Bruce Cleaver had a very focused “to do” list when he took over as De Beers CEO in July 2016. Having previously worked on strategy and business development at the company, as well as at parent Anglo American, he recognized De Beers’ need to evolve, and to protect it from the increasing volatility evident in the global economy and diamond market.

“I wanted to build a more sustainable business; one that was less prone to economic cycles,” Cleaver stresses in an interview with Rapaport News. “I wanted to ensure we’d never get caught in the position we had in 2008 when we hit a very serious downturn and our balance sheet was very stretched.”

He never imagined those goals would be challenged by a global pandemic and a war in Ukraine that has brought sanctions on Russian diamonds — approximately one-third of global rough supply. These aren’t events you predict in your risk analysis, he notes.

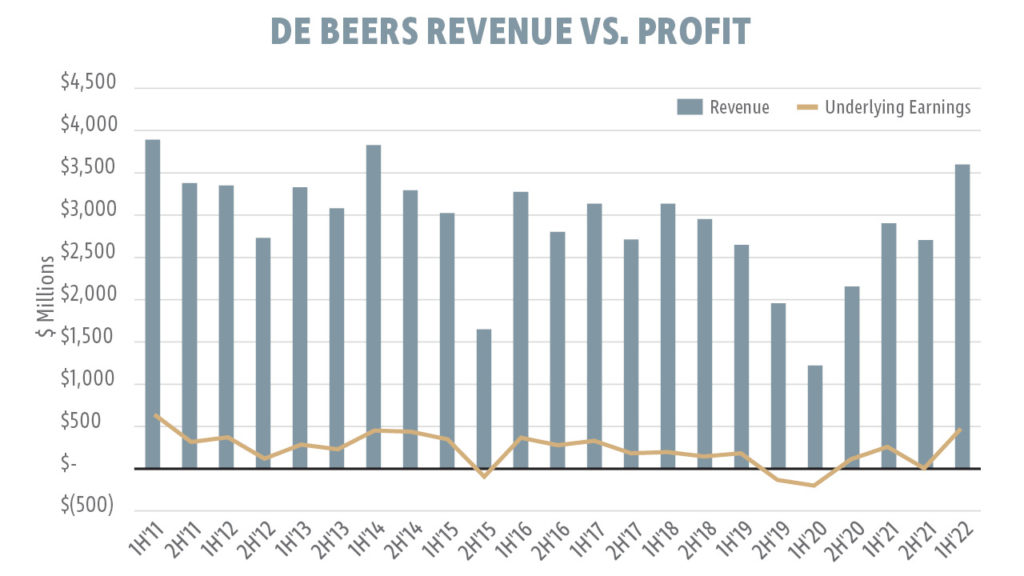

In contrast to 2008, when De Beers had to take on more debt to weather the financial crisis, the company emerged from Covid-19 stronger than before, and it may even have benefited from the limitations on Russia-based Alrosa — its biggest competitor. The $491 million in underlying earnings it reported in the first six months of 2022 was its best half-year profit since 2011, and the $3.54 billion in revenue its highest since 2014 (see graph).

But Cleaver looks beyond the financials as he reflects on his tenure at the helm of the world’s largest diamond company. His six-and-a-half-year stint brought a significant transformation to De Beers’ structure, brand positioning, messaging, and relationships, all of which he believes demonstrate transparency and a willingness to change that were not always evident at the company.

Call to collaborate

His first public statement after being appointed to the position called for greater cooperation and partnerships within the trade. He actively sought to ease the tension that often stood between De Beers and sightholders and at times its government partners, he admits.

“It was important for us to show people we would change, listen more and collaborate more,” he reflects. “I do feel there is much more trust now than before, and a sense of working toward a common goal — that we can agree to disagree in a more friendly way.”

Central to achieving that was the refurbishment of the sightholder application process, which he concedes had previously been complicated and intimidating. The current system further demonstrates De Beers’ willingness to be more open and transparent, Cleaver insists. It’s a complicated task, he adds, considering the company distributes some 33 million carats a year and must set criteria to award goods to certain people and not to others.

The sheer volume of De Beers’ production means the company is unlikely to shift away from the sight system any time soon. However, it did tweak its distribution at the beginning of 2022 to provide more bespoke supply by classifying sightholders according to their business type: manufacturer, dealer, or retailer. The move was seen as an attempt to reduce the flipping of boxes on the secondary market and to bring more efficiency to the supply chain.

Special stones to sell

There has been speculation that the Botswana government — a 15% shareholder in De Beers and a joint venture partner in its mining and selling distribution businesses — is pressuring the miner to sell its specials through the parastatal Okavango Diamond Company, in vertically integrated deals with manufacturers. The two are currently negotiating a new 10-year supply deal and the renewal of De Beers’ mining licenses in the southern African country.

Structuring supply in such a way would see the company (and government) take a share of profit from the sale of the resulting polished. Smaller companies have struck similar partnerships, such as Lucara Diamond Corp.’s agreement to sell its 10.8-carat-plus rough through manufacturer HB Antwerp.

