RAPAPORT PRESS RELEASE, April 4, 2023, Las Vegas… Diamond trading was slow in March due to US economic uncertainty and a stalled recovery in China. Rising interest rates, high inflation and a banking crisis contributed to the lull in business.

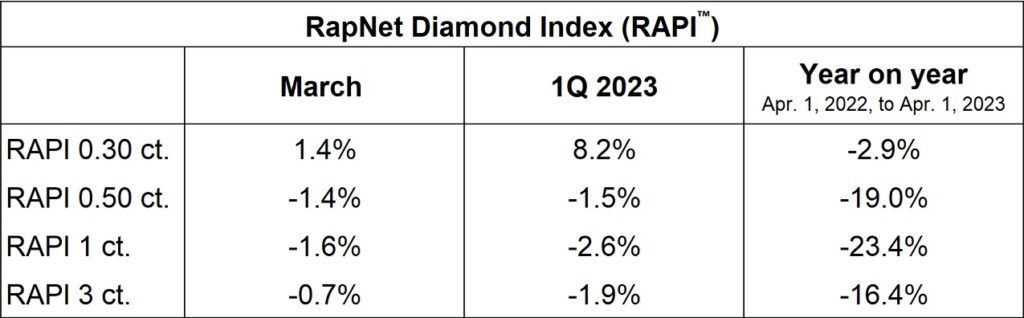

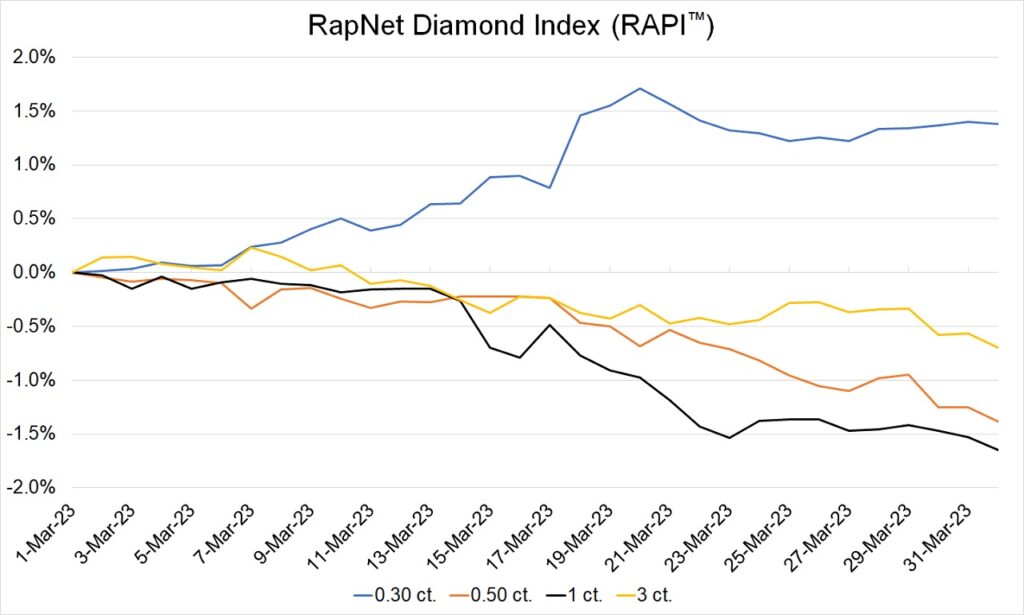

The RapNet Diamond Index (RAPI™) for 1-carat diamonds fell 1.6% in March and 2.6% during the first quarter. RAPI for 0.30-carat stones continued to firm, driven by the rebound in China – a strong market for this category. Inventory of 0.30-carat goods has declined due to reduced manufacturing over the past year.

Sentiment improved as the Hong Kong International Jewellery Show signaled a return of Chinese buyers after a prolonged absence due to Covid-19 restrictions. However, those buyers lacked urgency following the initial boost from the fair. The release of pent-up demand has yet to occur.

Polished inventory remains historically high but has come down in popular sizes. The number of unique diamonds listed on RapNet declined 3% in March to 1.72 million as of April 1. That was still 10% above the pre-pandemic levels of March 1, 2020.

Polished production is stable at lower quantities. India’s rough imports by volume dropped 14% year on year in the first two months of 2023. Manufacturers’ profit margins have tightened since prices for smaller rough increased an estimated 30% in the first quarter.

The diamond supply chain is bifurcating into goods that are fully traceable to responsible sources, and goods that are not. Ahead of a mid-May summit, the G7 nations are working on a plan that would require companies to declare the non-Russian origins of their diamonds. The directive would increase measures to keep any polished that came from Russian rough out of the major G7 consumer markets.

The updated sanctions will likely accelerate the market split and may lead to scarcities of popular items within G7 countries, especially with demand projected to improve in the second half of the year.

Rapaport Media Contacts: [email protected]

US: Sherri Hendricks +1-702-893-9400

International: Avital Engelberg +1-718-521-4976

About the RapNet Diamond Index (RAPI™): The RAPI is the average asking price in hundred $/ct. of the 10% best-priced diamonds, for each of the top 25 quality round diamonds (D-H, IF-VS2, GIA-graded, RapSpec-A3 and better) offered for sale on RapNet® (www.rapnet.com). Additional information is available at www.rapaport.com.

About the Rapaport Group: The Rapaport Group is an international network of companies providing added-value services that support the development of ethical, transparent, competitive and efficient diamond and jewelry markets. Established in 1976, the group has more than 20,000 clients in over 120 countries. Group activities include Rapaport Information Services, providing the Rapaport benchmark Price List for diamonds, as well as research, analysis and news; RapNet, the world’s largest diamond trading network; Rapaport Trading and Auction Services, the world’s largest recycler of diamonds, selling over 400,000 carats of diamonds a year; and Rapaport Laboratory Services, providing Rapaport gemological services in India and Israel. Additional information is available at www.rapaport.com

Image: Polished diamond with tweezers. (Shutterstock)