It may take a few months before sentiment improves and buoyancy returns to the trade.

Change in the diamond industry is often a slow burn. Generally, it takes a major global event such as the 2008 financial crisis, the 2020 pandemic or Russia’s 2022 invasion of Ukraine to spur the market into immediate action.

The outbreak of Covid-19 forced the industry, along with the rest of the world, to pivot to digital. The financial meltdown compelled the trade to raise its compliance and reporting standards — even if it took a few years to get fully onboard.

Now, the industry is adjusting to the consequences of the Russia-Ukraine conflict and the associated US sanctions on Alrosa. Market forces have not yet enabled that to play out fully. The conflict will likely become even more important in 2023 than it was in 2022 as the supply-demand dynamic adjusts and source-verification programs gain steam.

Other factors are also expected to affect the trade in 2023. The US and Chinese economies are experiencing lingering uncertainty, while the lab-grown market continues to grow and evolve. Finally, De Beers and the Botswana government are set to sign a deal that could have wider significance for the industry.

We predict the following developments will have the strongest impact on the diamond market in 2023:

- Alrosa supply

When the US imposed sanctions on Alrosa in April 2022, many — including this report — projected that scarcities would ensue given that the Russian miner accounts for approximately 30% of global rough production.

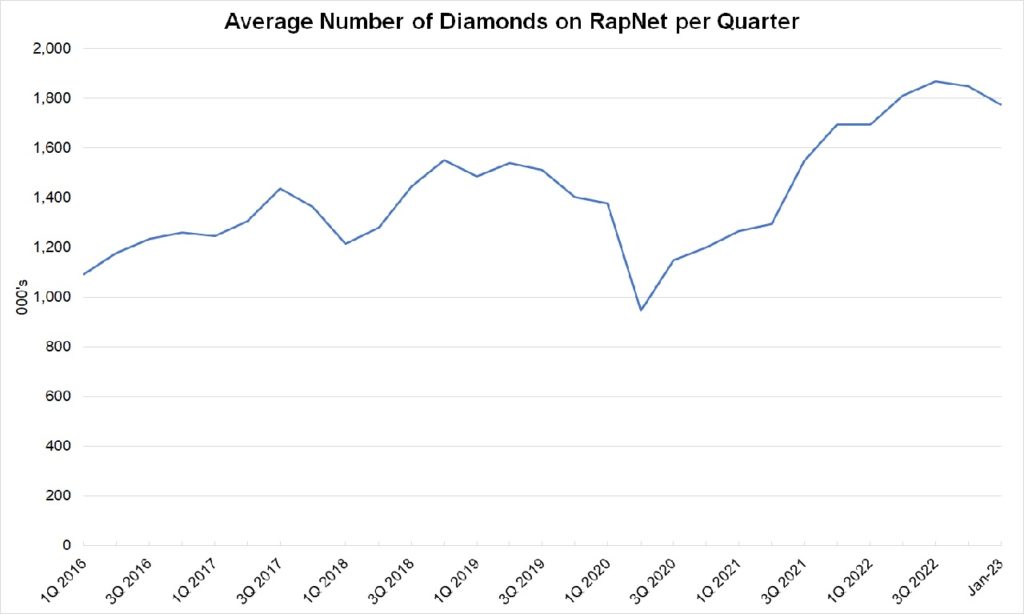

Instead, polished inventory levels were consistently at record levels throughout 2022, as reflected in the volume of diamonds listed on RapNet (see graph). That was largely due to the aggressive rough buying toward the end of 2021 and the beginning of 2022 when the industry rode the positive momentum of the strong recovery from the pandemic.

These stockpiles of rough kept factories busy and pushed up polished-inventory levels as the newly manufactured goods became available just when demand started to weaken in the second half of the year.

Polished prices dropped in the second half and continued to soften in the new year, with the RapNet Diamond Index (RAPI™) for 1-carat diamonds down 0.2% in the first 12 days of January.

Manufacturers subsequently reduced their rough buying, and factories drastically lowered their polished output. The volume of rough imports to India fell around 21% year on year in the first 11 months of 2022, although by value they increased 8%, with the average price rising 38% to $138 per carat. That was partly the result of lower Russian supply, as it signals a shift to lower volumes and higher-value goods. Alrosa yields a large quantity of smaller, lower-value diamonds.

Shortages have started to appear of those “Alrosa-type” diamonds. But overall, polished suppliers are left with substantial volumes of less popular goods that have been difficult to move in the weaker market.

Manufacturers are expected to continue to exert caution in their rough buying at the beginning of the year, especially if De Beers maintains higher price levels at its first few sights.

A price cut by De Beers may stimulate demand. For now, the company seems content to maintain levels, even as prices have declined at auctions and on the secondary market. It has to consider that in the inflationary environment of the past year, production costs have risen, meaning it needs to protect its profit margins through its pricing.

Still, the company had a strong year and benefited from Alrosa’s absence from the market. De Beers’ rough sales climbed 20% to an estimated $5.78 billion in 2022.

But Alrosa will gradually return to the market, even if sales are not disclosed. Indian banks have taken measures to facilitate rupee-based transactions with Russia, and Belgium has avoided imposing sanctions on Russia — its largest source of rough. There were already reports of Russian rough being sold toward the end of 2022.

We expect midstream polished-inventory levels to come down in the first quarter after manufacturing declined in recent months. Low availability of newly cut supply may influence jewelers’ buying in January and February when they typically replenish stock sold during the holiday period, although polished demand is more cautious than usual for this time of the year.