Cleaver notes the deeper considerations with which De Beers must contend. “It’s a whole different ball game selling 33 million carats a year than 50,000 carats. We have an offering that we must sort, value, sell, trace and track on a completely different scale,” he points out. “You have to be much more sophisticated, more thoughtful and have a much stronger balance sheet.”

That’s not to say the company is set in its ways, particularly regarding how it sells specials. Last year, it partnered with sightholder Diacore to buy an exceptional 39.35-carat blue rough stone from Petra Diamonds for $40.2 million and share in the profit from the polished. The De Beers Blue, the 15.10-carat, fancy-vivid-blue polished that resulted from that rough, fetched $58.7 million at Sotheby’s Hong Kong. The two companies also teamed up to buy five blue rough diamonds from Petra in 2020, with the resulting polished stones expected to garner over $70 million at Sotheby’s in November (after press time) and December.

“It’s not difficult as a seller of a small volume of goods to find one buyer who will buy one particular stone at a significant premium to the market — that happens to us all the time,” he adds. “We just don’t publicize it.”

Tech at play

Technology has been the central tool to improve the way De Beers sells rough, Cleaver underlines. He teases that the company will introduce various innovations in the next 12 to 18 months that will be “game changers in how we continue to sell in this evolving market,” but he declined to reveal further information about these developments.

Data is also playing a much more important role in enabling De Beers, and others, to make more rapid decisions than before — and that data-centric strategy is being driven by technology, he notes.

In fact, technology is influencing change across all De Beers business units, Cleaver says. That includes at its mining operations, where it is tackling the challenge to “mine more gently,” using less water and energy to be more environmentally friendly. He also highlights the Tracr program — De Beers’ blockchain-driven traceability platform — which is gaining traction and will enable companies to show the provenance of their De Beers supply.

Building forever

That all feeds into the strong focus on sustainability that De Beers has adopted in recent years and the need to show one’s diamond is ethically sourced. While Cleaver recognized the need to talk about sustainability early in his tenure as CEO, the rapidness with which the subject became a focal point for brands surprised even him.

“I wanted to make sustainability a bigger issue, but I don’t think I realized at the beginning just how important it is,” he admits. “Now ‘Building Forever’ is an absolutely key part of everything we do.”

Building Forever outlines 12 goals De Beers has set to achieve by 2030, encompassing four areas it has identified to make a meaningful impact.

Those are leading ethical practices, partnering for thriving communities, protecting the natural world, and accelerating equal opportunity. “These are vitally important not only to our business, but also to our employees, partners and communities across all facets of our operations,” the company emphasizes on its website.

The program gradually emerged as the core message of the De Beers brand, taking its cues from the rising awareness among millennials and Gen-Zers on issues such as carbon neutrality, climate change, and social upliftment. The program is what distinguishes De Beers, and it provides an opportunity to maximize the value of the brand that was not apparent five years ago, Cleaver says.

Cleaning the mess

The evolution of that message paralleled Cleaver’s advocating for more brands across the industry as well as cleaning up and strengthening the De Beers brand. Key to that development was taking full ownership of its name in early 2017, when it bought the 50% of De Beers Diamond Jewellers (DBDJ) that was owned by LVMH.

“It always felt messy having the De Beers name co-owned by someone else,” he observes. “I’m very pleased we’ve been able to unify the brands into one master brand.”

The company sought to leverage its strong name recognition as much as possible. Most notably that played out at retail with the LVMH deal and subsequently renaming the retail operation De Beers Jewellers (DBJ). It also rebranded Forevermark as De Beers Forevermark, and the strategy extended beyond its retail operations to align the whole group into one “De Beers” corporate identity with a common goal.

“I wanted to define a more holistic business strategy: to run the company as one business rather than three separate silos,” Cleaver shares. “I think we’ve been pretty successful in achieving that.”

Staying brilliant

De Beers previously had a more vertical structure, split between the pillars of mining, rough sales and its retail brands. Over the past half decade, it has morphed into a more integrated end-to-end business with every employee, regardless of which area of the company they work, having the same stated purpose: to “make life brilliant,” Cleaver explains.

As such, the outgoing CEO carefully defines De Beers as a “natural-diamond company” with an integrated structure that encompasses exploration, mining, rough sales, and retail brands. Lightbox, the company’s lab-grown business, is considered an “adjacency” that doesn’t fit into the core business model, he insists.

With that structure in place, Cleaver is confident the company can double-down on innovation – as he claims it did with Tracr and Lightbox — strengthen its relationships with the trade and government, and in doing so, lead the industry on big issues such as sustainability. He hopes to continue to influence that path in his new role as cochairman, through which he will take an active role in engaging with external stakeholders.

“It’s important that De Beers pushes agendas and ideas that might be surprising they came from a big organization,” Cleaver discloses. “But when you look at some of the sustainability work done by retailers and sightholders today, it’s fantastic, and I think that we did have some small influence on that — that was all deliberate.”

The industry will continue to evolve because the world will continue to change quickly, he continues. “I’ve tried hard to always think about what the next trend or the next move should be — and why shouldn’t it be us who makes them? We recognize that when De Beers talks, people do listen,” he concludes.

This article first appeared in the October issue of the Rapaport Research Report. Subscribe here.

Image: A portrayal of De Beers’ operations past and present. (De Beers)