This year will be remembered for the impact that geopolitical and economic developments had on all industries, while parts of the world were still contending with Covid-19.

The diamond trade is no exception. Fresh off a bumper 2021, which saw stellar gains in all segments of the pipeline, the market experienced the effects of the Russia-Ukraine war, US economic caution and the slowdown in China.

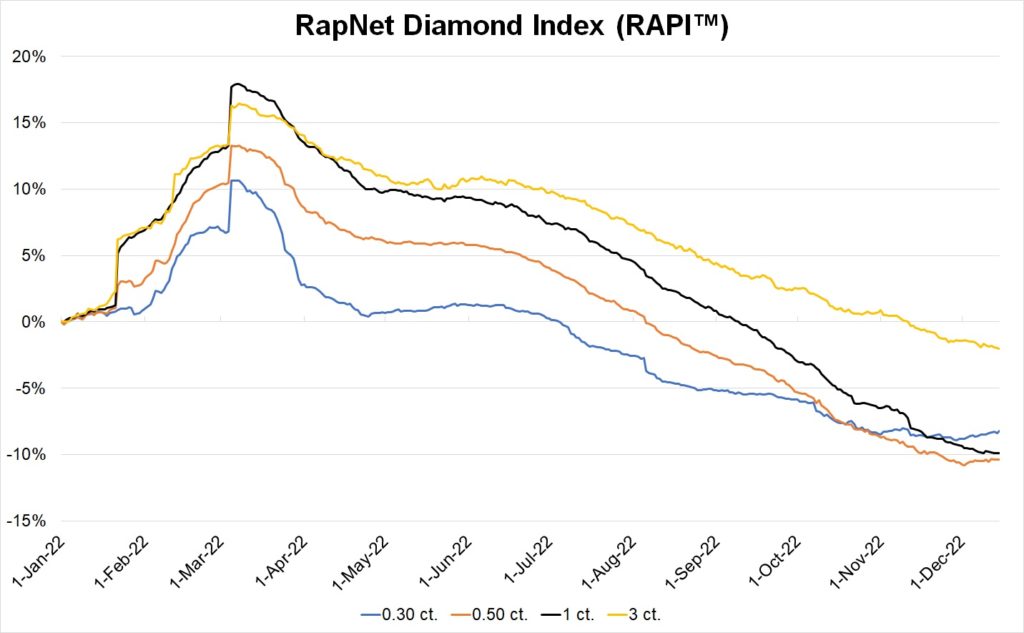

Those factors affected supply and demand, disrupting the growth experienced in 2021. Polished diamond prices declined, with the RapNet Diamond Index (RAPI™) for 1-carat stones down 9.9% for the year to date until December 15 (see Figure 1).

The RAPI is the average asking price in hundred $/ct. of the 10% best-priced diamonds, for each of the top 25 quality round diamonds (D-H, IF-VS2, GIA-graded, RapSpec-A3 and better) offered for sale on RapNet®.

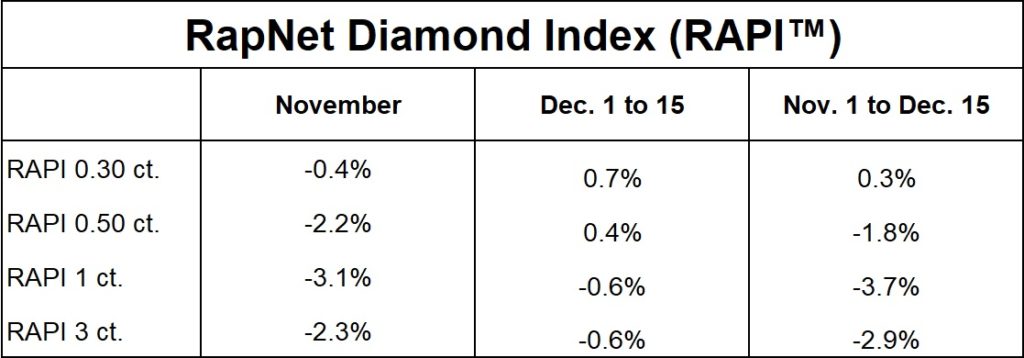

The index slid 3.1% in November and a further 0.6% in the first two week of December (see Figure 2).