- The US economy

US jewelers had a relatively good season, even if sales didn’t match last years’ bumper levels. However, there is no urgency for them to buy due to uncertainty about the market’s near-term prospects and given that prices — and therefore inventory valuations — continue to decline.

The reluctance to purchase stems from economic uncertainty as high inflation has led to cautious discretionary spending among consumers. Retailers are careful not to own excess stock and are able to hedge that risk by taking more goods on memo and tapping into suppliers’ inventory remotely while demanding more efficient delivery when they need it.

Retail inventory management will contribute to the slowdown in diamond-trading activity in the first quarter, continuing the trend seen in the latter half of 2022. There are still concerns about a pending recession, and that uncertainty may extend through the first half of the year. Diamond demand should improve as market forces settle and the trade gains confidence again for the end-of-year season.

- China recovery

There is some renewed optimism for China after the government eased its Covid-19 restrictions in December and announced in January that it would also lift quarantine measures for travelers. While the move sparked another wave of coronavirus infections, the country is reopening ahead of the Chinese New Year on January 22. It followed the reversal of its strict Covid-19 policy with other measures to make China more investor friendly and flexible.

That has spurred some expectations of a release of pent-up demand later in the year, if not during the lunar festival. We believe the recovery will gain momentum in the second half, because it will take Chinese consumers time to return to normal and gain confidence that the sudden turnaround in government policy is here to stay.

Furthermore, growth will be measured against last year’s numbers, which were weaker in the second half. The prolonged absence of Chinese buyers was a major contributing factor to the global slowdown in diamond trading in 2022. Their return should help boost the market in the coming year.

- Lab-grown diamonds

There is no doubt the development of the lab-grown sector affected demand for natural-diamond jewelry in 2022. At the same time, however, wholesale prices of synthetics continued to fall. That is largely due to increased supply driven by technological advancements. That said, demand has also segmented for synthetics. Retail jewelers have been pushing lab-grown diamond jewelry, with bridal emerging as a surprising sweet spot for the segment.

That has all influenced the lab-grown market to be more nuanced than expected, with jewelers demanding higher-quality production and a general shift toward better color and clarity goods taking place.

This year is set to be another landmark one for the lab-grown industry, amid expectation that more jewelers and established brands will start to carry the product. The price points at which luxury brands can sell lab-grown will show where the value lies — in the product or the brand story — demonstrating if the appeal of synthetics can extend beyond their lower price.

- Proof of origin

The rise of lab-grown along with US sanctions on Alrosa have been major catalysts for the natural-diamond industry to increase its sustainability and source-verification programs.

The natural industry has shifted its messaging to environmental, social and governance (ESG) matters over the past three years, arguably as synthetics growers and sellers claimed to offer a greener option. Meanwhile, the war in Ukraine fast-tracked various source-verification or traceability programs to assure brands and jewelers that their product offerings fell within legal and ethical boundaries.

With these initiatives in place, we expect more midstream players to streamline their operations and use those platforms to assure their clients that their supply is ethically sourced. We anticipate traceability and the associated source-verification programs will gain traction in 2023 and emerge as an important discussion point for the industry.

- De Beers-Botswana deal

Another story we’re watching keenly is the negotiations between De Beers and Botswana over their supply and marketing agreement. The deal is renewed once a decade and expired in 2020. A new contract was initially delayed because of Covid-19 and later due to a number of sticking points.

Currently, the deadline is for June of this year, and it would be surprising if there were further postponements.

It is difficult to grasp the full scope of the discussions, as both parties have been loath to reveal any details, but the issues could have significant ramifications for the rest of the industry.

It is understood that the government, a 15% owner of De Beers, wants more of the company’s Botswana supply to go to local sightholders for cutting and polishing. It is also seeking to boost the sales of Okavango Diamond Company — the government rough-selling arm — and wants stronger access to larger stones for Okavango while exploring potential value-adding deals with cutters.

Gaborone has steadily evolved into an important rough-diamond hub, stemming from the first sightholders setting up factories in the city and culminating in De Beers moving its aggregation and selling activities there from London around 2013.

As De Beers facilitates more diamond-related activity in the country, other cutting centers, notably India, lose out. Gaborone’s emergence also affects a diamond’s route to market. Perhaps companies manufacturing in Botswana will bypass the traditional trading centers of Antwerp, Israel and Dubai and send their polished straight to New York or Hong Kong for distribution.

That all ties into a general drive to bring about greater efficiency in the diamond trade by shortening the stone’s journey from mine to market. It also meets the growing need to demonstrate social responsibility in supply considering Botswana is a prime example of diamonds making a positive contribution.

With the De Beers deal behind it, 2023 could be the year Botswana consolidates its position in the diamond industry to buoy its brand and raise its revenue from the trade.

Conclusion

The adage that there’s never a dull moment in the diamond trade will likely prove true in 2023. But the industry is expected to get off to a slow start. We predict similar caution in the first quarter as there was toward the end of last year and that activity will improve in the second half.

Of course, there are factors out of the industry’s control that could force additional adjustments. In fact, geopolitical and macroeconomic developments are likely to exert strong influence on the market again this year. But there are other factors, and the experience of past crises, that should help the industry navigate the potential volatility — even if other changes are being adopted more gradually.

This article first appeared in the January edition of the Rapaport Research Report. Subscribe here.

Image: AI-generated. (midjourney bot)