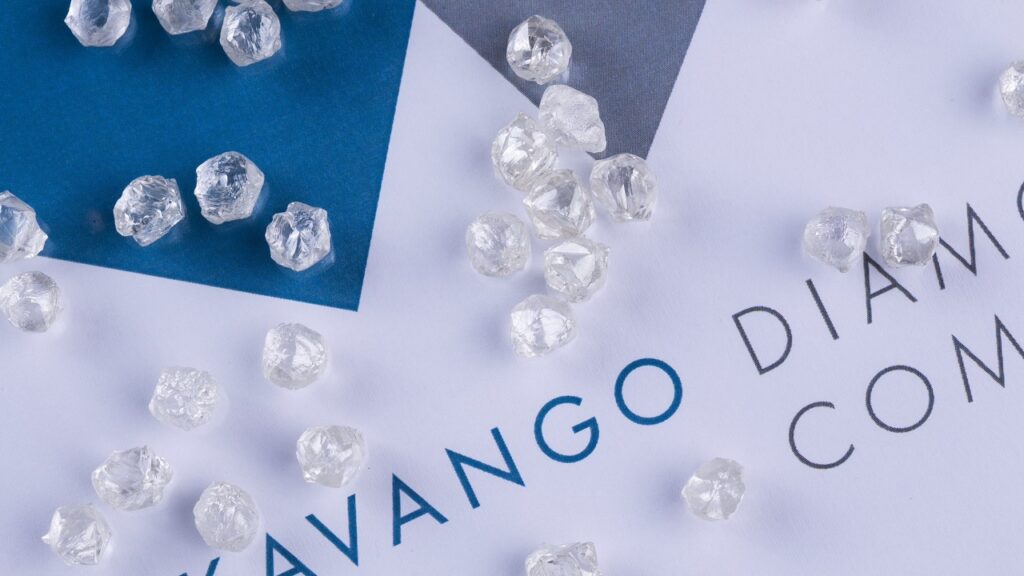

Okavango Diamond Company (ODC), Botswana’s state-owned rough trader, has had to stand strong in the face of the recent industry downturn. Managing director Mmetla Masire says the company is ready to tell Botswana’s diamond story as the sector looks toward a recovery in demand.

How has 2023 been for Okavango Diamond Company (ODC)?

ODC will be profitable in 2023, but we’re sitting with inventory. Our volume sold, and our margins are lower than in the previous two years.

We’ve been grappling with the question of how much we’re willing to lose on each auction. We’ve lost on some categories but have made some money on smalls and bigger stones. Most of our inventory is near-gem [quality diamonds] and cube [shaped], and those are not moving at all.

Our financial year ends in March and typically includes 10 auctions. We suspended our last two sales and have three left. We’re trying to help the market reduce [polished] inventory. It should have some impact given the major producers aren’t selling, and the seasonal Christmas buying.

How do you explain the downturn?

Several issues contributed. The Ukraine war broadly influenced sentiment, while sanctions on Russian diamonds had a more direct impact on the market. The US economy has not performed well, and China did not recover as expected after Covid-19.

We had post-Covid-19 irresponsibility whereby the industry got too excited and there was speculative buying. People’s mindset also changed relating to the valuation of assets, fueling the belief that gold and other products were better buys than diamonds.

Finally, synthetic diamonds had the single biggest impact on the natural-diamond market.

Could that post-Covid-19 irresponsibility have been avoided?

Depriving people of goods they want is not a good thing. We made diamonds available, and it was up to buyers to purchase at the right price. If people offer to buy at a higher price than expected, you’ll mess up the auction if you refuse.

Manufacturers should have been more careful about how they bought. When they need goods, I assume there’s demand on the other side.

How do we break the cycle?

It’s very difficult, because one solution does not address all the problems. Even if we reduce inventory, we’d still face the lab-grown diamond trend and other issues. Some things are in our control. We must manage the G7 [Group of Seven] requirements. We can advertise more aggressively to reclaim some market share from lab-grown.

What role does Botswana’s message play in that?

We can contribute. A strategically coordinated effort is better whereby everybody contributes either financially or by propagating the message about natural diamonds.

We must first make sure there is appetite for natural diamonds and then we can promote Botswana diamonds. The Botswana story gives more meaning to what diamonds can do, but marketing must be done by everyone.

Is ODC planning a branding effort to raise its market share?

We are developing a strategy. We want to elevate ODC such that our value proposition is clear. We have put out a request for proposals from consultants and other stakeholders who will help us build ODC’s provenance branding.

We’re working on three approaches. One is purely driven by ODC, the other is partnering with manufacturers, and then we want to work with select retail, preferably the brands.

What is the essence of Botswana’s diamond story?

It’s the fact that diamonds are singularly responsible for what you see in Botswana. Our policies clearly show that diamonds belong to the nation and the people. Free education and health care is testament to what diamonds have done, along with the fact that there has never been any conflict or tribalism associated with them.

How is Botswana affected by the growth of lab-grown?

Botswana is dependent on natural diamonds. If lab-grown is eating into the natural-diamond market, it eats directly into Botswana’s earnings.

What impact will the government’s recent agreement with De Beers have on ODC?

We’re going to have a greater allocation of local production. We haven’t yet received the first step up from 25% to 30% of Debswana goods, but we are making changes to accommodate the larger supply.

Next year we’ll move into our new head office, which has the capacity for more viewing and a larger sorting area. The bigger impact will come as our allocation rises to 40% and then 50% of Debswana production over the next decade. We’ll have to change our business model.

What are your considerations in changing the business model?

Until now, we only sold via auctions, which could reach $120 million to $150 million. That is too big. We’re assessing what an optimal auction looks like and will probably reduce them to between $50 million and $80 million. We also don’t want them to be too small. They must be attractive and competitive.

We’re diversifying our selling channels by introducing international and beneficiation contracts next year. We anticipate a 50-50 or 60-40 split between contracts and auctions, weighted either way.

And we’re looking at a more deliberate marketing approach. We can’t hold so many goods and not deliberately try to influence the market.

What’s your forecast for next year?

The market should level out by March-April, and I expect a slow recovery by June-July. The impact of synthetics should be less, but it will still be there. We’ll have reduced inventory, the US economy is showing signs of improvement, and I think there will be some stimulation of the market in China.

The challenges are not going to disappear, but we believe they’ll be less impactful. Just as multiple factors pulled us down, multiple factors will help improve the market.

RELATED READING

Main image: Mmetla Masire. (Okavango Diamond Company)

Stay up to date by signing up for our diamond and jewelry industry news and analysis.