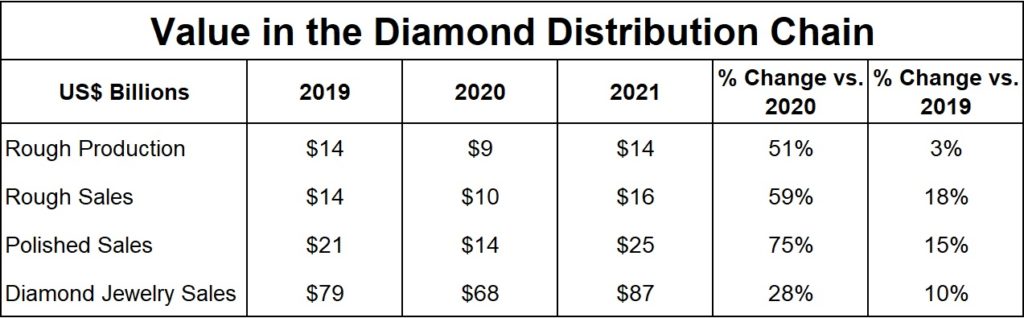

The declines stood in stark contrast to the gains made in 2021, when the RAPI for 1-carat diamonds rose 17.4%. Global diamond-jewelry sales grew 27% to $87 billion that year, according to the latest De Beers Diamond Insight report. The stellar performance at retail stimulated the rest of the trade, with strong numbers seen in the polished and rough sectors in 2021 (see Figure 3).

Based on Rapaport estimates, along with data from the Kimberley Process, mining company sales, data from India’s Gem & Jewellery Export Promotion Council (GJEPC), and De Beers Insight reports.

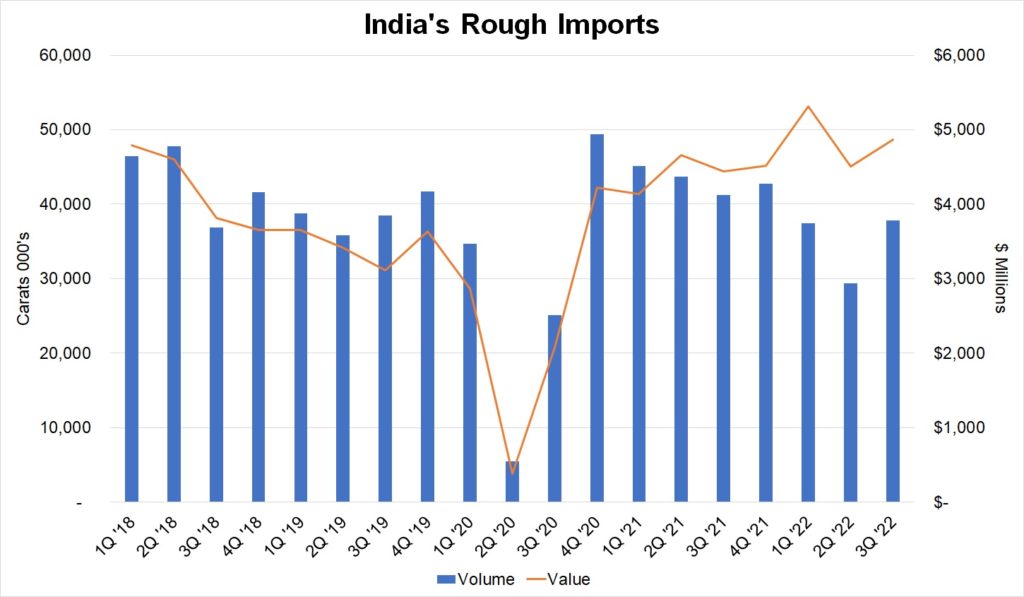

The diamond trade began 2022 confident that the momentum would continue. Manufacturers aggressively bought rough throughout 2021 as the recovery from Covid-19 took hold, and they continued to do so in the first quarter of this year, which was reflected in India’s rough-import data (see Figure 4).

Based data from India’s Gem & Jewellery Export Promotion Council (GJEPC.

But economic and political conditions shifted massively in 2022. The pandemic had moved the consumer focus away from services toward goods, which along with earlier factory closures, shipping challenges and labor scarcities in the US, left a supply shortage of basic products.

That forced suppliers to raise prices, while the outbreak of the Russia-Ukraine war on February 24 caused a spike in oil prices and influenced a more cautious economic outlook in global sentiment. The Federal Reserve and other central banks began raising interest rates to curb inflation.

