the peak of the Covid-19 crisis in April 2020.

The index for 0.50-carat stones slumped 8.6% — the sharpest drop for any month since RAPI records began in 2005 — and 3-carat diamonds slipped 2.1%.

The market was even tougher for stones with lower colors and clarities than the RAPI tracks. Prices for 1-carat, D-L, IF-SI2 items on RapNet fell 5.7%.

© Copyright 2023, Rapaport USA Inc.

The declines reflected weak retail sales in the US and China as well as competition from lab-grown stones. The industry is approaching the holidays with apprehension.

Rounds lost value at a sharper rate than fancies. Fancy shapes usually trade at a discount to rounds, but as of this publication, the Pears Price List matched rounds in seven categories. The market for square cushions cooled as production increased and demand slid.

Indian manufacturers kept polished production at around 40% to 50% of capacity. Submissions to the Gemological Institute of America (GIA) declined, prompting the laboratory to lay off about 20% of the workers at its headquarters in Carlsbad, California.

Rough supply fell in accordance with weak polished demand. De Beers’ August sales slid 42% year on year to $370M. Okavango Diamond Company brought in $48.5 million for the same month, a 55% decline from July.

Both retail and wholesale in China remained slow as the country’s economy weakened. Exhibitors at the upcoming Jewellery & Gem World Hong Kong show expect relatively subdued trading. India’s domestic jewelry market boosted sales of polished under 1 carat as the wedding season began.

Rapaport Media Contacts: [email protected]

US: Sherri Hendricks +1-702-893-9400

International: Avital Engelberg +1-718-521-4976

About the RapNet Diamond Index (RAPI™): The RAPI is the average asking price in hundred $/ct. of the 10% best-priced diamonds, for each of the top 25 quality round diamonds (D-H, IF-VS2, GIA-graded, RapSpec-A3 and better) offered for sale on RapNet® (www.rapnet.com). Additional information is available at www.rapaport.com

About the Rapaport Group: The Rapaport Group is an international network of companies providing added-value services that support the development of ethical, transparent, competitive and efficient diamond and jewelry markets. Established in 1976, the group has more than 20,000 clients in over 121 countries. Group activities include Rapaport Information Services, providing the Rapaport benchmark Price List for diamonds, as well as research, analysis and news; RapNet, the world’s largest diamond trading network; Rapaport Trading and Auction Services, the world’s largest recycler of diamonds, selling over 400,000 carats of diamonds a year; and Rapaport Laboratory Services, providing Rapaport gemological services in India and Israel. Additional information is available at www.rapaport.com

Main image: Polished diamonds. (Shutterstock)

Stay up to date by signing up for our diamond and jewelry industry news and analysis.