De Beers’ sales value fell this month as global rough demand weakened and the miner reduced prices of its larger stones.

Proceeds dropped 32% year on year to $450 million at 2023’s fifth sales cycle from $657 million in the equivalent period a year earlier, De Beers reported Wednesday. Sales declined 6% compared with the $479 million that the fourth cycle brought in. The total included the June sight as well as auction sales.

“Following the JCK [Las Vegas] show, and with ongoing global macroeconomic challenges continuing to impact end-client sentiment, the diamond industry remains cautious heading into summer,” said De Beers CEO Al Cook. “Reflecting this, we saw demand for De Beers rough diamonds during the fifth sales cycle of the year slightly softer than in the fourth cycle.”

De Beers lowered prices at the sight by 5% to 10% mainly in 2-carat categories and larger, as well as for some 1- to 1.5-carat items, market insiders said. It also extended its buyback program, which allows sightholders to sell goods back to the miner following the purchase.

This reflected weakness in the rough that produces polished above 0.30 carats, and especially the stones that yield 1-carat finished diamonds. These sizes are especially weak in the US market amid economic uncertainty and a lull in engagements, dealers explained. Rough under 0.75 carats has seen a mild recovery as Indian manufacturers look to fill their factories with low-cost material.

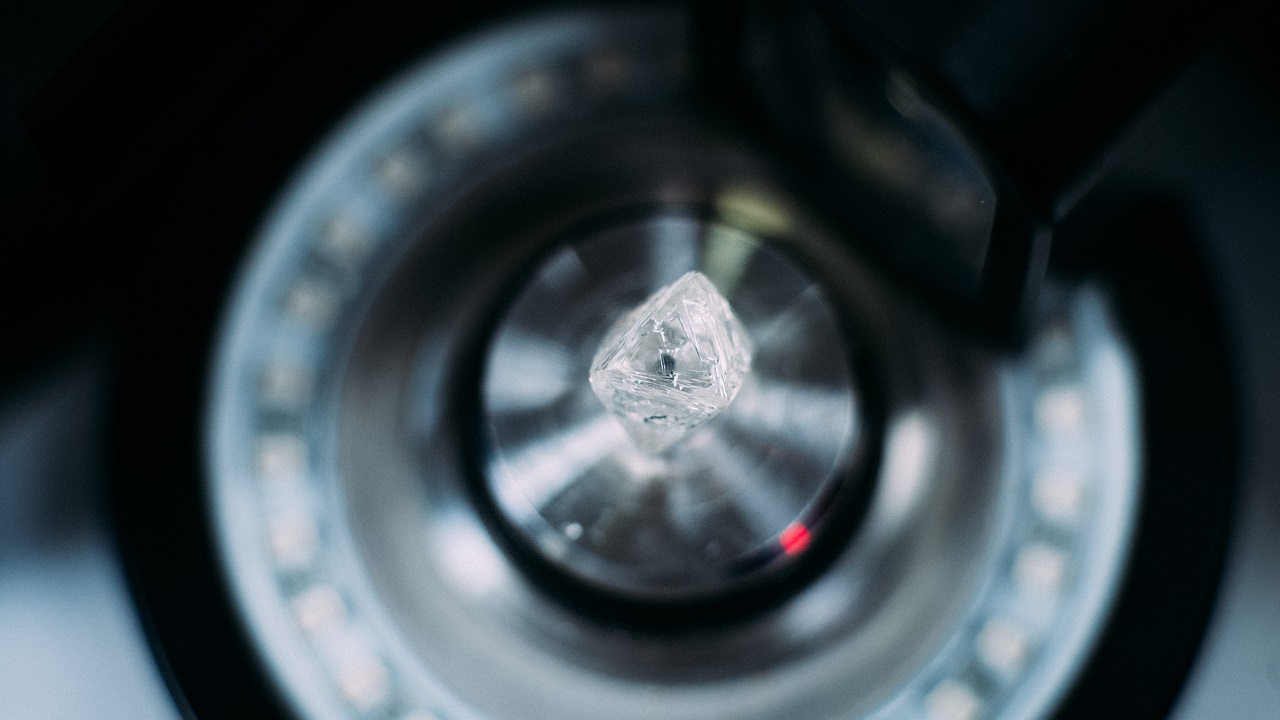

Image: Rough diamonds for cutting and polishing at KGK Botswana. (De Beers)