Inflation and personal income

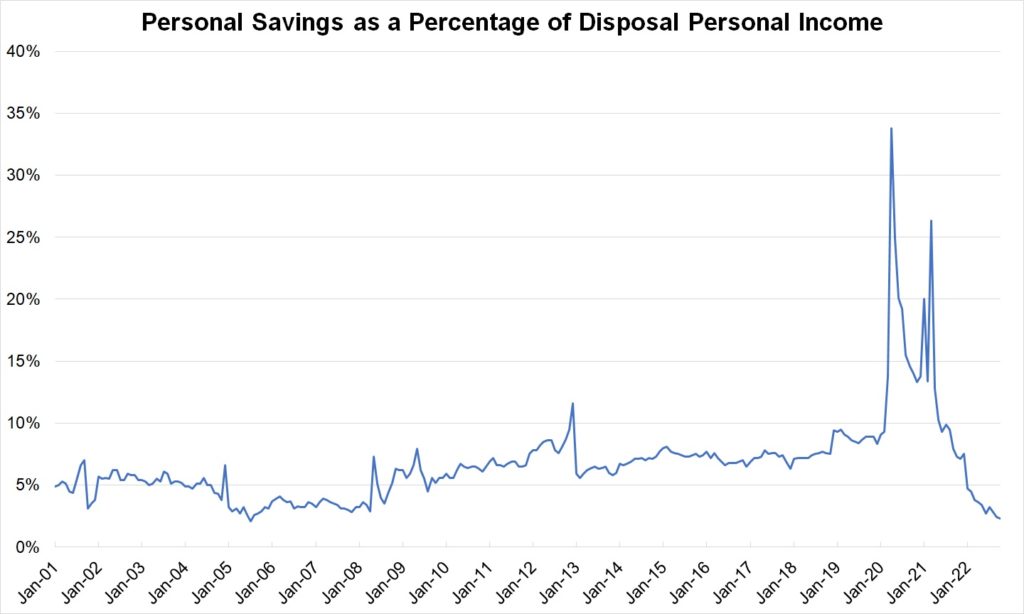

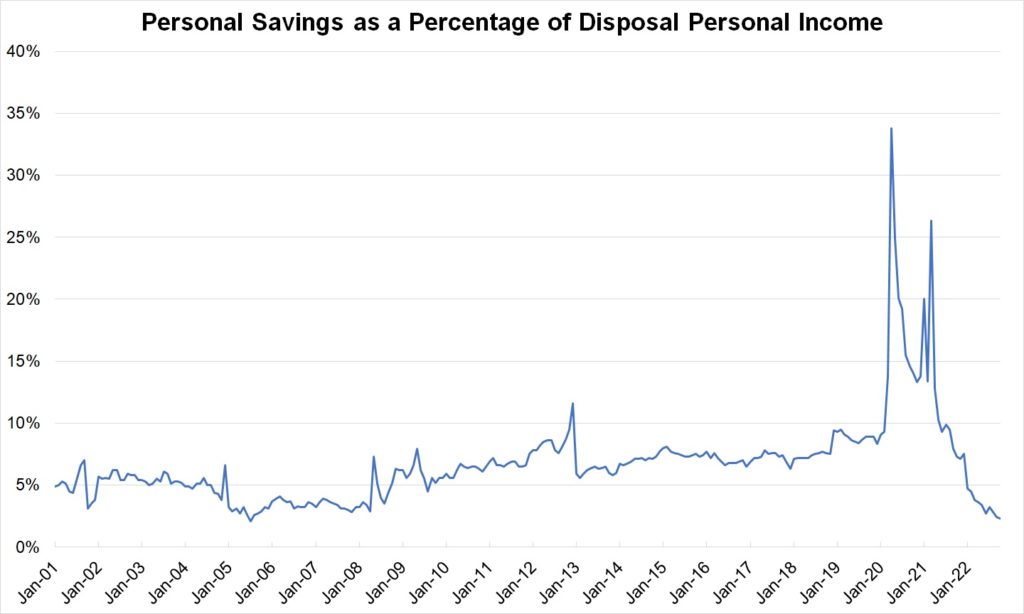

Households had less to spend on discretionary items in 2022. Personal savings as a percentage of disposable income shot up to above 30% in the depths of the pandemic when households spent less on travel and received stimulus checks to see them through the difficult times. With fuller wallets, there was a release of pent-up demand in 2021 that saw consumers spend more on jewelry and other experiences.

That boost to personal savings tapered off in 2022. In fact, it slumped to a multi-decade low in October, according to the latest data published by the US Bureau of Economic Analysis (see Figure 5).

Based on data from the US Bureau of Economic Analysis.

Households no longer had stimulus payments coming in. They were also out and about and keen to travel again as the pandemic subsided, resulting in a shift back toward spending on services and experiences over products, while contending with higher prices. In addition, stock market setbacks reduced wealth, with the S&P 500 down 16.7% for the year to date on December 15.

All this squeezed consumers’ budgets and influenced a trend away from discretionary luxury spending.

That weaker economic sentiment had a clear impact on the diamond market in 2022. Jewelry sales appear unlikely to match 2021 levels, even as retail sales have presented mixed trends.

The first half of the year saw positive growth, particularly among the luxury-jewelry brands, whereas more commercial, bridaloriented jewelers reported more conservative results. Signet Jewelers’ same-store sales were down 7.6% in the third fiscal quarter and by 4.4% in the nine months ending October 31.

Overall, US sales are expected to fall slightly below 2021 levels but should still beat pre-Covid-19 numbers.

Buyer caution

While retail is by no means in a dire position, US jewelers have been cautious about buying inventory as economic uncertainty became more apparent. They were able to do that by focusing more on memo goods and by tapping into suppliers’ online inventory in real time while demanding faster delivery.

Meanwhile, Chinese buyers were also less prevalent on the market, with retail and wholesale activity there slowing due to ongoing lockdowns to contain Covid-19 outbreaks — particularly in the latter part of the year. China accounted for approximately 11% of global polished demand in 2021, corresponding to its share of global diamond-jewelry sales, according to the De Beers Diamond Insight Report. The

reduction of dealer activity in the Far East had a major impact on midstream sentiment, particularly in India, which is the largest diamond-manufacturing center. Diamond demand consequently slowed, leaving the diamond midstream with a large volume of polished inventory — a result of all the rough bought in 2021. As of December 15, the total volume of diamonds on RapNet stood at 1.85 million stones — an 4% rise year on year (see Figure 6).

Cutters exerted greater caution than dealers in the second half of the year. They needed to generate liquidity to buy rough and keep their factories operating, so they reduced prices to boost sales and diminish their bloated inventory – even as De Beers maintained steady rough valuations. A sense of panic in the manufacturing sector was notable in October when companies sought to boost polished sales before the Diwali break in India.

In contrast, dealers had more flexibility to hold goods and maintain price levels through the market slowdown, since they only buy and sell polished and don’t have the pressure that manufacturers do to buy rough to maintain their operations. Suppliers to large US jewelers were doing well whereas companies relying just on dealer trading also grew jittery due to the price declines.

Rough dynamic

The rough market went through several cycles during the year.

The first quarter saw strong sales, followed by a slowdown between April and June, before demand picked up in the third quarter. But there was a lot of polished in the midstream, and that influenced renewed caution in the rough market in the final three months of the year.

De Beers allowed sightholders more flexibility than usual at its November and December sights given the market uncertainty.

However, the company kept prices relatively unchanged, opting to sell fewer goods, rather than reduce prices to stimulate demand at more attractive valuations. Mining companies are facing higher costs considering the impact that inflation has had on their operations. Still, rough prices have declined on the secondary market and on the auction circuit, and buyers remain cautious given the excess of available polished supply and overall uncertainty.

The Russia factor

The wild card in the market has been Russia. In addition to the impact of the war on global sentiment, US sanctions on Alrosa and the restrictions placed on international money channels to Russia have limited access to the world’s largest producer of rough diamonds.

Restricting only direct imports from Russia but allowing the import of diamonds sourced in Russia yet polished in other centers, the sanctions have loopholes. In addition, other countries did not impose sanctions — notably Belgium, the largest trading center of Alrosa diamonds; India which typically manufactures them; and the Chinese consumer market.

Russian goods still had a clear path to market. The initial projections of widespread shortages that would result from the restrictions placed on Alrosa have not yet materialized. The Russian miner reportedly continued to sell its rough, albeit at lower levels than before. However, the sanctions did impact

certain categories of diamonds. The market saw scarcities of smaller, better-quality diamonds for which Alrosa is a dominant supplier, as well as the fluorescent goods that also typify its production.

Being responsible

While the sanctions had their limitations, more retail jewelers and brands implemented their own “ethical” ban on buying Russian diamonds. The war inspired companies to fast-track their traceability programs, while more jewelers are requiring their suppliers to provide proof of origin with their invoices.

It also motivated industry bodies and major brands to raise the bar regarding their environmental, social and governance (ESG) credentials. Sustainability emerged as a central theme in the industry’s marketing and messaging, playing into the growing consumer sensitivities toward these issues.

The rising competition that natural diamonds are facing from lab-grown also contributed to this approach. More retailers are pushing synthetics, both as an “ethical” alternative and one in which they can get more bang for their buck.

Indeed, the consumer landscape presented new challenges for the diamond industry in 2022. Customers are buying, but they have tighter budgets and a different mindset that lingers from the pandemic. That, combined with the global developments that have been affecting supply and demand, highlight how much the market has changed in a year.

The trade likely saw stagnant growth in 2022 versus last year. That can be considered an achievement as it demonstrates that the levels reached in 2021 are sustainable. But the industry does face some headwinds: Some are within its control, yet the more prevalent macroeconomic and geopolitical factors are less so.

This article first appeared in the December edition of the Rapaport Research Report. Subscribe here.

Image: AI-generated. (midjourney bot)